Online shopping and holidays steal sleep from consumers. Here's how

It turns out that staying up late at night to scroll through online sales is far more common than many realize. In fact, sleep resource Each Night found that 71.6 percent of people have made bedtime purchases and more than half admitted to feeling fatigued in the morning.

With a whopping 60 percent of respondents making online purchases between midnight and 4 a.m., it’s not that shocking that late-night shoppers are waking up tired.

'SLEEP DIVORCE' COUPLES DEMAND MORE FROM A HOME THAN MAN CAVES, SHE SHEDS

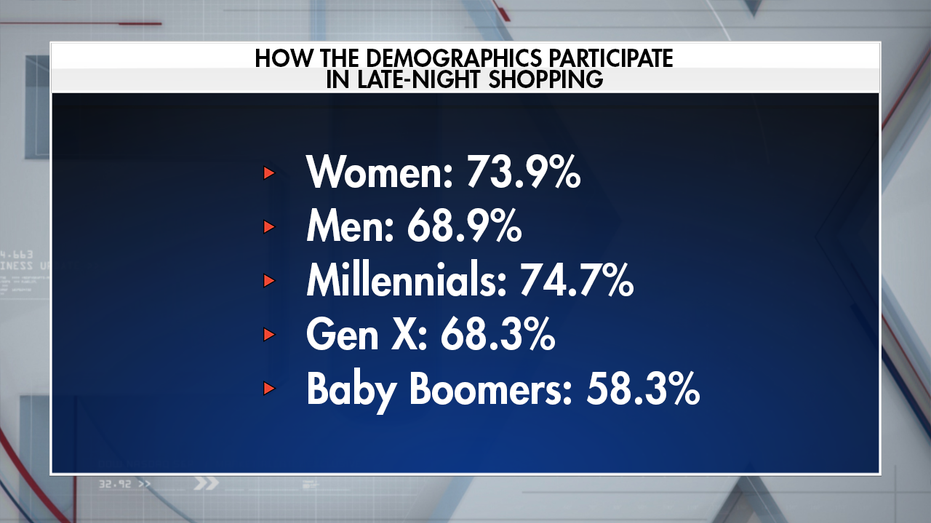

Evening shopping sessions showed prevalence across genders and generations, according to the survey. Women admitted to shopping more than men at 74 percent. Likewise, 69 percent of men admitted that they do the same.

Millennials were the generation to admit to late-night shopping the most at 74.7 percent. Gen X was a close second at 68.3 percent while Baby Boomers clinched third place at 58.3 percent.

Forty-three percent of respondents said they have also made an online purchase within the first hour of waking up at some point throughout the year.

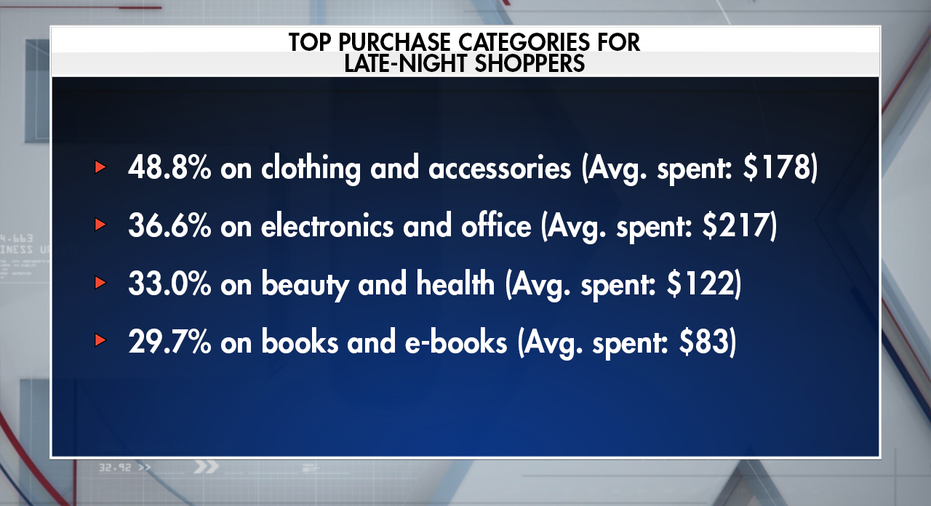

On average, people spent $165 on late-night purchases and incurred $186 in debt, according to Each Night. The top four categories people said they made purchases for included apparel, electronics and office supplies, beauty and health and books. The bottom four categories were food, toys and youth products, home improvements and sporting goods.

