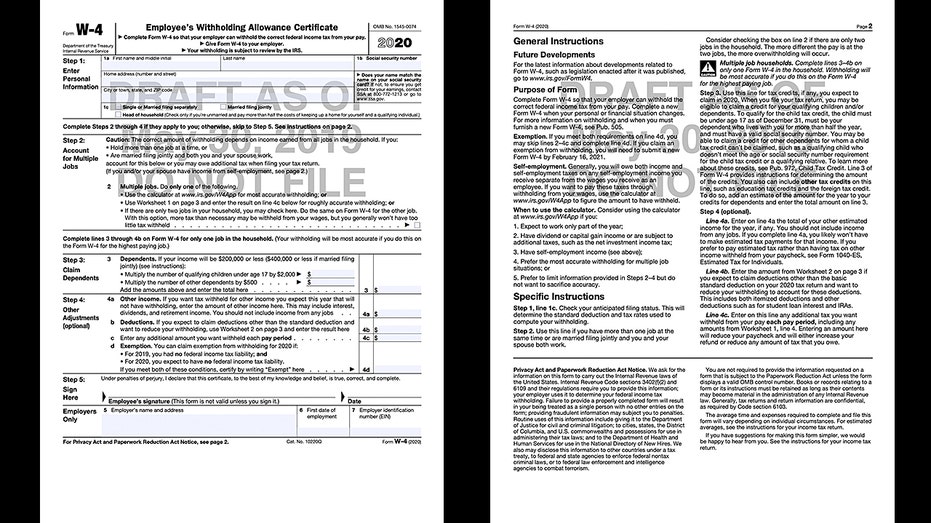

IRS releases new W-4 draft, here's what it looks like

The Internal Revenue Service released a new draft of its W-4 to reflect changes made to the tax code under Tax Cuts and Jobs Act, after critics said the previous proposal was too complicated.

W-4 forms are filed with employers to calculate how much of your paycheck should be withheld for federal taxes.

“I am proud of our dedicated teams at Treasury and the IRS who worked for more than a year to develop and refine this redesign that reduces the complexity of the tax filing experience for hardworking Americans,” Treasury Secretary Steven Mnuchin said in a statement on Friday.

The newly unveiled form is an early draft, the agency noted, and will be subject to a public comment period which is expected to end at the beginning of July.

Here’s a look at the new form:

The IRS said it will release employer instructions soon. The agency cautioned that these forms are likely to change following the comment period and should not be relied upon. Another draft will be released later this summer.

Ed Slott, tax expert and founder of Ed Slott and Co., told FOX Business that the IRS is trying to draw taxpayers' attention to the items they need to know in order to make their withholding more accurate. That's why there is a new section dedicated to income amounts and the agency is asking you to identify whether your have multiple jobs..

"[The IRS is] trying to tell you you really have to take everything into account," Slott said. "You are going to have to know your situation."

Phase out thresholds are also being highlighted.

"The new draft emphasizes the phase out of the ability to claim dependents ($200,000 single; $400,000 married filing jointly or MFJ)," Bill Smith, Managing Director at CBIZ MHM's National Tax Office, told FOX Business.

A draft released last summer for public comment was criticized for being too complicated and for asking taxpayers to reveal too much personal information.

“It had changed completely and it really asked for personal information that people didn’t want to reveal,” Jennifer Bobe, a senior manager at Margolin, Winer & Evens LLP, told FOX Business.

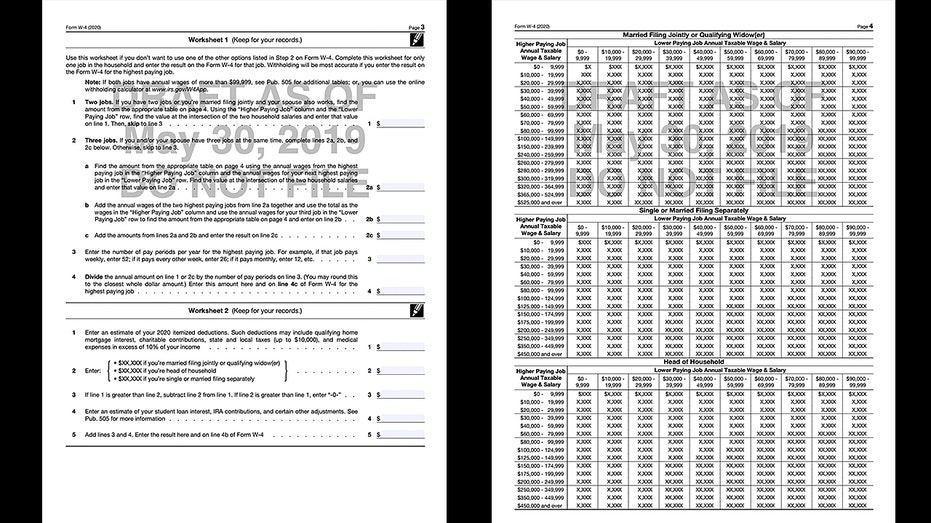

The American Institute of CPAs, for example, urged the IRS to simplify the “unduly complicated” form, which asked for items like nonwage income, itemized and other deductions, tax credits, and total pay of all lower paying jobs – personal information people may not want given to employers. Filling out the previous draft version of the form would essentially require people to calculate their tax liability, the group said.

Overall, however, for people with simple tax situations, the process of filling out the latest draft form should remain pretty simple .

"For folks with simple tax situations ... they can just leave the whole thing blank pretty much," Pete Isberg, Vice President of payroll processing from ADP, told FOX Business.

CLICK HERE TO GET THE FOX BUSINESS APP

Changes were needed after the implementation of the Tax Cuts and Jobs Act, because the law enacted several major changes to the tax code – including eliminating personal exemptions, limiting deductions and doubling the standard deduction.

Employees who submitted a W-4 prior to 2020 are not required to submit a new form just because it has been redesigned. Withholding will continue to be computed based on the most recent W-4 that is on file.