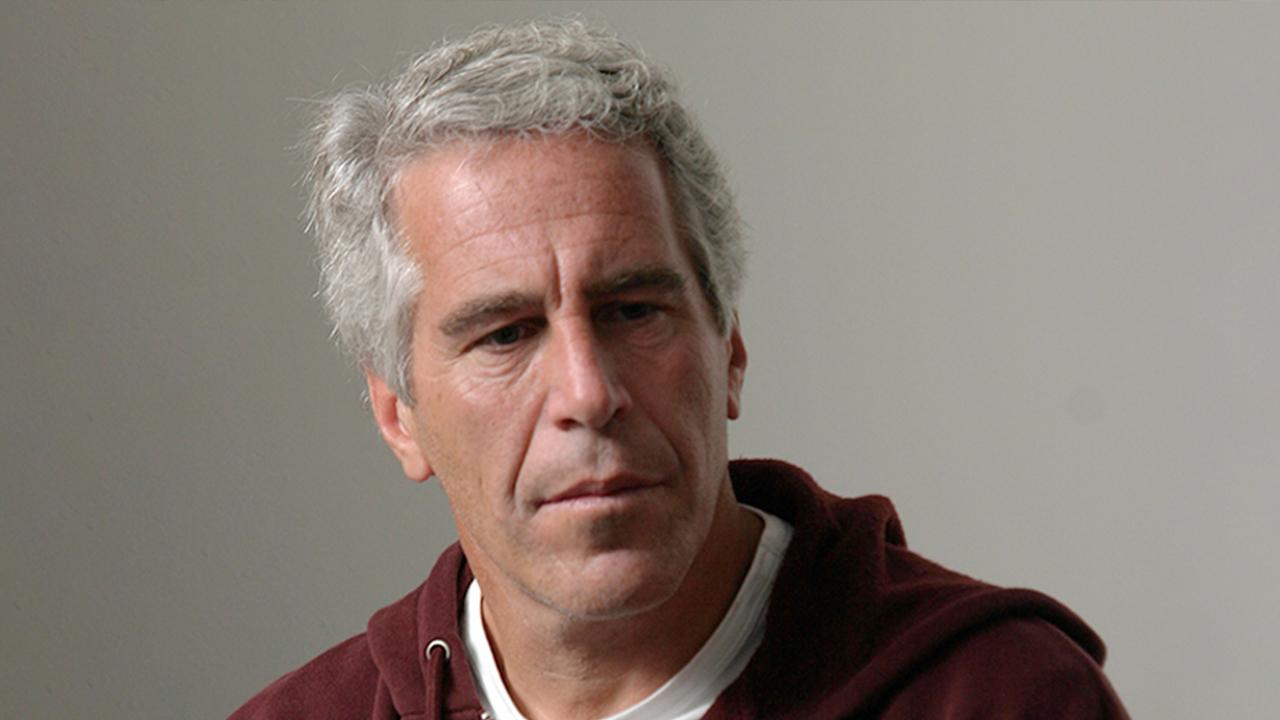

Deutsche Bank execs responsible for Epstein relationship named by New York Times

Deutsche Bank was fined $150M last week for Epstein relationship

The New York Times on Monday named multiple Deutsche Bank executives who were responsible for the bank’s relationship with Jeffrey Epstein, the convicted sex offender and financier who was found dead by apparent suicide last August.

This comes one week after New York state’s Department of Financial Services fined Deutsche Bank $150 million “for significant compliance failures in connection with the Bank’s relationship with Jeffrey Epstein.”

Deutsche Bank confirmed to FOX Business that The New York Times piece is accurate, and said that all individuals involved have been appropriately disciplined.

GHISLAINE MAXWELL ATTORNEYS, PROSECUTORS SPAR OVER FLIGHT RISK CONCERNS

A spokesman for Deutsche Bank said the 2015 arrival of Jan Ford, the bank’s head of compliance in the Americas, was a turning point that ultimately led to the termination of the bank’s relationship with Epstein.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DB | DEUTSCHE BANK AG | 37.98 | +0.76 | +2.04% |

Deutsche Bank maintained a relationship with Epstein from August 2013 until December 2018 despite the fact that he was convicted of soliciting prostitution from a minor in 2008, according to a consent order filed by New York financial regulators.

The Times reports that Paul Morris, who previously helped manage Epstein’s account at JPMorgan, was the banker that originally introduced Epstein to bank executives in 2013 as a client who could generate $2-4 million of revenue annually. He was referred to as “RELATIONSHIP MANAGER-1” by financial regulators in the consent order.

FEDS FEARED EPSTEIN CONFIDANTE GHISLAINE MAXWELL MIGHT KILL HERSELF

It was Charles Packard, the head of the bank’s American wealth-management division, who approved of the bank’s relationship with Epstein in 2013, according to The Times. Both Morris and Packard are no longer employed at Deutsche Bank.

After the relationship with Epstein began, Deutsche Bank ignored dozens of red flags that regulators say should have prompted additional scrutiny.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

According to a press release by the NY Department of Financial Services, these red flags included: “payments to individuals who were publicly alleged to have been Mr. Epstein’s co-conspirators in sexually abusing young women; settlement payments totaling over $7 million, as well as dozens of payments to law firms totaling over $6 million for what appear to have been the legal expenses of Mr. Epstein and his co-conspirators; payments to Russian models, payments for women’s school tuition, hotel and rent expenses, and (consistent with public allegations of prior wrongdoing) payments directly to numerous women with Eastern European surnames; and periodic suspicious cash withdrawals — in total, more than $800,000 over approximately four years. “

The New York Times details how Morris and Packard visited Epstein at his Manhattan mansion in January 2015 to ask him about these red flags as well as “about the veracity of the recent allegations” in the media. They left satisfied with Epstein’s explanation.

Deutsche Bank ended its relationship with Epstein in November 2018 after The Miami Herald exposed the extent of Epstein’s sexual misconduct as well as the sweetheart deal he got from prosecutors.