MOST AMERICANS LOSE SLEEP OVER MONEY ISSUES, SURVEY FINDS

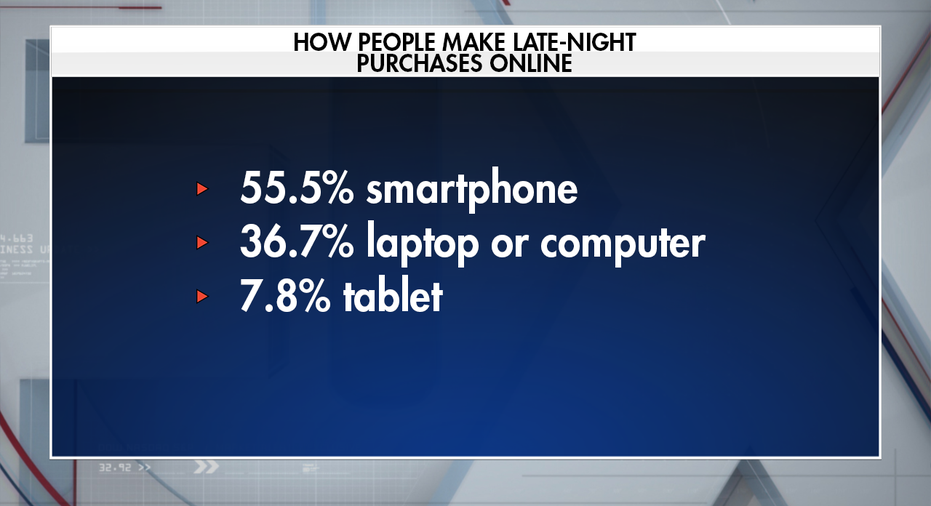

The study considers the rise of mobile gadgets and the convenience of e-commerce as contributing factors for the late-night shopping phenomenon. More than half of respondents said they make these purchases on their smartphone while over a third use a laptop or computer and less than a 10th use a tablet.

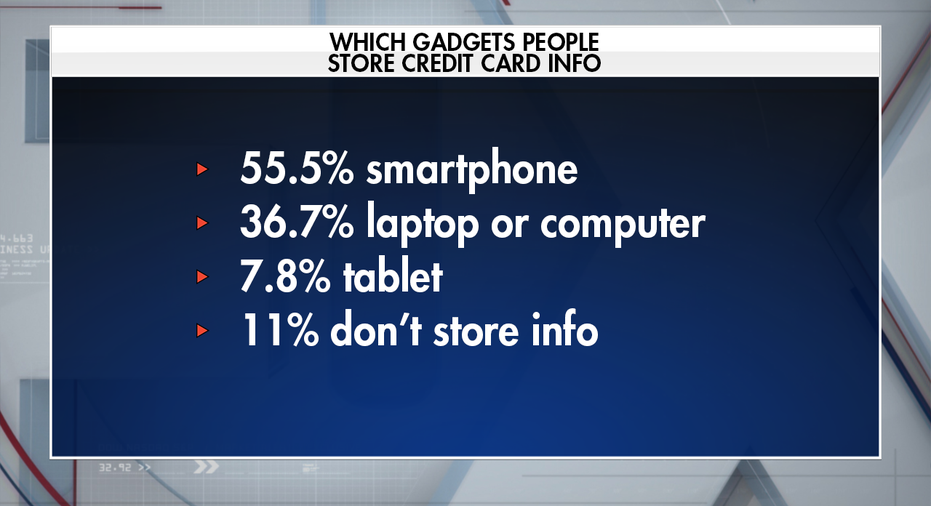

Respondents also noted which gadgets they store credit card information on. It turns out that more than half store this information on their laptop or computer and smartphone – though the former tends to be a more frequent go-to by a slight margin. Less than a fifth store their credit card information on a tablet while more than a 10th said they don’t store their info at all.

