The trick to becoming a 401(k) millionaire and retiring early: ‘Make your money work for you’

CPA Dan Geltrude says 'start early' for a comfortable retirement

It's never too late to have 'your money working for you': Dan Geltrude

Market analyst and CPA Dan Geltrude on the importance of compounding investments and portfolio diversification.

A recent survey by Northwestern Mutual suggested it takes nearly $1.5 million to retire comfortably, leading many Americans to wonder if they'll ever be able to experience those "golden years" as they'd hoped.

Market analyst and CPA Dan Geltrude says the best way to get there is to make your money work for you, and it starts with your 401(k).

"You want to start investing as early as possible because compounding time is on your side, so start early," he said Monday on FOX Business' "Mornings with Maria."

Investing while young is better, but it's also important to take advantage of matching opportunities employers offer to help secure your future.

COST OF LIVING HINDERS YOUNGER GENERATIONS FROM SAVING FOR RETIREMENT: FIDELITY

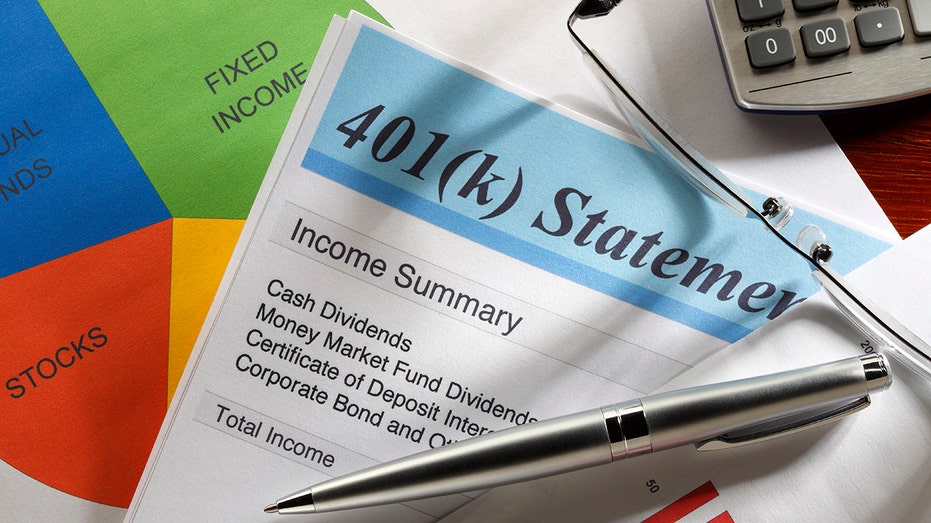

A recent survey by Northwestern Mutual suggested a comfortable retirement would require nearly a $1.5 million nest egg. (iStock / iStock)

"There's no reason not to take advantage of that," Geltrude continued before diving into a discussion about diversifying investments.

"Spread out that risk because, when you have all your eggs in one basket, what happens to that basket if things go a little bit south? And, of course, what are your goals? Are you looking for retirement savings? How about college? Buying a house…?"

"Time is on your side when you're young. Any time you're going to get a mentality to start to invest, it goes back to when's the best time to plant a tree? Twenty years ago. The next best time [is] today, so it's never too late to have your money working for you," he explained.

It's going to take more than Social Security to survive, he warned, pointing to that startling $1.46 million needed for comfortable retirement, a number even more dismal than the $1.27 million from a year ago.

401(K)S VS PENSION PLANS: WHAT'S THE DIFFERENCE?

Saving for retirement might be more difficult today, considering the high cost of living, but CPA Dan Geltrude says to make sure your employer is matching your input and think of your desired outcomes. (iStock / iStock)

"If you want to be able to save that kind of money, or shall I say, earn that kind of money to that point, you need to start right now because no one is going to help you. You have to help yourself."

His other advice is to "work backwards," keeping in mind what outcome you'd like to attain.

"What are the things you need to do to be able to get to that point? You can't just say, 'Well, I'm going to invest emotionally. This sounds like a good idea.' That doesn't work," he continued.

401(K) PLANS INCLUDE THESE HIDDEN BENEFITS YOU NEED TO KNOW ABOUT

Sunshine State workers weigh in on retirement

Florida resident shares her thoughts on the U.S. economy as concerns regarding retirement savings grow.

High living costs, meanwhile, have stifled younger Americans' hopes to save for retirement.

A report from Fidelity Investments last month found that over half of Millennials and Gen Z believe they will have a harder time saving for retirement than the generations before them due to the higher cost of living.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Diners weigh in on retirement as new study shows what it would take to retire comfortably

FOX Business' Ashley Webster talks to diners in The Villages, Florida about retirement as a Northwestern Mutual survey claims it will take $1.46M to retire comfortably.