Rich Californians flock to Las Vegas housing market as lawmakers consider wealth tax

Los Angeles home prices top $1M while Las Vegas median sits at $465K

FOX Business Flash top headlines for February 13

Check out what's clicking on FoxBusiness.com.

High-net-worth Californians are increasingly setting their sights on Las Vegas as they look to reduce their tax burden and protect their finances as a proposed wealth tax looms in the Golden State.

New data shows that by the end of 2025, more than 23% of Realtor.com listing views for Las Vegas homes came from Los Angeles, making it the leading source of out-of-market interest.

San Jose accounted for more than 8% of views, while Riverside, California, made up nearly 4%, according to Realtor.com.

"Migration from California to Las Vegas may reflect both tax considerations and the meaningful affordability gap between the two markets," Realtor.com senior economic research analyst Hannah Jones told FOX Business in an email.

MARK ZUCKERBERG BECOMES LATEST CALIFORNIA BILLIONAIRE TO RELOCATE TO FLORIDA AMID TAX CONCERNS

A view of the Los Angeles city skyline is seen here. (Simonkr / Getty Images)

That gap is substantial. Los Angeles’ typical home price topped $1 million in January, while San Jose’s median listing price was even higher at $1.1 million.

In contrast, Las Vegas’ median listing price stood at $465,000, according to Realtor.com.

Nevada’s lack of a state income tax also remains a major draw, Jones said.

"Taxes and overall cost of living are major drivers, and Nevada’s lack of state income tax continues to be one of the most frequently cited reasons for the move," Jones said.

"For some clients, it’s purely financial. They can sell a $2 million to $3 million home in California and purchase a comparable or larger property in Las Vegas for less while reducing their ongoing tax burden."

HOMEBUYERS GAIN UPPER HAND IN 3 MAJOR CITIES AS INVENTORIES GROW

The Bellagio Water Fountain Show is viewed from Caesars Palace Hotel & Casino on May 29, 2025, in Las Vegas, Nevada. (George Rose/Getty Images)

The migration trend also comes as California considers a proposed wealth tax that would impose a one-time 5% tax on the net worth of residents with assets exceeding $1 billion.

The measure, backed by the Service Employees International Union–United Healthcare Workers West, would need roughly 875,000 signatures to qualify for the November ballot.

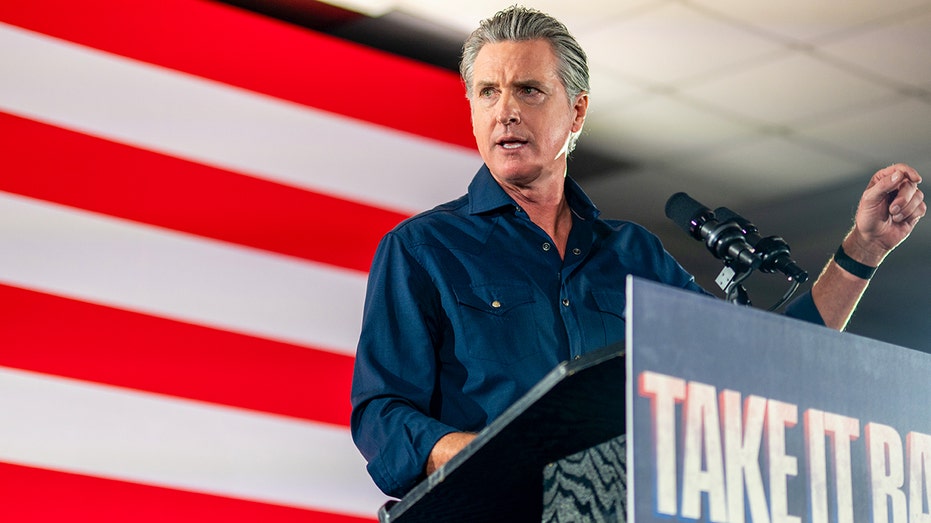

California Gov. Gavin Newsom has opposed the measure, warning it could push high earners to leave the state.

"While policy discussions like a potential wealth tax may influence timing for some high-income households, the ability to convert expensive coastal real estate into greater purchasing power in a lower-cost market is likely also a significant driver," Jones told FOX Business.

California Gov. Gavin Newsom speaks during a rally on Nov. 8, 2025, in Houston, Texas. (Brandon Bell/Getty Images)

"Together, these financial incentives are helping sustain cross-state housing demand."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Meta CEO Mark Zuckerberg and his wife, Priscilla Chan, are buying a waterfront mansion in Miami’s exclusive "Billionaire Bunker," becoming the latest high-profile California billionaire to establish roots in Florida amid tax concerns.

FOX Business' Kristen Altus contributed to this report.