SoftBank takes control of troubled WeWork

WeWork, the beleaguered co-working startup, chose a rescue offer from investor SoftBank over a competing proposal from JPMorgan Chase, the Wall Street Journal reported.

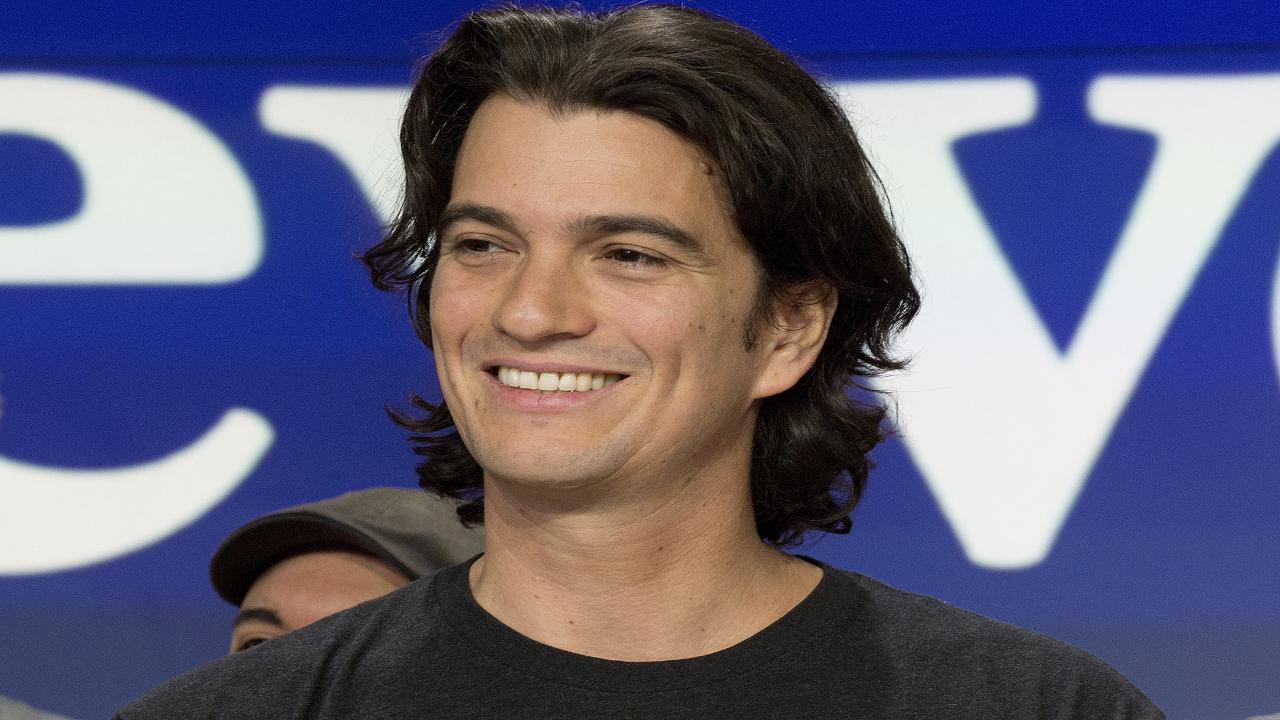

The deal would pay co-founder Adam Neumann nearly $1.7 billion, ending most of his ties with the company, the Journal said, citing sources it didn't identify. The transaction is expected to value WeWork at about $8 billion, down from an earlier valuation of $47 billion.

WeWork, which was planning to begin public sales of its stock last month, was forced to pull the offering despite bankers at Goldman Sachs pitching valuations as high as $90 billion — after investors began studying its high debt levels, massive losses and how quickly it was burning through cash.

Many prospective stock-buyers were dismayed by the numbers, a sour note after savvy, upbeat marketing pitches by Neumann, who subsequently faced claims of heavy personal spending with little oversight from the company's board.

SoftBank, which already controlled about a third of the startup, plans to buy $1 billion of stock from Neumann, who was previously forced to relinquish the role of CEO, the Journal reported. The Japanese firm will also pay him a $185 million consulting fee and provide a loan of about $500 million to repay credit extended by JPMorgan.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Based in New York and hailed at one time for its innovative approach to work spaces for small firms, WeWork has lost money every year since 2016, with the shortfall widening to $1.61 billion last year. In the first six months of this year, expenses outpaced revenue by $689.7 million, according to a regulatory filing.