House Republicans resume favorite pastime: bashing Gary Gensler and demanding SEC documents

Republican letter to SEC calls the agency's opaqueness 'inadequate'

Republicans launch full offensive on SEC's Gary Gensler over climate disclosure proposal

FOX Business senior correspondent Charlie Gasparino reports top GOP members are demanding Gary Gensler comply with their request for more information on the SEC's climate change proposal on 'The Claman Countdown.'

House Republicans never seem to miss an opportunity to amp up their feud with Securities and Exchange Commission Chairman Gary Gensler.

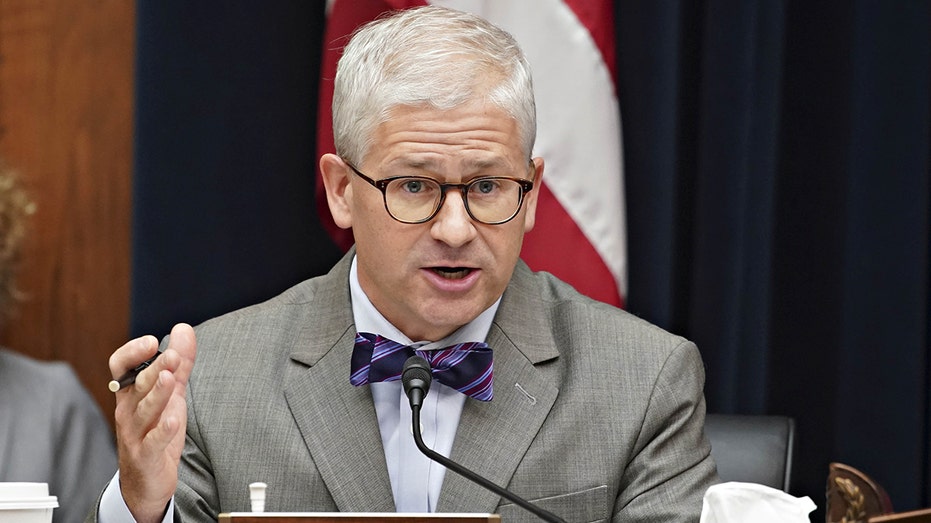

On Tuesday, Patrick McHenry, Chairman of the House Financial Services Committee, and Bill Huizenga, Chairman of the Subcommittee on Oversight and Investigations, penned a joint letter to Wall Street’s top cop demanding that his agency turn over internal documents previously requested by the Committee — spanning SEC’s activities involving corporate climate disclosures, crypto regulation and his dealings with disgraced former crypto kingpin Sam Bankman-Fried — which they say, the agency has so far failed to deliver.

The letter, exclusively reviewed by Fox Business, chastises Gensler and his staff for producing "inadequate" responses to the requested documents. It also threatens to hold a hearing, and grill Kevin Burns, the director of the SEC’s Legislative Affairs Office, and Megan Barbero, the agency’s General Counsel, if the documents are not turned over by next Friday, May 19.

Securities and Exchange Commission Chairman Gary Gensler, Monday Apr. 4th 2022 (Photo by Evelyn Hockstein-Pool/Getty Images) (Photo by Evelyn Hockstein-Pool/Getty Images / Getty Images)

The letter is the latest skirmish between the GOP-controlled committee and the SEC over what Republicans believe is Gensler’s failure to comply with oversight requests while he politicizes an agency that was designed to protect investors from stock scammers and aid in capital formation. Since becoming Chairman of the SEC in April 2021, Gensler has put forward no fewer than 50 new regulatory proposals, many of them touting progressive causes such as his plans to mandate corporate disclosures of how public companies and their operations affect the environment.

SEC STAFF THROW COLD WATER ON CALLS FOR BAN ON SHORT SELLING OF BANK STOCKS

Committee members also have been critical of Gensler’s foray into crypto regulation; they believe his enforcement crackdown against companies such as Ripple Labs and Coinbase is forcing digital asset innovation overseas. They also point out that while Gensler was focusing on marginal enforcement actions, his agency failed to reign in Bankman-Fried’s alleged fraud before his FTX exchange imploded and billions of dollars in customer accounts were allegedly looted. Gensler, they point out, met with Bankman-Fried twice before the alleged swindle unraveled.

An SEC spokesperson didn’t immediately respond to a request for comment.

Sam Bankman-Fried, founder and chief executive officer of FTX Cryptocurrency Derivatives Exchange, speaks during a Senate Agriculture, Nutrition and Forestry Committee hearing in Washington, D.C., U.S., on Wednesday, Feb. 9, 2022. (Photographer: Sarah Silbiger/Bloomberg via Getty Images / Getty Images)

"To date, your responses to our requests have been wholly inadequate," the letter states. "It is inconceivable to us that a nearly 5,000-person agency with nearly 150 attorneys in its General Counsel’s office and more than 200 employees in the IT department is struggling to process three requests from Congress in a timely and responsive manner."

GARY GENSLER'S GROSS SEC OVERREACH

Since Republicans took back the House of Representatives in January, the financial committee has written Gensler eight times, demanding information about his agenda. Gensler’s climate proposal, scheduled to be voted on by the full commission before year’s end, is among the most controversial SEC edicts in recent memory, securities lawyers tell Fox Business.

Public companies are mandated to provide so-called "material information" to investors in public documents, data that could impact business conditions and ultimately share price.

Representative Patrick McHenry (R-NC) attends the House Financial Services Committee hearing on Capitol Hill in Washington, U.S., September 30, 2021. Al Drago/Pool via REUTERS (Reuters)

Gensler is arguing that investors increasingly need to know how public companies are managing and reducing their carbon footprint, despite its more nebulous impact on earnings. GOP lawmakers say the SEC is overstepping its jurisdiction by requiring investors to disclose this information, creating a significant and costly regulatory burden.

Gensler last testified before the committee on April 18 and received a shellacking from GOP members including Huizenga for failing to meet oversight requests. Huizenga, at one point, chided Gensler for an odd response from the SEC to an oversight request. Instead of sending the documents the committee wanted, Gensler’s staff merely replied by supplying the committee with a copy of the letter that McHenry and Huizenga sent Gensler back in April 2021 congratulating him on his new job as head of the Commission.

CLICK HERE TO GET THE FOX BUSINESS APP

Gensler responded that, in the matter of FTX and Sam Bankman-Fried, the agency must keep investigative matters confidential.

In an interview with Fox Business, Huizenga said: "We are tired of the bureaucratic stonewalling from the SEC. During a recent Committee hearing, Chairman Gensler told me he respects the role of Congressional oversight. If Chairman Gensler won’t live up to his own standard and answer our questions, we’ll make sure someone from his staff does his job for him."