Coronavirus pandemic could force half of small businesses to close within 6 months, study finds

Twelve percent of businesses could close within 1 month

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here.

More than half of all small businesses in the U.S. are on the brink of going out of business over the next six months if the coronavirus pandemic continues, according to a new report.

New research released Wednesday by the Society for Human Research Management found that 52 percent of small businesses expect to close within six months. Twelve percent said they may be forced to close within one month, and 20 percent said they can only stay afloat for three more months.

"SHRM has tracked COVID-19’s impact on work, workers, and the workplace for months," SHRM President and CEO Johnny Taylor said in a statement. "But these might be the most alarming findings to date. Small business is truly the backbone of our economy. So, when half say they're worried about being wiped out, let’s remember: We're talking about roughly 14 million businesses."

TREASURY SAYS SOME PUBLIC COMPANIES NOT ELIGIBLE FOR SMALL-BUSINESS LOANS AFTER BACKLASH

Despite the government-backed Paycheck Protection Program, which provides forgivable loans to small businesses at an interest rate of 1 percent to help them maintain payroll throughout the crisis, 54 percent of owners reported laying off employees. Fourteen percent said they have laid off all of their employees. Twenty-two percent said they have furloughed workers.

FILE - In this March 24, 2020, file photo, a pedestrian passes a business which has closed temporarily in San Antonio. (AP Photo/Eric Gay, File)

But business owners were divided about whether the government had done enough to protect small businesses. About 46 percent said they believe the government is not doing enough, despite the $660 billion rescue program. The sentiment was worse for state governments; 49 percent of small business owners believed they weren’t doing enough to protect them.

CORONAVIRUS SMALL BUSINESS BILL STILL INCLUDES LOOPHOLE FOR BIG COMPANIES

Since launching in early April, the PPP has been plagued by complaints that big businesses and national chain restaurants tapped the fund while small businesses languished. So far, 348 publicly traded companies have secured loans worth more than $1.7 billion, according to Washington D.C.-based data analytics firm FactSquared. Of those companies, 42 have returned the money, or about $337 million.

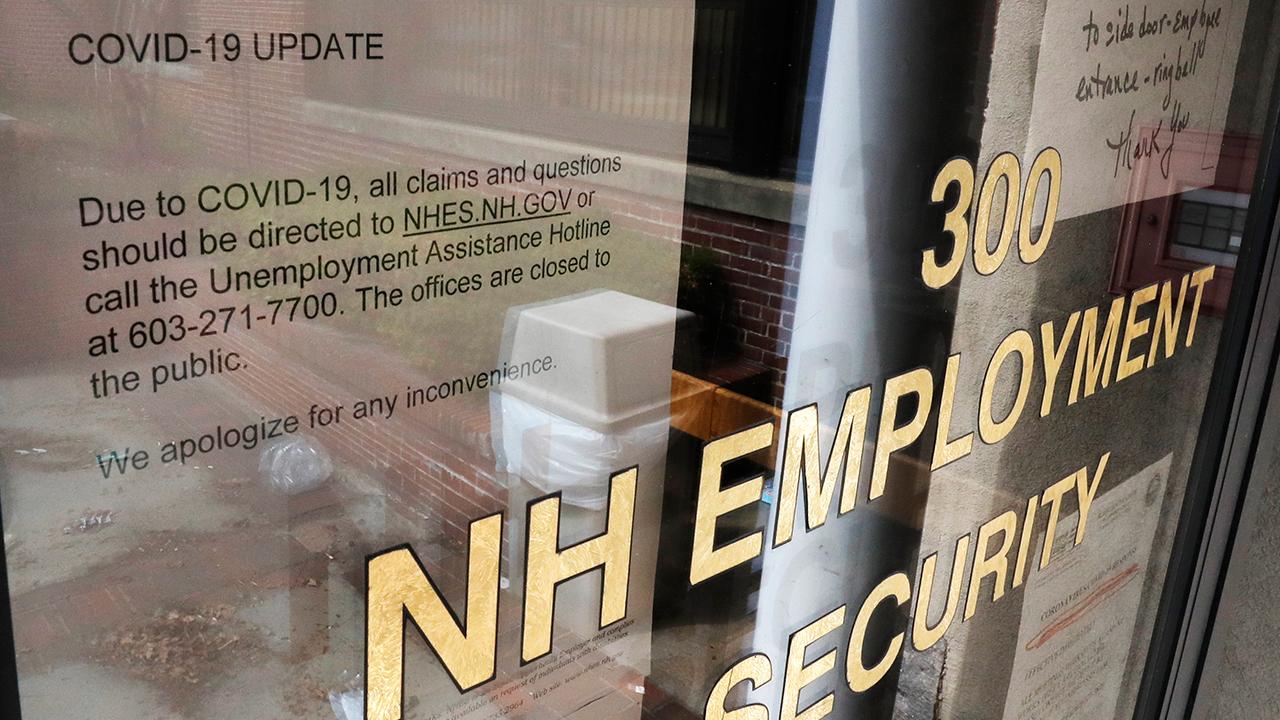

The report comes amid a bleak backdrop: Over the past seven weeks, more than 33 million Americans have filed for first-time unemployment benefits, a record not seen since the Great Depression.

'WE ARE RUNNING THIN': RESTAURANTS REOPEN, BUT SOME WON'T RETURN TO WORK

Still, small business owners were optimistic about rehiring laid-off workers. Nearly two-thirds, or 66 percent, of owners believed layoffs would be temporary and positions would be rehired. Just 9 percent said they think layoffs will be permanent.

About seven in 10 owners expected it will take less than six months after the pandemic ends for business to return to normal.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The study, conducted between April 15 and April 21, surveyed 375 small business owners.

CLICK HERE TO READ MORE ON FOX BUSINESS