BlackRock admits ESG advocacy could prove bad for business

Fink, who has been an advocate for investing in clean energy, has faced scrutiny by conservatives

Is climate change more of a threat than nuclear bombs?

Fox News contributor Liz Peek, National Review reporter Caroline Downey and author Batya Ungar-Sargon react to President Biden claiming climate change is worse than nuclear bombs on 'Kudlow.'

Investment management company BlackRock admitted in its annual filing to the Securities and Exchanges Commission that CEO Larry Fink’s environmental, social, and governance policies (ESG) advocacy could harm its reputation and hurt its bottom line.

"BlackRock’s business, scale and investments subject it to significant media coverage and increasing attention from a broad range of stakeholders," the filing submitted late last month said. "This heightened scrutiny has resulted in negative publicity and adverse actions for BlackRock and may continue to do so in the future."

It continued, "Any perceived or actual action or lack thereof, or perceived lack of transparency, by BlackRock on matters subject to scrutiny, such as ESG, may be viewed differently by various stakeholders and adversely impact BlackRock’s reputation and business, including through redemptions or terminations by clients, and legal and governmental action and scrutiny."

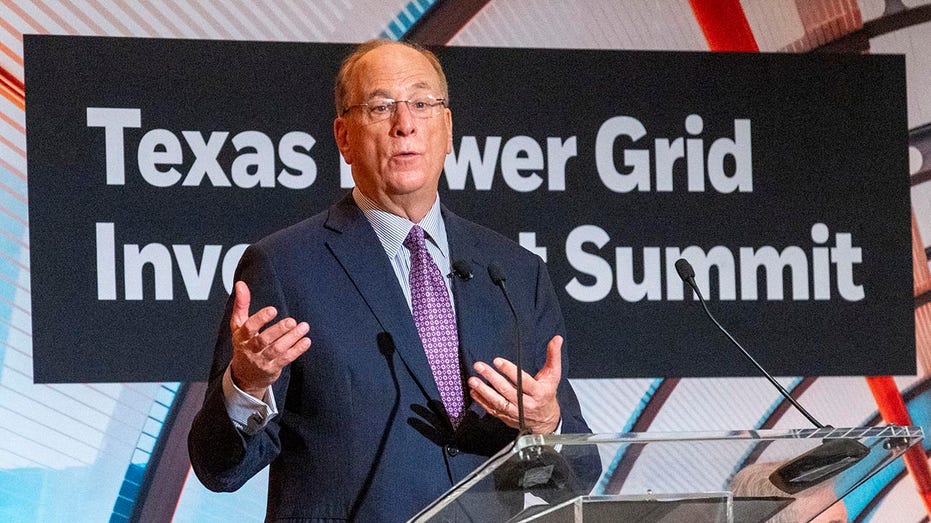

Fink, who has been an advocate for investing in clean energy, has faced scrutiny by conservatives, including a number of Republican attorneys general.

Larry Fink met with Republicans at a Houston summit last month after being blacklisted from the state over BlackRock's ESG advocacy. (Kirk Sides/Houston Chronicle via Getty Images / Getty Images)

"The overlapping web of personal and business relationships between major mutual fund directors and BlackRock raise red flags about potential conflicts of interest, and call even further into question the misguided investment strategies done in the name of ESG," Virginia’s Attorney General Jason Miyares said last year in a release announcing Virginia was joining a coalition of states demanding answers from BlackRock.

Tennessee’s Attorney General Jonathan Skrmetti said last year, while announcing a lawsuit against BlackRock over ESG, "[s]ome public statements show a company that focuses exclusively on return on investment, others show a company that gives special consideration to environmental factors. Ultimately, I want to make certain that corporations, no matter their size, treat Tennessee consumers fairly and honestly."

BlackRock said it rejects the lawsuit’s claims.

"BlackRock has included risk factors related to ESG and sustainability matters going back several years. In the last 5 years, clients have entrusted BlackRock to manage nearly $1.9 trillion in net new business," a BlackRock spokesperson said in a statement to Fox News Digital. "They do this because BlackRock serves clients with a range of investment objectives and demands, and as a fiduciary on their behalf we offer them choices to help them reach those goals."

BLACKROCK, STATE STREET FACE SUBPOENAS IN HOUSE ESG PROBE

Last month, Texas blacklisted the company over its ESG policies, prompting Fink to reach out to State Lieutenant Governor Dan Patrick and other Republican officials at an energy investment summit in Houston.

BlackRock has about $10 trillion in assets of which ESG accounts for around $700 billion, according to the New York Post.

As ESG becomes more controversial, it has affected other companies too.

Bank of America appeared to renege on its 2021 pledge to not fund new coal projects, saying in its end of year "Environmental and Social Risk Policy Framework" filing in December, new coal mines and plants, or Arctic oil drilling, such projects will now face "enhanced due diligence."

Some states, like New Hampshire, Texas and West Virginia, have passed laws to prevent banks from refusing to finance coal projects, and have even sought to criminalize what is called, "environmental, social and governance" principles within companies, according to The New York Times.

The conservative backlash to environmental considerations in business has led other companies to pull back from certain eco-friendly initiatives.

Earlier this year, a coalition of 12 Republican state agriculture commissioners wrote a letter to six large U.S. banks, including Bank of America, over their net-zero ambitions, opening a new front in the pushback against what they call "woke investing," a fight that has primarily been spearheaded by state attorneys general and financial officers.

CLICK HERE TO READ MORE ON FOX BUSINESS

All six banks are members of the Net-Zero Banking Alliance (NZBA).