U.S. Adds 203,000 Jobs In November

The U.S. economy added 203,000 jobs in November, topping expectations and fueling speculation that the Federal Reserve could begin dialing back its easy-money policies later this month.

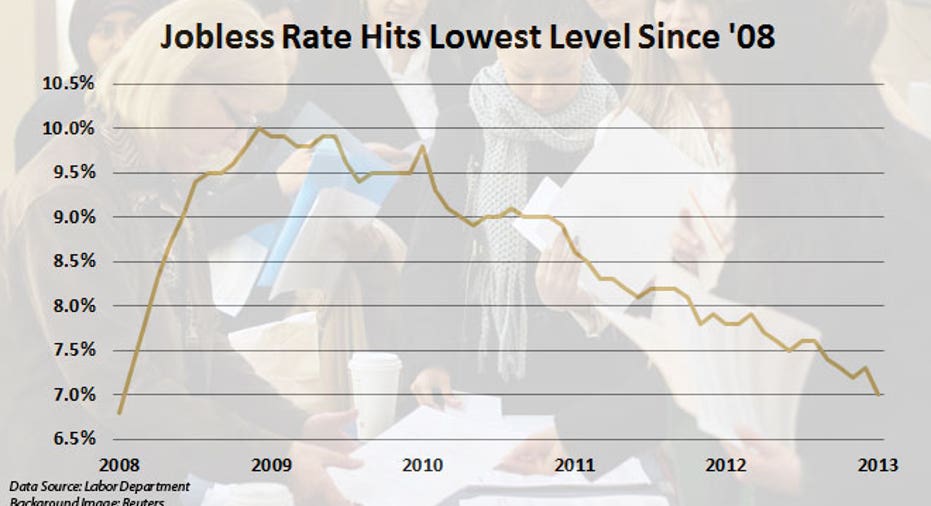

The headline unemployment rate fell unexpectedly to 7.0%, down from 7.3% a month earlier, according to data released by the U.S. Department of Labor. Economists had forecast 180,000 new jobs and a November unemployment rate of 7.2%.

“A strong jobs report could be the clincher for the Fed starting to taper in December,” said Greg McBride, senior financial analyst at Bankrate.com, ahead of the report’s release.

The labor participation rate, a closely watched gauge of the percentage of working-age Americans currently employed, ticked slightly higher to 63% from 62.8%, a positive sign although the rate remains at its lowest level in three decades.

Sectors that saw particularly strong growth last month included manufacturing, construction, transportation and warehousing, according to the Labor Department’s figures.

Job growth at U.S. factories nearly doubled month-over-month, climbing to 27,000 in November, up from 16,000 a month earlier. The construction sector added 17,000 jobs. Employment in transportation and warehousing jumped by 31,000 in November, led by gains in couriers and messengers, truck transportation, warehousing and storage, and air transportation.

Average hourly earnings rose by 0.2% to $24.15 in November from the previous month, and climbed 2% from a year ago.

Report Shocks Wall Street

U.S. stock markets rallied Friday morning on the positive jobs data. As of 10:00 a.m. ET, the Dow Jones Industrial Average climbed 141 points, or 0.9%, to 15963, the S&P 500 advanced 16.4 points, or 0.92%, to 1802 and the Nasdaq Composite rose 29.8 points, or 0.74%, to 4063.

"Wall Street is shocked by this jobs report. Historically, the fourth quarter has been a weak period for hiring, with the lone exception occurring in seasonal retail positions,” said Todd Schoenberger, managing partner at LandColt Capital. “Even the whisper on the revision was ridiculously off. The word of the day will be tapering, as the recent GDP report and today's jobs metric is the most credible evidence to support a change to monetary policy."

For months analysts have used the monthly jobs report as a barometer for what the Fed might do regarding its unprecedented stimulus policies put in place in the wake of the 2008 financial crisis. Since late 2008, the Fed has kept interest rates at near-zero and ballooned its balance sheet to nearly $4 trillion through monthly bond purchases known as quantitative easing.

As the economy seemed to be healing earlier this year and key sectors such as housing appeared to be gaining momentum, the Fed strongly hinted that it would begin scaling back those stimulus policies at some point in 2013. But that message shifted in the fall when labor markets stumbled and housing fell off after mortgages ticked higher.

Now the economy looks like its picking up again. The strong October jobs report -- 204,000 new jobs -- surprised just about everyone, especially since it came on the heels of the partial government shutdown at the beginning of the month.

“This week’s data therefore add to the sense that the Fed will be itching to pull the trigger to take the first shot at killing off its huge $85 billion per month asset purchase program at its December meeting, at least to fire a warning shot that the time has come to start slowly bringing about some normalization of policy. However, the most likely outcome still looks like a deferment of any decisions until the new year,” said Chris Williams, chief economist at research firm Markit.

Equally important as the strong October figures was the upward revision to the September number, which, added to the healthy November report, indicates that the job market could be gaining sustained strength.

Fed Intensely Focused on Labor Markets

“The general tone of economic data has been pretty good since the government shutdown,” McBride said. “Certainly, there’s some positive momentum there.”

The Fed has been intensely focusing on the labor markets for more than a year, ever since introducing a third program of bond purchases in September 2012 in an effort to keep interest rates low and spur economic activity.

The bond purchases seemed to be working through the first half of 2013 as the unemployment rate fell to its lowest level since the recent recession. But just below the surface there were deep structural problems within the labor market.

For instance, each time the unemployment rate fell it was primarily because thousands of Americans had left the workforce that month frustrated by their inability to find a job. When people stop looking for a job they are no longer counted by the Labor Department as unemployed.

Also, for the first nine months of 2013 the average number of jobs created each month was 178,000, not terrible but also not the 200,000 most economists said were needed to make a significant dent in the unemployment rate.

The Fed is scheduled to meet next week on Tuesday and Wednesday and announce any changes to policy at the conclusion of the two-day session.