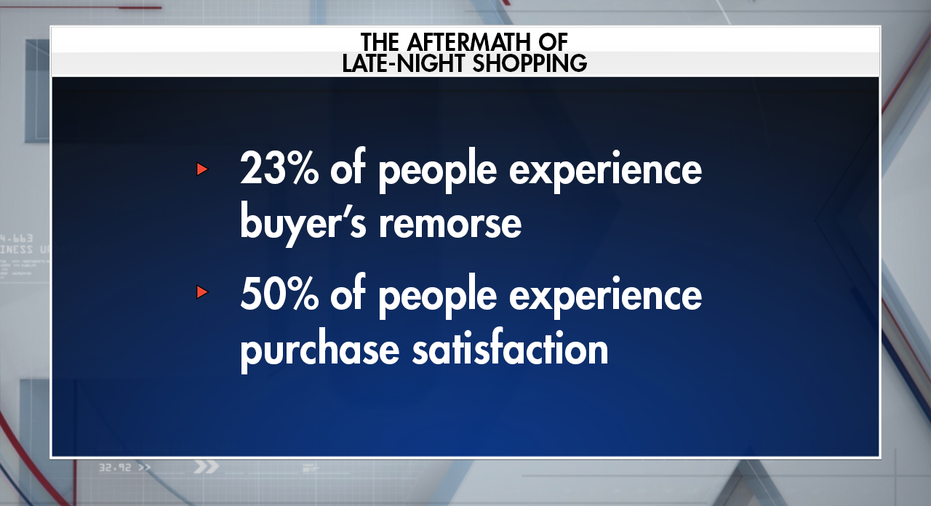

Late-night shopping in the digital world doesn’t come without regrets, according to Each Night’s respondents. Nearly a quarter experienced buyer’s remorse after making purchases past their bedtime. Conversely, half of the survey's participants reported feeling fine with what they bought

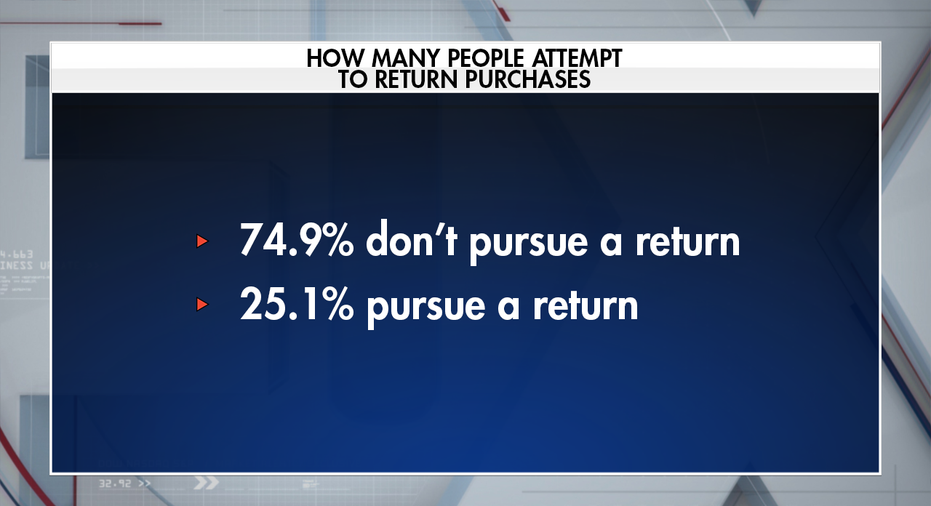

Of those who felt guilty about what they purchased, 25.1 percent attempted to recoup their money with a return at some point in the past year. Ninety-three percent successfully received a refund.

A WEIGHTED BLANKET BETTER FOR SLEEP?

“There are two ways I tell clients to avoid late-night impulse shopping," Ryan Marshall, a partner and certified financial planner at Ela Financial Group, told FOX Business. "The first is to put down the electronic device and pick up a book. This will not only help you fall asleep because you avoid the infamous blue light from the electronic screen, but there is no way you can make the purchase if you are reading a physical book.”

“The second way is the 48-hour rule. If you are thinking about making a late-night purchase add the item to your cart and wait 48 hours to make sure you really want to make the purchase,” he continued. “Usually after those 48 hours, you are no longer making an impulse purchase and may even forget you put something in your cart.”

