Southern states most burdened by credit card debt: Study

The occasional splurging that comes with southern hospitality might just be responsible for credit card debt in key states, according to a study conducted by personal finance resource CreditCards.com.

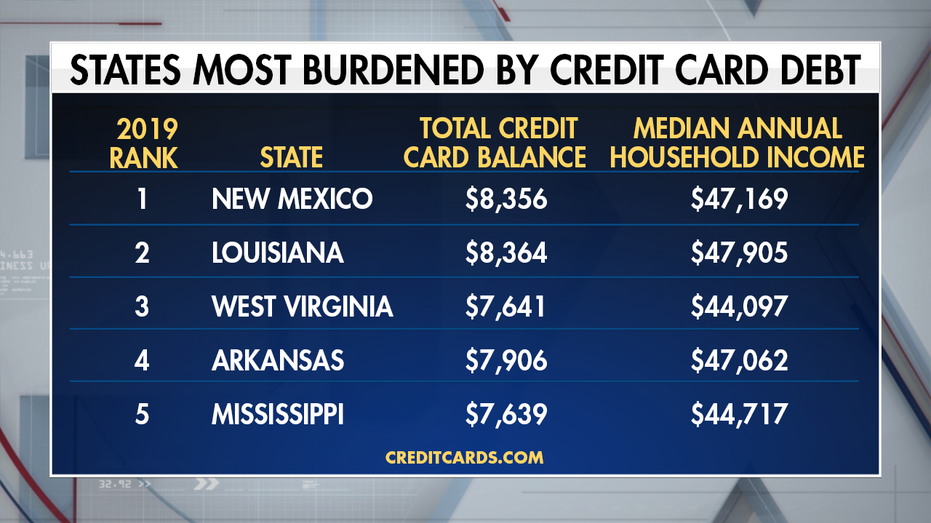

The data released on Wednesday found that out of the top 10 states with the highest amount of credit card debt, nine were southern states. The only geographical outlier on the list was New Mexico, which also turned out to rack up the most debt when compared to its median household income.

HERE’S HOW TO AVOID CREDIT CARD DEBT DURING THE HOLIDAYS

Louisiana, West Virginia, Arkansas and Mississippi follow New Mexico on the list.

According to the study’s findings, a typical household in New Mexico carries $8,356 in credit card debt and earns a median income of $47,169.

To illustrate how long it would take New Mexican households to pay off the four-figure amount, CreditCards.com calculated that it would take 17 months to eradicate the debt if 15 percent of earnings were put aside. Total interest paid within that time frame would be $1,339.

SIMPLE WAYS TO IMPROVE YOUR CREDIT, GET OUT OF CREDIT CARD DEBT

In contrast, the study said a typical American household that earns $61,937 can pay down the average credit card balance of $8,407 in 13 months. The interest charge would be $1,005, according to CreditCard.com’s calculations.

“This study illustrates how your income has a huge effect on your ability to pay off your credit card debt,” explained CreditCards.com industry analyst Ted Rossman.

If you’re in debt, regardless of where you live, I recommend balance transfer cards and seeking opportunities to raise your income and lower your expenses. Taking on a side hustle can dramatically reduce your debt payoff time and total interest expense.

MANY AMERICANS LEAVING CREDIT CARD, TRAVEL REWARDS ON TABLE

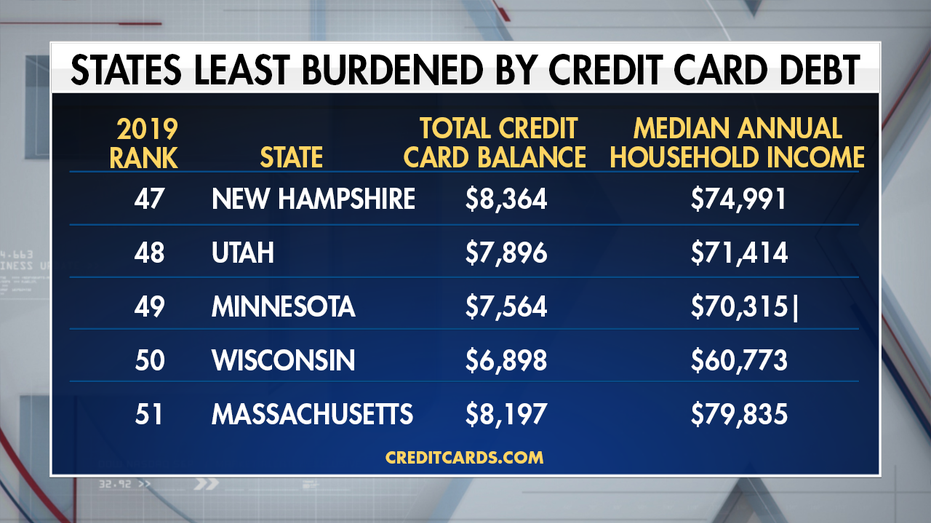

Conversely, the other U.S. regions are not as encumbered by credit card debt.

For example, CreditCards.com found that a typical Massachusetts household earns $79,835 per year and has an average credit card balance of $8,197. Putting aside 15 percent of the household’s income would knock out the total debt in nine months. Paying off the debt sooner would only cost $734 in interest.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

After Massachusetts, CreditCards.com noted credit card holders also have an easier time paying off their balances in Wisconsin, Minnesota, Utah and New Hampshire due to the higher median household income.