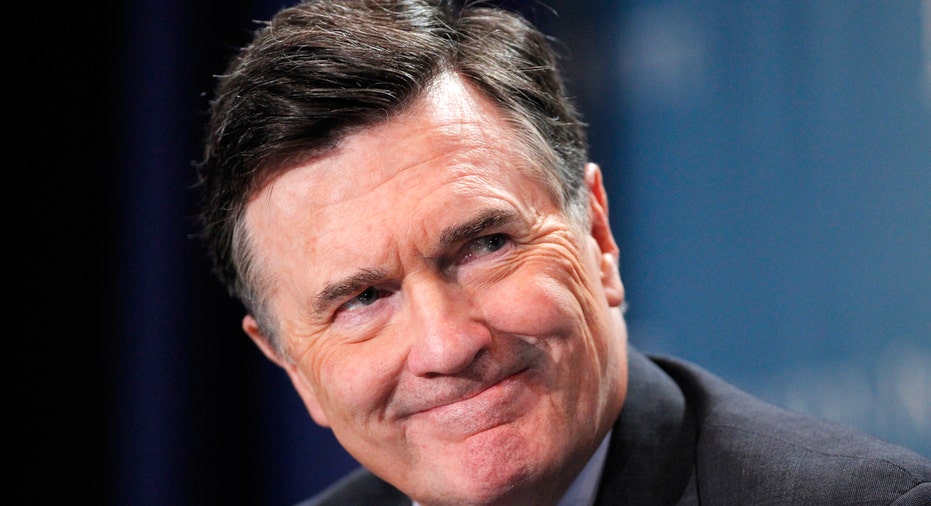

Fed's Lockhart Sees Rate Rise Before End of Year

Federal Reserve Bank of Atlanta President Dennis Lockhart said Friday that he still believes the U.S. central bank will raise short-term rates before the year ends. The U.S. economy's current path of growth "is consistent with liftoff relatively soon," Mr. Lockhart said. "The economy remains on a satisfactory track, and, speaking for myself, I see a liftoff decision later this year at the October or December [Federal Open Market Committee] meetings as likely appropriate," Mr. Lockhart said. That said, the official said the decision to boost borrowing costs off their current near zero levels isn't easy. "The data are giving off varied signals, and there is more ambiguity in the current moment than a few weeks ago," Mr. Lockhart said. That calls for "especially diligent monitoring of incoming data" to determine what steps to take, he said. "I maintain that the broad economy continues to move ahead at a satisfactory pace," Mr. Lockhart said. Still, "very recent data have not provided much confirmation that my narrative still holds," he said, explaining "I perceive a touch more downside risk today than I saw some weeks ago." Mr. Lockhart's comments came from the text of a speech prepared for an event held with business journalists in New York. The official currently holds a voting role on the interest-rate setting FOMC, and he is viewed as a reliable guide to the shared outlook of policy makers. He spoke a day after the release of the meeting minutes from the mid-September FOMC meeting. In recent remarks, Mr. Lockhart has said the decision to hold off on a rate rise at that meeting was a close call while officials took stock of how ominous international events might be affecting the otherwise healthy outlook for the U.S. The minutes showed officials wrestling with that difficult question. Fed officials since then, including Mr. Lockhart, have largely agreed that a rate rise this year still remains likely, but many observers are uncertain how officials will be able to gain the confidence they need to boost rates off current near zero levels before the year ends. The next FOMC meeting comes at the end of this month. Mr. Lockhart said he believes the current jobless rate of 5.1% is near its natural long-term level. He said he accepts the view that currently weak levels of inflation are due to transitory factors that will allow price pressures to rise back to the Fed's 2% target over time. Mr. Lockhart cautioned that while central bankers need to take note of the state of financial markets, it needs to make policy with the needs of "Main Street" at the forefront. He noted that the performance of consumer spending data will be of particularly importance over coming months. Write to Michael S. Derby at michael.derby@wsj.com