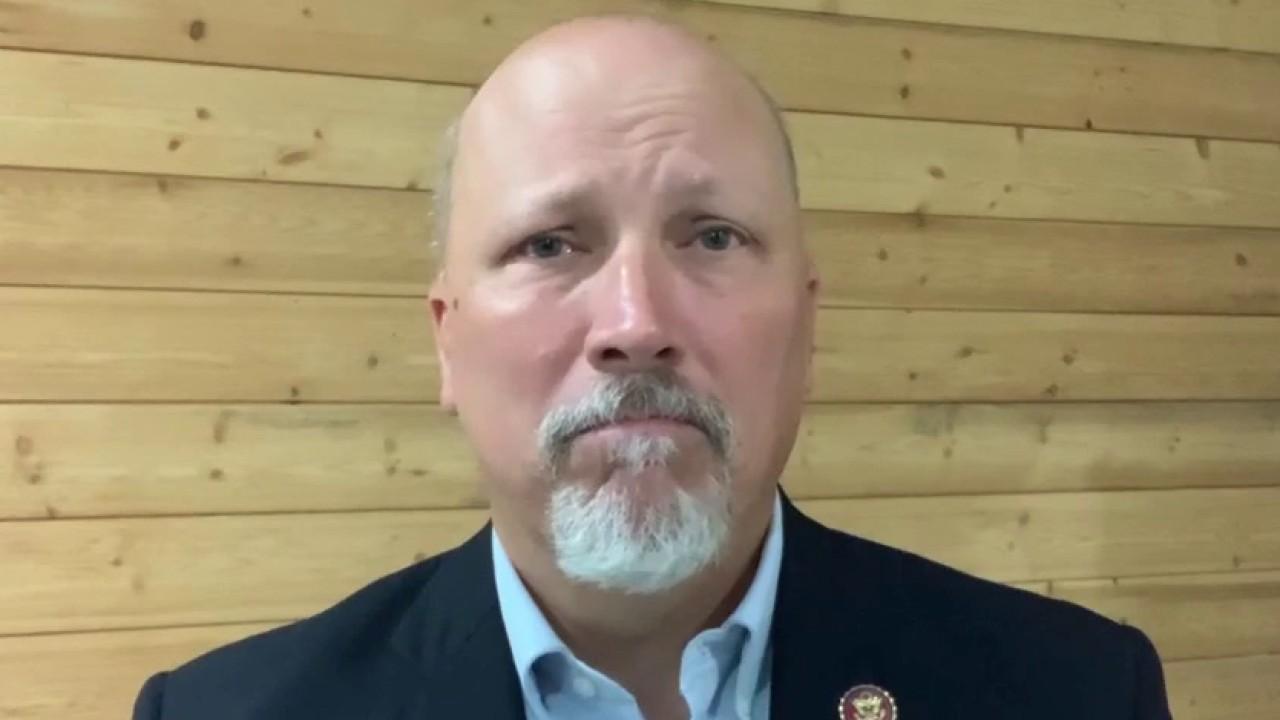

Rep. Chip Roy tells Mnuchin to stop 'sticking it to small businesses'

'Moreover, please order Treasury to get on with completing loan forgiveness ASAP so banks can be free to lend. That was the whole point'

Rep. Chip Roy, R-Texas, wrote a letter to Treasury Secretary Steve Mnuchin demanding that he stop “sticking it to small businesses” by denying deductibility for Paycheck Protection Program loans.

“Small businesses are getting destroyed in America,” Roy wrote in the letter, which was obtained by FOX Business. “Many big businesses are making tons of money. Stop sticking it to small businesses by denying the intended deductibility of business expenses paid with forgiven PPP loans when the program is a public policy designed to make them whole after having their livelihoods taken by the force of government. Moreover, please order Treasury to get on with completing loan forgiveness ASAP so banks can be free to lend. That was the whole point."

The Small Business Administration’s PPP provided loans that could be forgiven so long as the money was used to cover expenses such as payroll, rent and utilities, in appropriate proportions.

FORGIVEN CORONAVIRUS PPP LOAN RECIPIENTS INELIGIBLE FOR TAX DEDUCTIONS

Tucked into Congress’ pending $908 bill COVID-19 relief bill is a provision allowing businesses to deduct expenses from the government’s Paycheck Protection Program, but one administration official standing in the way is Mnuchin.

The CARES Act, which funded the PPP, originally said such loans weren’t included in gross income, but the IRS determined after the fact that expenses paid with it were not deductible.

PPP deductibility has broad bipartisan support, and was included in the House’s HEROES Act.

The IRS and the Treasury issued a statement saying that since businesses aren’t taxed on the proceeds of a forgiven PPP loan, the expenses aren’t deductible.

“The money coming in the PPP is not taxable. So if the money that’s coming is not taxable, you can’t double-dip,” Mnuchin said on FOX Business. “You can’t say you’re going to get deductions for workers that you didn’t pay for.”

BUSINESS GROUPS PUSH CONGRESS TO CHANGE TAX TREATMENT OF FORGIVEABE PPP LOANS

In May, Sen. John Cornyn and a bipartisan group of senators, including Sen. Chuck Grassley, R-Iowa, chairman of the Finance Committee, and ranking member Ron Wyden, D-Ore., introduced the “Small Business Expense Protection Act,” which would have clarified that businesses that receive a loan from the PPP, and the loan is forgiven, can deduct expenses paid for with the money.

Cornyn’s legislation was consistent with Congress’s intent with the CARES Act and therefore doesn’t cost the Treasury any funds, according to a letter from the Joint Committee on Taxation.

A December letter from over 700 business groups said that not allowing deductibility amounted to a “surprise” tax increase of up to 37 percent on small businesses when they file taxes for 2020.

“Many PPP loan recipients retained employees on their payrolls, even when there was little to no work to perform, in compliance with the intent of the program to keep people employed and off the unemployment rolls. The IRS changed the rules after businesses took out PPP loans, and business owners are now being asked to pay what amounts to a surtax on their workforce," the letter read. "Without Congressional action, businesses will face an unexpected tax bill when they file their taxes for 2020, as they continue to struggle with government-mandated shutdowns or slowdowns. Many of those businesses will close and never re-open. This senseless tax policy stands both the letter and spirit of the PPP on its head.”

Some tax policy experts do side with Mnuchin. The Tax Policy Center’s Steven Rosenthal wrote that allowing PPP loans to be tax-deductible would “benefit the richest Americans.”

CLICK HERE TO READ MORE ON FOX BUSINESS

“There are hundreds of billions of dollars of deductions at stake, which will benefit the richest Americans (the top 1% of U.S. taxpayers, by income, report more than 50% of pass-through income; the top 1% of Americans, by wealth, own 50% of stock). Congress can better target relief to those most in need, without providing double dips for those who are not,” he wrote.