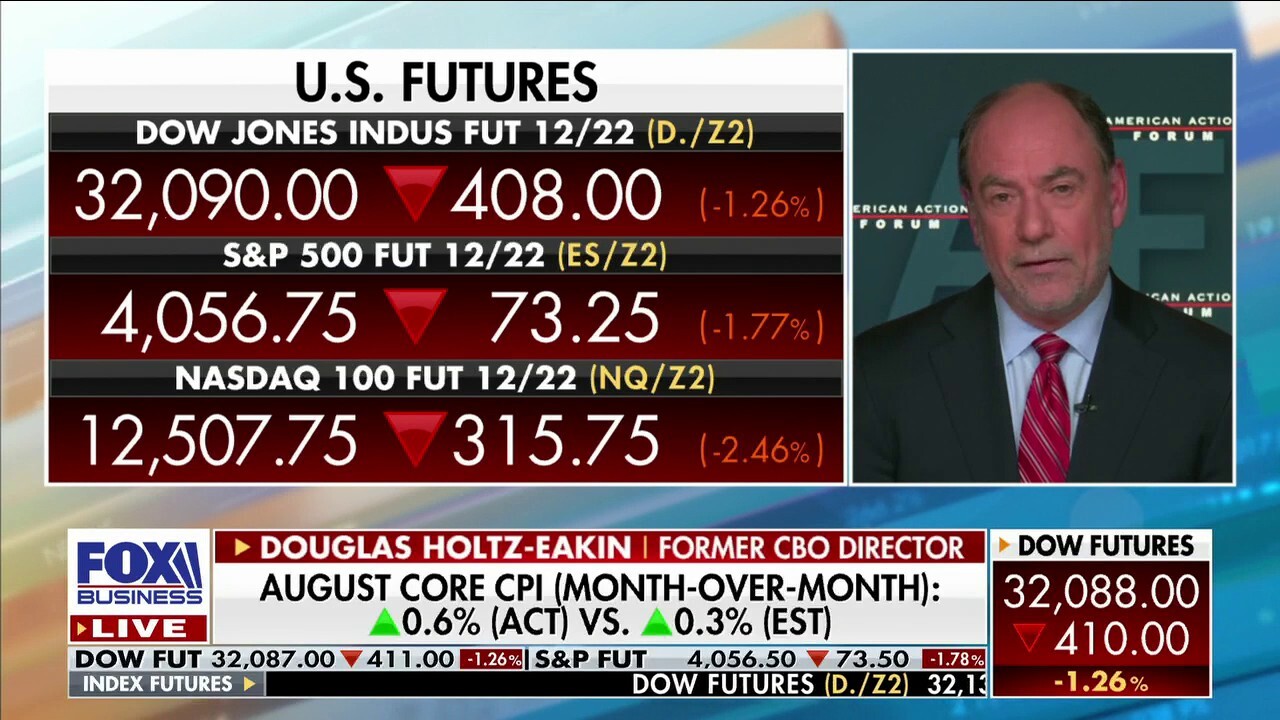

US economic future looks ‘messy’ after August inflation report hotter than expected

Dow Jones, S&P see immediate fall after August CPI climbed 8.3% from one year ago

Future of US economy looks ‘messy’ after August inflation rises above expectations: Market expert

Former Congressional Budget Office Director Douglas Holtz-Eakin says the Fed is operating with a ‘backward-looking’ rule of thumb.

On a "Mornings with Maria" panel Tuesday, former Congressional Budget Office Director Douglas Holtz-Eakin reacted to August inflation data coming in hotter than expected, warning the future of the U.S. economy looks "messy" and explaining why.

STOCKS PLUNGE AS INFLATION RISES 8.3% IN AUGUST

DOUGLAS HOLTZ-EAKIN: Food, energy and shelter are 50% of the CPI, 50% of the typical family's budget. That's up 10.5% year over year. So the American public is not going to tolerate this inflation, and the Fed knows that. They're going to continue on their course; this ratifies a 75 basis point increase for sure at the next meeting. And the future is, I love this term, messy, there's no question about it.

After stocks plunged following the August CPI report, a "Mornings with Maria" market panel warned of a "messy" economic future on Tuesday, September 13, 2022. (Getty Images)

The Fed needs to see less job growth. It needs to see fewer job openings. It needs to see fewer houses built, needs to have slower growth in retail sales. All of that is bad news for the average American, for the average business. And the only question is whether they will go too far.

And given the way they operate, which is to look at actual inflation and see it actually come down, they are operating with a backward-looking rule of thumb, and they are going to over-tighten in the process of fighting this inflation. The only question is when we see the downturn, is it late this year or early next year? But it will happen.

WATCH THE FULL INTERVIEW BELOW

Panel: August inflation numbers will ‘certainly have an influence’ on Fed’s next rate hike

A ‘Mornings with Maria’ market panel breaks down the impact of August’s CPI numbers, which showed inflation rising 8.3% year-over-year.