Saudis, Abu Dhabi chill to Softbank’s Masayoshi Son and Vision Fund 2

Is SoftBank Group's Masayoshi Son losing his touch?

Almost six months after SoftBank Group Corp. chief Masayoshi Son announced a second “Vision Fund,” he has yet to convince two of his most important investors to throw money his way.

FOX Business has learned that Saudi Arabia’s Public Investment Fund (PIF) and Abu Dhabi’s Mubadala Investment Co. have yet to commit money to a second Vision Fund despite months of what has been described as constructive discussions between the sovereign wealth funds and top executives at Softbank. Corralling both funds to make an investment into Softbank’s second Vison Fund is critical for its success because PIF and Mubadala were the biggest investors in the first Fund, putting in $45 billion and $15 billion respectively.

If the Saudis and Mubadala invest in the second Fund, it would be seen as a huge vote of confidence, potentially attracting other major investors.

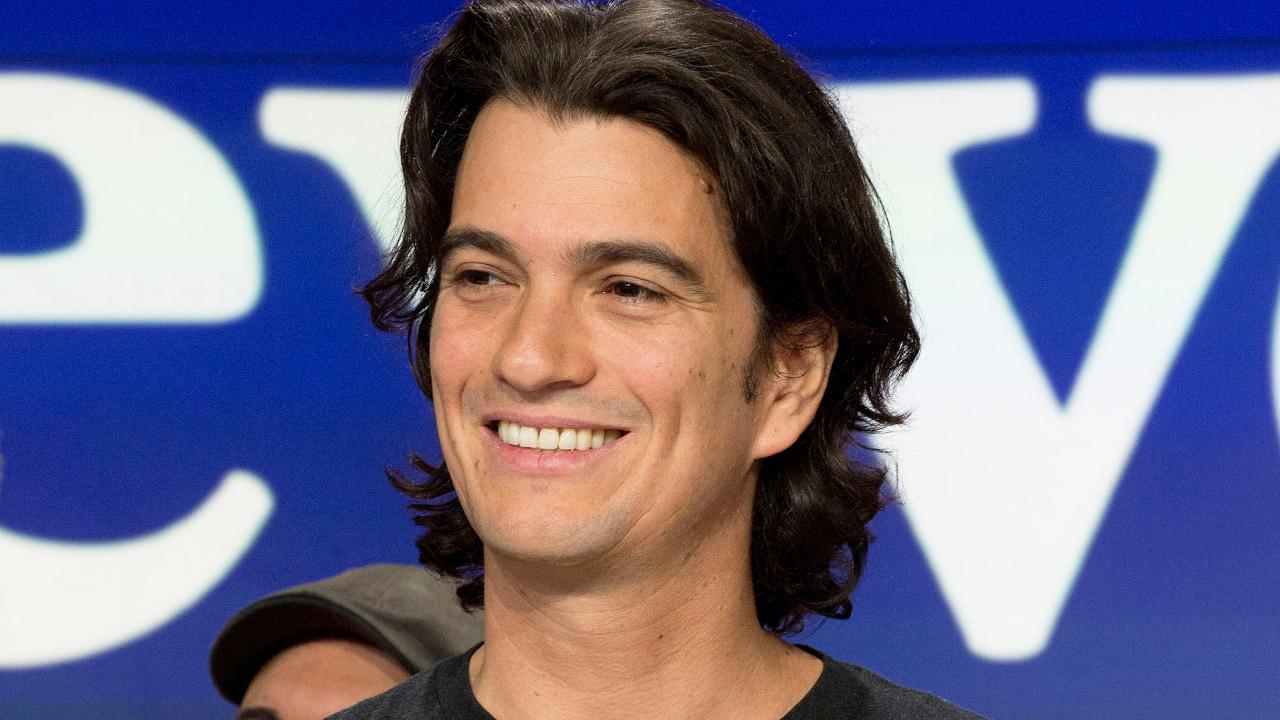

But Son, who began reaching out to potential investors in July, is said to have his work cut out for him in selling a second investment to both parties, according to bankers with direct knowledge of the matter. While neither fund has ruled out an investment, officials at PIF and Mubadala have butted heads with Son over Softbank’s involvement with WeWork—beginning with Son’s $2 billion January 2019 investment and most recently, the massive bailout of the shared workspace company following a botched initial public offering and disclosures of mismanagement that nearly led to WeWork’s demise.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| SFTBY | SOFTBANK GROUP CORP. | 14.59 | +0.74 | +5.34% |

WeWork was one of the Vision Fund’s first and largest investments, and because of the size of its holding, Softbank itself stepped in to prevent the company from falling into bankruptcy—a move that further strained the relationship with both the Saudis and Mubadala, bankers say. Softbank had a 29 percent stake in We Co. before bailing it out in October. Following their $9.5 billion investment, Softbank owns 80 percent of the company.

Press officials for WeWork and PIF declined comment. A spokesman for Mubadala did not respond to request for comment. A spokesman for Softbank told FOX Business, “Fundraising is progressing as expected as investors assess potential commitments to Vision Fund 2” but declined to comment further.

The first Vision Fund was considered groundbreaking for the massive sum it raised—$100 billion—and the huge amounts of money it doled out to tech startups including $7.7 billion to Uber and $4.4 billion to WeWork (this doesn’t include Softbank’s recent bailout of the company).

But the Fund appeared to lose its Midas touch this year as some high-profile investments fell on more difficult times; Uber, for example, has struggled since its IPO while the valuation of WeWork has plummeted to possibly less than $8 billion from its high of $47 billion following its debacle that exposed a trouble balance sheet and other controversial issues.

CLICK HERE TO READ MORE ON FOX BUSINESS

Son initially had great ambitions for the second Vision Fund which he hopes will “facilitate the continued acceleration of the AI revolution” following years of decent returns in the first Vision Fund, which has produced gains of 13% across the board. In fact, when the second Fund was announced Softbank had said they’d “secured pledges” worth $108 billion for the AI-focused Fund.

But it was launched before WeWork’s failed September IPO, and in recent weeks Son has faced significant investor skepticism particularly after he publically apologize for his “really bad” investment judgment when it came to WeWork. So far, Softbank has only been able to raise $2 billion for the second Vision Fund.

For now, the Saudis and Mubadala are not ruling out an eventual investment and may just be balking to get better terms from Softbank; as FOX Business was first to report, the Saudis are looking for reduced fees should they invest in the Fund.

And Softbank officials are said to remain optimistic that both funds will eventually make an investment since discussions are continuing, bankers say. A source close to Softbank tells FOX Business, “Discussions are constructive and ongoing.”