Borrowers who consolidated credit card debt saved $2K+ on average, data shows

It's easy to get in over your head with credit card debt, but debt payoff can seem much more difficult. With the right financial products, though, getting rid of your credit card balances can be totally manageable. (iStock)

Credit card debt is a drain on your budget that can keep you from saving up for life's milestones, like a down payment on a home or your child's college tuition. And considering that credit usage jumped 8.8% in Q2 2021, you may be among the many Americans looking for ways to get out of debt.

One common way to reduce an uncontrollable credit card balance is with a debt consolidation loan. This is a type of personal loan that you take out at a lower interest rate than what you're currently paying on your credit cards in order to pay down debt faster and save money while doing it.

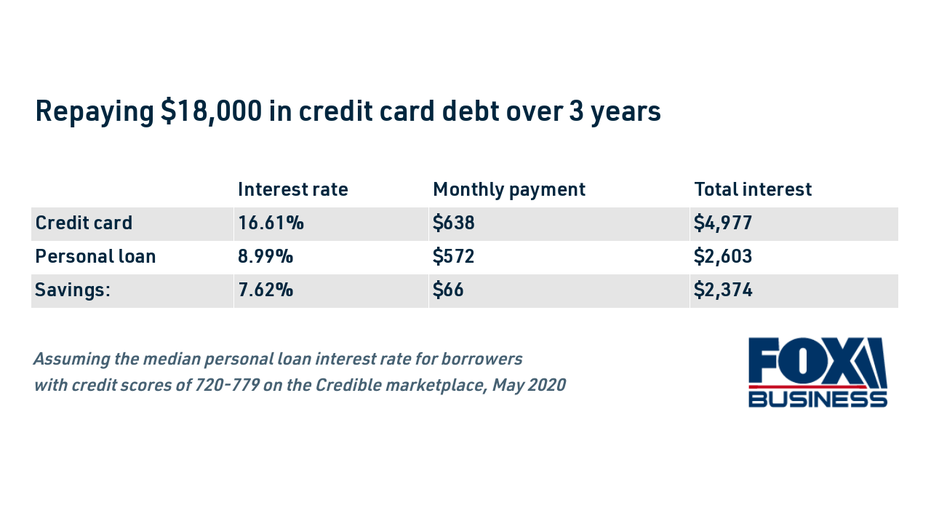

In fact, you may be able to save thousands of dollars by taking out a personal loan to pay off credit cards. Borrowers who took out a personal loan for debt consolidation on Credible's online marketplace in May 2020 had a potential savings of $2,374.

Be sure you're getting the lowest possible interest rate on a personal loan by comparing offers across multiple lenders. You can compare personal loan offers on Credible's online loan marketplace, all without impacting your credit score.

DOES A CREDIT CARD BALANCE TRANSFER AFFECT YOUR CREDIT REPORT?

How a credit card consolidation loan saved borrowers $2K+

Personal loans are a popular option for debt consolidation because they have a low, fixed interest rate and consistent repayment schedule. An unsecured personal loan doesn't require the borrower to put up collateral, allowing fast access to funds. Often, the loan amount can be disbursed into your bank account as soon as the next business day after being approved.

These benefits are significant, but the true reason why personal loans are such a popular debt repayment strategy is because of the potential for cost savings. Credit card issuers offer some of the highest interest rates on the market, whereas personal loans can offer a lower rate for borrowers with good to excellent credit. In fact, well-qualified consumers who took out a personal loan for debt consolidation on Credible's online loan marketplace saw a potential savings of nearly $2,400.

Credible analyzed a sample of borrowers with a 720-779 credit score who took out a 3-year personal loan for debt consolidation during the month of May 2020. Borrowers consolidated $18,000 on average, with a median personal loan rate of 8.99%. Based on the average credit card interest rate of 16.61% at that time, borrowers could save $2,374 on total interest payments and even reduce their monthly payments by $66.

DEBT SNOWBALL METHOD VS. DEBT AVALANCHE: WHAT’S THE DIFFERENCE?

The amount you can save depends on the personal loan rate you can secure. Interest rates on personal loans are dependent on the borrower's FICO score and debt-to-income ratio, as well as the loan amount and length of the repayment term.

Since personal loan interest rates can vary from lender to lender, it's important to shop around for the best possible rate for your financial situation. You can see your estimated personal loan rates across multiple lenders by filling out a single form on Credible.

3 RISKS OF RELYING ON BALANCE TRANSFER CREDIT CARDS

See your estimated monthly payments using a personal loan calculator

Whereas credit cards have a minimum payment requirement, personal loans have fixed monthly payments. This way, you'll always know how much you owe and when it's due. Plus, many personal loan lenders offer a discounted annual percentage rate (APR) if you enroll in automatic payment withdrawals, giving you an added benefit to making your payments on time.

Often, borrowers are able to get a lower monthly payment by refinancing their credit card debt with a personal loan thanks to the lower interest rates offered by personal loans. Here's how to find out your monthly payment using Credible's personal loan calculator:

- Total up your credit card debt. With personal loans, you can combine balances from multiple credit cards or just pay off one. You'll put the total in the "loan amount" box.

- Find your personal loan rate. You can get prequalified for a personal loan on Credible to estimate your potential interest rate without affecting your credit score.

- Select your loan term. Longer-term personal loans may offer lower monthly payments, but you'll likely get a higher rate and pay more interest over time.

PERSONAL LOAN ORIGINATION FEES: ARE THEY WORTH THE COST?

This calculator will help you determine your personal loan payment as well as your total interest paid over the life of the loan. That way, you can see if paying off your credit card debt with a loan is the best option for your financial situation.

Still not sure if credit card consolidation is right for you? Get in touch with an expert loan officer at Credible to explore your options for paying off high-interest credit card debt.

HOW TO AVOID A MORTGAGE PREPAYMENT PENALTY

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.