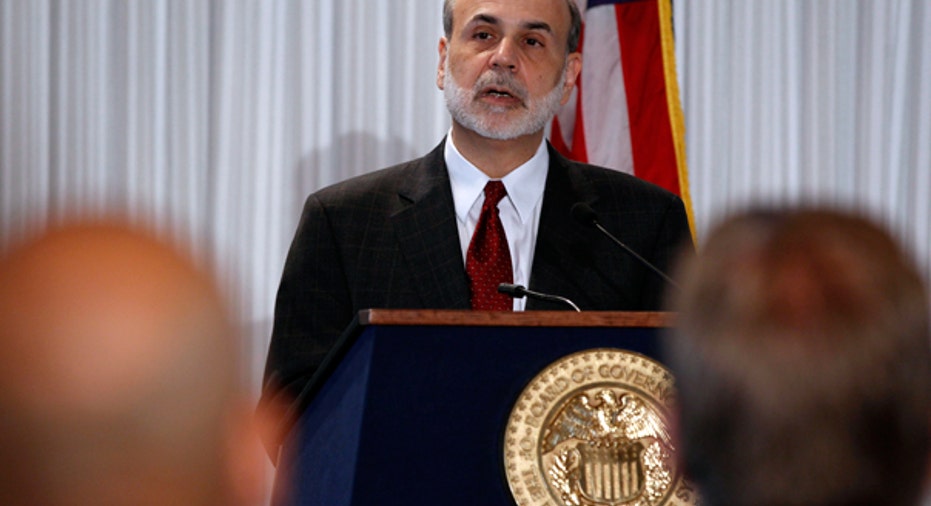

Bernanke Defends Fed Policies

Federal Reserve Chairman Ben Bernanke defended easy money policies in advanced economies against the charge they are overheating emerging markets, saying factors such as exchange rate rigidity are also to blame.

Speaking ahead of a diplomatic summit in Paris that will include many critics of the Fed's aggressive bond buying program, Bernanke acknowledged that strong capital flows from advanced economies to emerging markets may be having negative spillover effects.

"Capital flows are once again posing some notable challenges for international macroeconomic and financial stability," he said in remarks prepared for delivery to a Banque de France event in Paris before meetings of the finance ministers and central bankers of the Group of 20 leading economies.

However, he said that although policy-makers in the emerging markets clearly face challenges, such concerns should be put into perspective.

Bernanke's own unorthodox $600 billion bond buying initiative launched in November has stirred harsh criticism from countries around the world, and he has used international venues to defend it before.

U.S. quantitative easing measures have been attacked for driving down the value of the dollar, hurting emerging economy exports and inflating asset bubbles, and the Fed chairman can expect to hear about it from his counterparts at the summit.

Bernanke did not mention inflation concerns directly except to say that strong demand in emerging markets is contributing to global commodity price increases, something which affects the most advanced economies as well.

Gradually smoothing global imbalances of trade and investment is a top priority for G20 officials. Officials have set themselves the goal of drawing up a list of indicators to measure imbalances, with the aim of making growth more stable and less prone to cycles of boom and bust.

In comments similar to ones he has made in the past, the Fed chairman said faster growth in emerging markets is one factor driving strong capital flows into those economies. Furthermore, emerging market policy-makers have tools at their disposal -- including exchange rate adjustment -- to prevent overheating, he said.

The argument that greater currency flexibility is necessary to right imbalances is a recurring theme for U.S. officials who have persistently sought to pressure China to allow its yuan currency to float more freely against the dollar.

U.S. officials say that by keeping the yuan weak, the Chinese government is supporting an export-led economy that leads to its large trade surplus with the United States.

Washington wants to keep the spotlight on the yuan at the G20."The maintenance of undervalued currencies by some countries has contributed to a pattern of global spending that is unbalanced and unsustainable," Bernanke said.

Advanced economies are also experiencing the ill effects of strong capital flows into emerging economies in the form of higher prices, Bernanke argued.

Spillovers can go both ways. For example, resurgent demand in emerging markets has contributed significantly to the sharp recent run-up in global commodity prices," he said.

Higher prices for food and energy have raised worries about inflation around the world and are prompting many central bankers to consider tightening financial conditions even as some economic recoveries remain shaky. China and India have already raised interest rates to combat inflation, and Britain is under pressure to do the same.

Not all of Bernanke's recommendations were directed at his international counterparts. Countries with persistently high trade deficits must increase saving and put their fiscal houses in order, he said, a reference to record U.S. budget deficits.