Fed's Lockhart: Need to Step Up Shadow Bank Monitoring

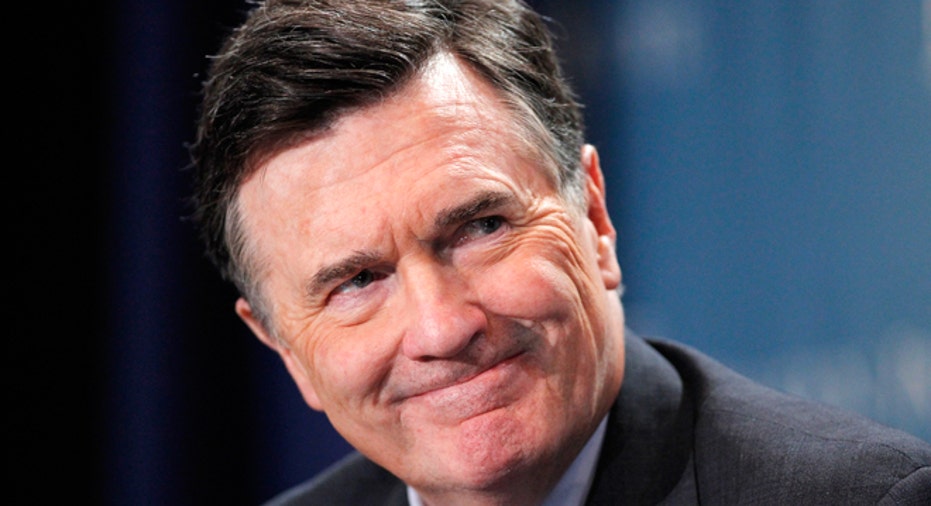

U.S. regulators need to step up monitoring of shadow banks as part of their effort to build a more stable financial system, Atlanta Federal Reserve President Dennis Lockhart said on Friday.

Shadow banks, the massive network of financial firms that falls outside of formal banking regulations, may not need to come under the same rules as commercial banks since most investors in that sector are more sophisticated, Lockhart said at a University of Georgia Law School symposium.

He added that regulating the sector too closely also could hurt economic growth.

But the potential for "non-banks" to disrupt the economy - from the roughly $2.7 trillion money market industry to the most aggressive hedge funds - remains a risk, and "a robust regime of monitoring is justified," Lockhart said.

"Shadow banking activity is large, growing, and opaque," he said.

"At a minimum, I feel the authorities responsible for preserving financial stability must monitor the sector very closely with ever-improving techniques."

The Fed has increasingly focused on trying to put more oversight into the shadow banking industry, which played a central role in the spread of the financial crisis. The Fed, however, lacks regulatory authority over hedge funds and money market funds.

Fed Governor Daniel Tarullo said in January that the Fed plans to propose a rule that applies minimum margin requirements to certain forms of securities financing deals. The proposal is aimed in part at reducing the risk posed by the shadow lenders.

The Fed board's three-member committee on financial stability, created last summer and led by Vice Chair Stanley Fischer, is targeting shadow banking as an area of focus.

Lockhart said on Friday that he did "not believe we have to choose between complete exemption from prudential regulation and a wholesale extension of the existing framework of regulation developed for banks."

He did not address monetary policy in his remarks or propose specific regulations or rules for the shadow banking industry. (Reporting by Howard Schneider; Additional reporting by Michael Flaherty; Editing by Paul Simao)