Trump plans to terminate payroll tax but will protect Social Security

In White House briefing also touts auto demand, home builder sentiment and manufacturing activity

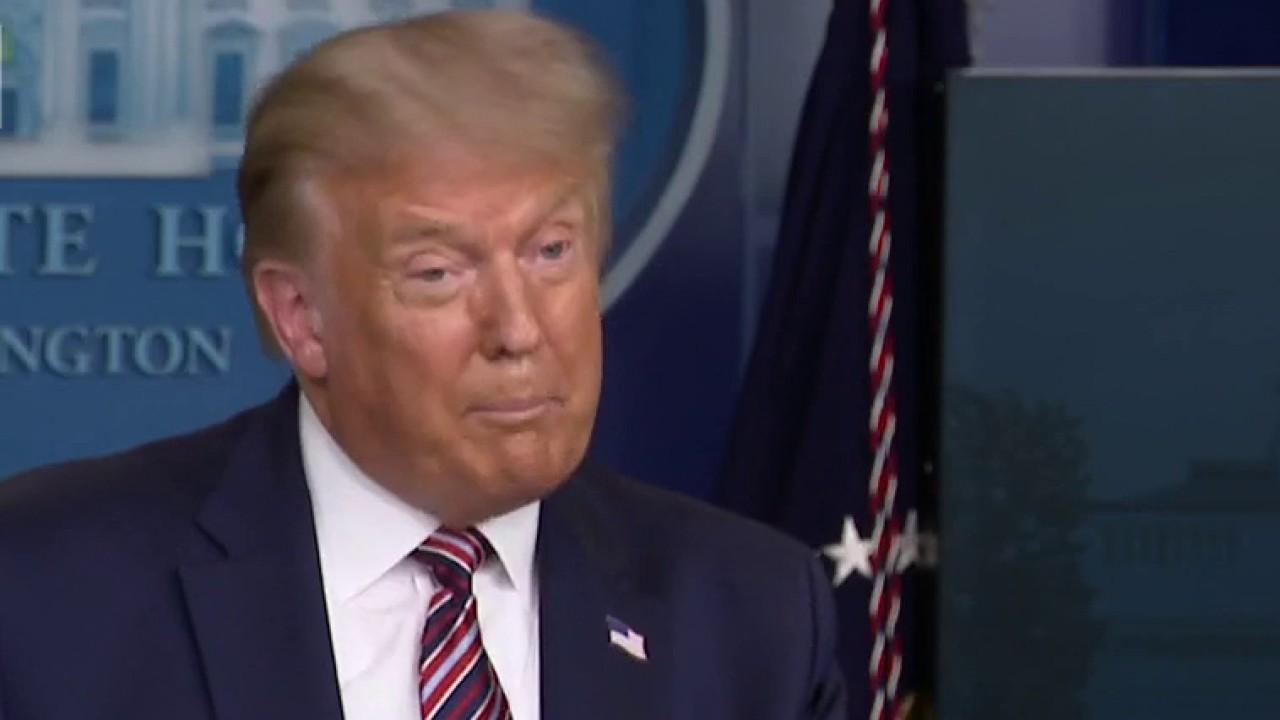

President Trump on Wednesday touted his plan to implement a payroll tax deferral, a levy he plans to eliminate entirely if re-elected, but promises Social Security will not be negatively affected.

“At the end of the year, on the assumption that I win, I’m going to terminate the payroll tax,” Trump said during a press briefing at the White House. “We’ll be paying into Social Security through the general fund.”

Trump has proposed implementing payroll tax deferrals from Sept.1 through Dec. 31 for employees whose bi-weekly wages are less than $4,000, on a pre-tax basis.

On Wednesday he said he will forgive all of these taxes next year, which means the measure would in fact be the equivalent of a payroll tax cut. After that he said he will terminate the tax entirely.

TRUMP’S PAYROLL TAX HOLIDAY WON’T HURT SOCIAL SECURITY, MNUCHIN SAYS

The payroll tax is paid separately from federal income taxes and funds Social Security and Medicare. Employers and employees each pay 6.2 percent for Social Security and 1.45 percent for Medicare, and an additional 0.9 percent is levied on the highest earners.

Without those taxes, Trump said funding for the popular programs will be taken from general government revenues.

When questioned on that strategy given the massive deficits currently facing the federal government, the president responded that it will be doable because the U.S. economy is “going to have tremendous growth.”

CORONAVIRUS PUTS FULL SOCIAL SECURITY BENEFITS AT RISK YEARS EARLIER THAN EXPECTED, RESEARCHERS SAY

Trump defended his economic record on Wednesday, stating the U.S. has seen one of the “shallowest contractions” of any country throughout the global pandemic.

He also touted automobile demand, homebuilder sentiment and manufacturing activity as positive indicators of the recovery.

“It’s coming back at a level that’s far greater than anybody anticipated,” Trump said.

He has repeatedly predicted that 2021 may be a record year for the economy.

According to Trump, economists have said that a payroll tax cut is better than many other types of stimulus for American families.

CLICK HERE TO READ MORE ON FOX BUSINESS

Funding for Social Security is a problem, however, as experts warn reserves might be depleted earlier than expected as a result of the pandemic.

An analysis conducted by researchers at the Penn Wharton Budget Model showed that Social Security is at risk of running out of funds as many as four years earlier than anticipated – in 2032 – depending on the shape of the U.S. economic recovery. Prior to the pandemic, the group had a 2036 estimate for the OASDI trust fund.

A separate analysis estimated that Social Security’s funding may run dry as soon as 2029.

GET FOX BUSINESS ON THE GO BY CLICKING HERE