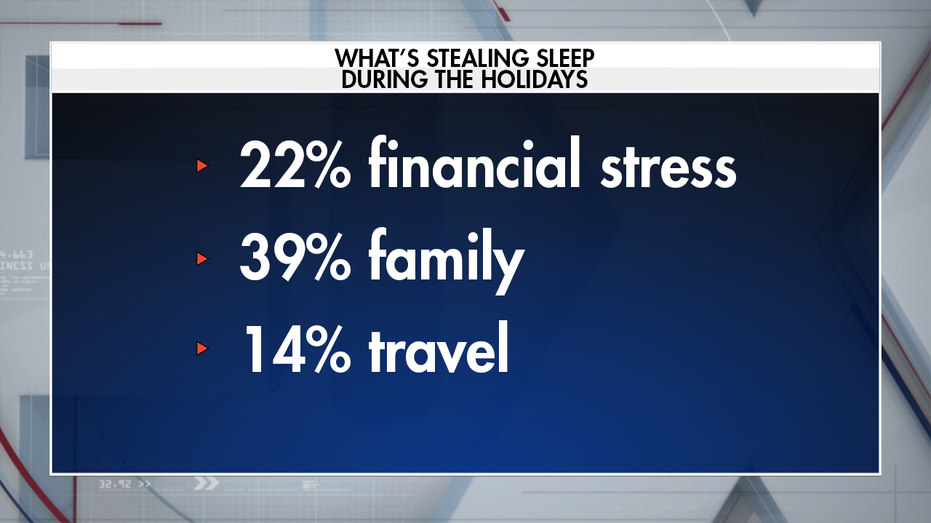

Shopping-related sleep loss also plays a role for some during the holiday season, according to a study conducted by Mattress Advisor. Twenty-two percent of respondents said they lose sleep due to financial stress. Family was another root cause at 39 percent along with travel at 14 percent.

Further broken down, general holiday pressures related to finding the right gift, errands and visits with Santa Claus were other factors that stole sleep.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

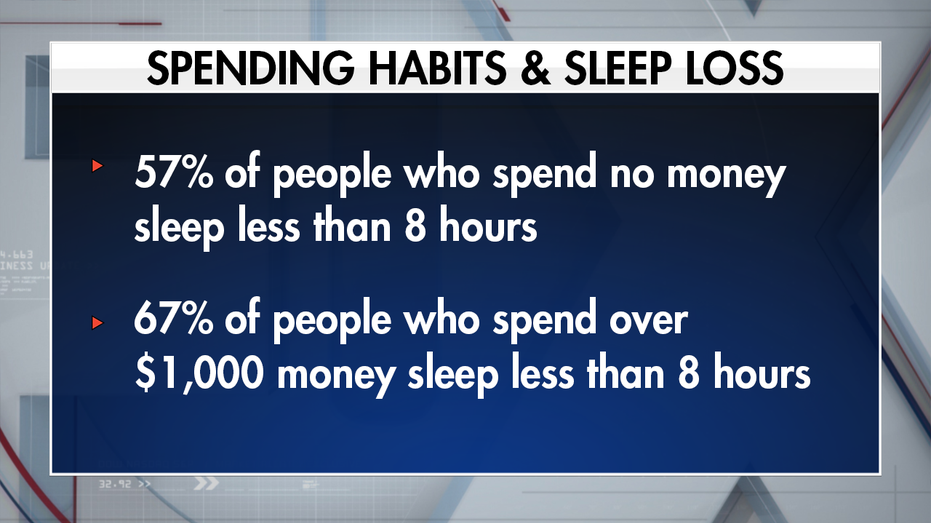

In terms of spending, Mattress Advisor found that individuals who spent more during the holidays lost more sleep than those who were conservative and spent under $100.

Conversely, individuals who spent no money at all during the holidays got the least amount of sleep from all the study’s respondents. Mattress Advisor suggested that this may be “due to the guilt of skipping out on the gift-giving tradition altogether.”

CLICK HERE TO READ MORE ON FOX BUSINESS

“To avoid stress make sure you lay out a holiday spending budget and stick to it,” Marshall offered as a piece of advice for antsy holiday shoppers. “If you know what you want to spend before you go out shopping it will not only save you time by avoiding goods that are out of your price range, but you shouldn't have any surprises when you receive your credit card statement next month.”