BlackRock not ESG enough for NYC, comptroller says

New York City accuses BlackRock of 'backtracking' on its commitment to fight climate change

Arizona AG Brnovich warns BlackRock of pushing its 'woke' agenda on investors

Arizona Attorney General Mark Brnovich argues one of the world's largest investment firms is potentially putting its 'leftist' policies over investors' interests and returns on 'Cavuto: Coast to Coast.'

BlackRock's ongoing push for environmental, social, and governance (ESG) standards for companies appears to have put the firm between a rock and a hard place.

After the world's largest asset manager recently defended its policies to several Republican attorneys general, now New York City's comptroller says BlackRock is not doing enough to fight climate change and issued his own threats against the investment titan.

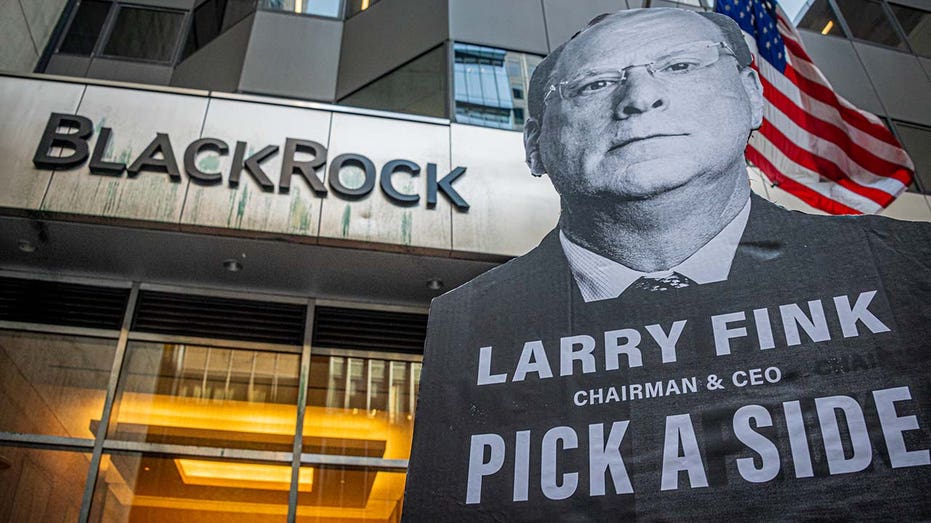

Participant seen holding a sign at a protest outside BlackRock Headquarters in Manhattan, where their annual shareholders meeting took place. Participants and speakers demanded that BlackRock exclude companies expanding fossil fuel production from it (Erik McGregor/LightRocket via Getty Images / Getty Images)

BlackRock manages roughly $8.5 trillion in assets, including those of more than 35 million Americans, handling several pension funds in both the public and private sectors. The company has come under increasing fire from fossil fuel-producing U.S. states concerned that the firm's "net zero" investment strategies threaten both investors and the economy, particularly amidst an ongoing global energy crisis.

A coalition of 19 states led by Republican Arizona Attorney General Mark Brnovich sent a letter to BlackRock CEO Larry Fink last month accusing the company of putting its political agenda ahead of clients' best interests by pushing "comprehensive efforts to retire fossil fuels" and possibly violating "multiple state laws" through its "actions on a variety of governance objectives."

BLACKROCK CEO LARRY FINK DISCUSSES INFLATION, ESG INVESTING IN THE ENERGY SECTOR

The letter from the states pointed to several commitments BlackRock has made that the attorneys general say "indicate that BlackRock has already committed to accelerate net zero emissions across all of its assets, regardless of client wishes."

BlackRock pushed back in a Sept. 6 response signed by Dalie Blass, the company's head of external affairs, who told the AGs their "letter makes several inaccurate statements about BlackRock’s motive for participating in various ESG-related initiatives."

Blass wrote that "BlackRock does not boycott energy companies or any other sector or industry," and insisted that the company's "engagement and voting around climate risk does not require that companies meet specific emissions standards."

BlackRock offices in New York City. Founded in 1988, BlackRock, Inc. is the world's largest asset manager. (Erik McGregor/LightRocket via Getty Images / Getty Images)

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BLK | BLACKROCK INC. | 1,056.88 | +2.43 | +0.23% |

But BlackRock's letter defending itself to the AGs prompted progressive New York City Comptroller Brad Lander to send Fink a letter of his own, accusing BlackRock of not following through with its ESG commitments after the company "has repeatedly and rightly recognized climate change as an investment risk."

He cited a number of examples, including, "Your 2021 letter to CEOs committed to ‘supporting the goal of net zero greenhouse gas emissions by 2050 or sooner’—in line with BlackRock’s pledge as a signatory to the Net Zero Asset Managers Initiative (NZAMI)—and asked businesses to disclose how they are integrating their own net zero plans into their long-term business strategies."

TEXAS DEMANDS DOCUMENTS FROM BLACKROCK, OTHER FINANCIAL SERVICE FIRMS IN ESG PROBE

"Unfortunately, despite these repeated proclamations, in its September 6 response to the attorneys general, BlackRock now abdicates responsibility for driving net zero alignment in its own portfolio by saying that it does not ask companies to set specific emissions targets, and that its participation in NZAMI does not mean BlackRock is setting or meeting any net zero targets," Lander wrote, condemning the company for going "so far as to tout its continued investment in fossil fuels."

"The fundamental contradiction between BlackRock’s statements and actions is alarming," Lander continued. "BlackRock cannot simultaneously declare that climate risk is a systemic financial risk and argue that BlackRock has no role in mitigating the risks that climate change poses to its investments by supporting decarbonization in the real economy."

Brad Lander, then-Democratic nominee for New York City Comptroller, speaks during an interview in New York, U.S., on Tuesday, Oct. 19, 2021. Lander is a progressive politician and has been described as "one of the most left-leaning politicians in the (Photographer: Christopher Goodney/Bloomberg via Getty Images / Getty Images)

Lander wrote, "As a fiduciary cognizant of the risks of inaction, BlackRock must demonstrate a plan to use its position as the world’s largest asset manager, with all the corporate governance responsibilities that go along with that position, to move its portfolio companies to get their businesses in line with a net zero economy."

The New York City comptroller called on BlackRock to respond to his concerns that the asset manager "is backtracking on its climate commitments," and issued a veiled threat, writing, "We will be prudently reassessing our business relationships with all of our asset managers, including BlackRock, through the lens of our climate responsibilities."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

When reached for reaction to Lander's letter, a BlackRock spokesperson said the company did not have an official comment but directed FOX Business to several points in its 2030 net-zero statement where the firm says it anticipates "that by 2030, at least 75% of BlackRock corporate and sovereign assets managed on behalf of clients will be invested in issuers with science-based targets or equivalent."

"BlackRock’s role in the transition is as a fiduciary to our clients," the statement says. "Our role is to help them navigate investment risks and opportunities, not to engineer a specific decarbonization outcome in the real economy. The money we manage is not our own – it belongs to our clients, many of whom make their own asset allocation and portfolio construction decisions."