Coronavirus led 33% of Americans to make a credit-harming decision: Study

Cardholders admitted to engaging in behaviors or decisions that lower credit scores

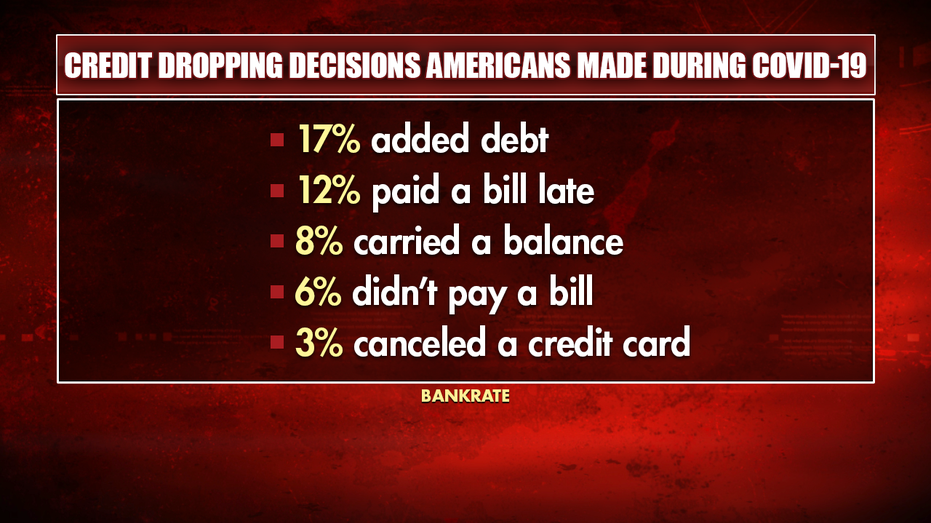

As the coronavirus persists in the U.S., one-third of Americans have admitted to making at least one financial decision in the last four months of the pandemic that is likely to hurt their credit score, a new Bankrate study has revealed.

Particularly, the main financial decisions Americans have made that can adversely affect their credit score include adding more debt, paying at least one bill late, carrying a balance, ignoring a bill payment date or canceling a credit card.

CORONAVIRUS PANDEMIC HURTING AMERICANS’ FINANCES IN DISPARATE WAYS

Of those who increased their debt, 22 percent of respondents said their household income was negatively impacted by the pandemic while 11 percent said their household income was not negatively impacted. Meanwhile, for the people who reported paying a bill late, only 18 percent had their household income negatively impacted while seven percent did not.

Interestingly, when it comes down to the people who kept a balance on their credit card, 44 percent incorrectly believe carrying balance would increase their credit score. This finding may suggest that around two in five cardholders may not be aware that credit utilization can make up 30 percent of a person’s credit score, according to Experian.

TYPES OF CREDIT CARD RELIEF YOU CAN REQUEST

Twelve percent of respondents who carried a balance reported their household income being negatively impacted while four percent reported their household income was fine.

The respondents who said they did not pay a bill at all or canceled a credit card were in the vast minority, Bankrate found.

Ten percent of people who reported not paying a bill had their household income negatively impacted while two percent reported they did not.

HOW MUCH EQUITY DO YOU NEED TO REFINANCE YOUR MORTGAGE?

Of those who canceled a credit card, 26 percent incorrectly thought the move would help to improve their credit score, which it generaly does not because it can shorten a person’s overall credit history and result in a lower score, according to TransUnion.

(iStock)

Likewise, age of credit makes up about 15 percent of a person’s credit score, a report from Credit.com says – a fact that can potentially hurt the five percent of Bankrate respondents who caneled a credit card because their household income was negatively impacted as well as the two percent who did the same despite their household income not being harmed.

READ MORE ON FOX BUSINESS BY CLICKING HERE

Although Bankrate’s survey has shown that some Americans have dabbled in financial behaviors that aren’t the best for a healthy credit scored, only 13 percent of cardholders said they are concerned about shrinking credit reports.

However, households with challenged finances are reportedly more than three times as likely to have money concerns versus their financially stable counterparts at 20 percent versus six percent, respectively.

CLICK HERE TO READ MORE ON FOX BUSINESS