Average mortgage closing costs top $6,000, study finds: Here's how to pay

Home buyers pay closing costs of $6,000 on average, according to a new report. Here are three ways to cover the costs associated with buying a home in today's real estate market. (iStock)

Buying a home is a financial decision that can't be taken lightly. In addition to the cost of buying new furniture and hiring a moving company, you have to think about the upfront expenses of taking out a mortgage. These closing costs may include an appraisal fee, application fee, attorney fee, mortgage broker fee, loan origination fee and home inspection, for example.

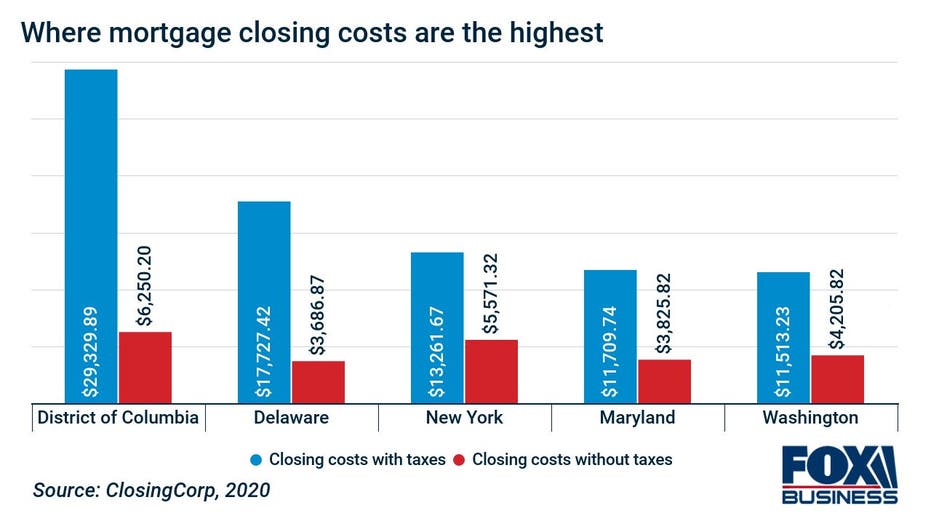

The average closing costs for a single-family home in 2020 topped $6,087 including taxes, or $3,470 excluding taxes, according to new research by ClosingCorp. These represent a year-over-year increase of 5.9% and 3.9%, respectively. But that's actually not too bad, considering that home values increased by 8.4% during this time, per Zillow data.

Estimated closing costs are more expensive in states with high costs of living and home prices. For example, closing costs and taxes on a home in our nation's capital cost nearly $30,000, but the average home sales price was $710,669 during this time.

ClosingCorp's report also broke down closing costs by metro areas and counties. Closing costs reached a staggering $67,000 in the New York county that includes Manhattan — where the average home sales price was $1.34 million.

Fortunately, the typical homeowner won't owe tens of thousands of dollars in closing costs, but even a few thousand dollars can be hard to scrape together when you're already saving up for a downpayment and other moving expenses. Keep reading to find out how you can pay for closing costs on a mortgage.

If you're in the market for a new home, it's important to compare mortgage rates so you can make sure you're getting a good deal. You can get prequalified for a mortgage on Credible's online loan marketplace to see potential interest rates across multiple mortgage lenders without affecting your credit score.

HOW TO BUY HOMEOWNERS INSURANCE

3 ways to pay for closing costs

It's recommended to pay for closing costs in cash, but that comes with a few drawbacks. Mortgage closing costs can eat into your savings at a time when you have little extra money to spare. You don't want to dedicate your entire savings to closing costs just to risk depleting your emergency fund, should an unexpected expense arise.

And even after dedicating every spare penny and tax refund check to your savings account, you may still come up short when the right time comes to buy a house. Thankfully, there are a few ways to pay for closing costs without having to drain your life savings:

- Roll closing costs into the mortgage

- Request seller concessions

- Borrow from your retirement fund

HOW TO REFINANCE A RENTAL OR INVESTMENT PROPERTY

1. Roll closings costs into the mortgage

Depending on the type of mortgage you have, you may be able to roll most of your closing costs and fees into the balance of the loan. For example, FHA loans allow first-time home buyers to include closing costs in the loan amount.

If you're refinancing your existing mortgage, you can typically roll your closing costs into the new home loan. Just make sure closing costs aren't too high to offset the lower interest rates.

Whether you want to purchase a new home or refinance your existing mortgage, shop around for the lowest possible mortgage rate for your financial situation on Credible. You can compare rates across multiple lenders without impacting your credit score.

WHAT IS PRIVATE MORTGAGE INSURANCE AND HOW DOES IT WORK?

2. Request seller concessions

Another common way to cover closing costs is to ask the seller for concessions during the negotiation process. Here's how it works: Instead of offering a lower price for the house you want, you could offer the full asking price and request that the seller absorbs 5% in closing costs.

The amount of concessions you can ask for varies depending on the type of mortgage loan you have. Here are the maximum seller concessions for common home loans:

- FHA loans: 6%

- USDA loans: 6%

- VA loans: 4%

- Conventional loans: 3-9%

In today's red-hot real estate market, it may be difficult to negotiate closing costs with a seller. Asking for concessions may make your offer less appealing, and a seller who gets multiple bids on their property is likely to disregard any offers that include concessions.

THIS IS THE BEST WAY TO LOWER YOUR MONTHLY MORTGAGE PAYMENT

3. Borrow from your retirement fund

Some 401(k) providers allow you to take a loan against your retirement account or make an early withdrawal in order to pay for costs associated with buying a house, including mortgage closing costs.

Taking out a 401(k) loan is typically the better choice because you won't have to pay taxes or an early withdrawal penalty, as long as the loan is repaid on time. You can borrow up to 50% of the vested balance or up to $50,000, whichever is less. Plus, since you're borrowing money from yourself, you'll pay interest back to yourself, and you won't have to undergo a credit check like other forms of financing.

With a 401(k) withdrawal, on the other hand, you'll have to pay income taxes on the amount, as well as a 10% early withdrawal penalty if you're younger than 59 and ½. The only limitation is that the withdrawal can't exceed the amount needed to purchase your home.

The best option for paying for or reducing closing costs will depend on your unique financial situation. To learn more about the costs of buying a home and taking out a mortgage, get in touch with a loan officer at Credible who can guide you through the process.

WHAT ARE MORTGAGE POINTS — AND HOW DO THEY WORK?

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.