Larry Kudlow: Why are gas prices hitting record highs on a daily basis?

Larry Kudlow calls out Biden's anti-fossil fuel policies

Larry Kudlow on rising gas prices: US is still significantly undersupplied in oil

FOX Business host provides insight on why Americans are seeing rising gas prices on 'Kudlow.'

Why are gasoline prices hitting new record highs on a daily basis? Why are diesel prices doing the same thing?

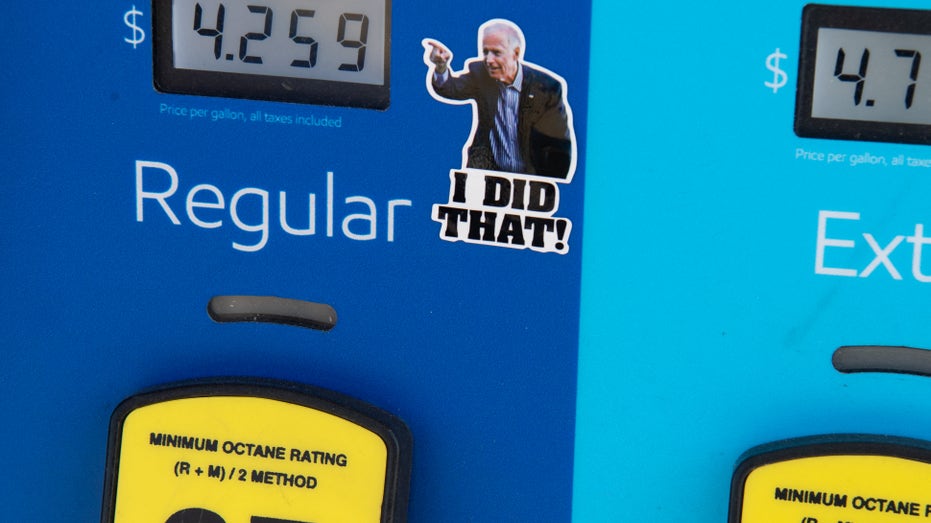

Gas at the pump hit $4.91 today. That's more than double the $2.40 on President Joe Biden's inauguration day. A year ago in June of 2021, gasoline was $3.05 and diesel was $3.20.

You get the picture. Motorists and truckers are getting killed and so are middle- and lower-income consumers, who get hit the hardest by the inflation tax.

By some estimates, the typical family is going to pay $3,500 more for energy costs. Other estimates go above $5,000. Seventy-five percent of the goods and products distributed in the U.S. are shipped by truck, so those record diesel prices go right into the cost of everything, including food.

MEDIA LOVE BIDEN'S HIGH GAS PRICES WHILE ORDINARY AMERICANS STRUGGLE WITH PUMP RECORDS

A gas pump displays current fuel prices, along with a sticker of US President Joe Biden, at a gas station in Arlington, Virginia, on March 16, 2022. (SAUL LOEB/AFP via Getty Images / Getty Images)

If you think there's no end to this, you may be right. According to the Energy Information Administration, that's the EIA in the Energy Department, gasoline inventories are going down, while demand is going up.

Total domestic stocks fell by 700,000 barrels last week, while gas demand picked up by over a million barrels. That supply-demand imbalance is bullish for gas prices, but bearish for everything else.

I haven't mentioned natural gas, which is probably the most important energy source of all and the cleanest, outside nuclear.

The latest quote for nat gas is $9.34 per million BTUs. That's about double from a year ago. Nat gas cools and heats homes, offices, factories, power grids — you name it. It's a double.

The world price of oil is running about $120 a barrel right now. That's up $50 for the year and up $70 since Joe Biden took office. I keep hearing about something called "peak inflation." Color me very skeptical.

Widely followed commodity charts Bloomberg commodities and Goldman Sachs commodities have just hit new peaks from energy and food. So, I wouldn't be so sure about inflation peaking and if and when it does, it's going to be very sticky on the way down, but even with the hike in oil prices and nat gas prices, the Baker Hughes rig count has flattened out recently, despite record high prices. Why is that?

GAS PRICES CLIMB 5 CENTS OVERNIGHT, AMERICANS ARE PAYING NEARLY $2 MORE FROM JUST ONE YEAR AGO

Gas cards for guns buyback program sees 'overwhelmingly positive' response: Sacramento police chief

Sacramento Police Department Chief Kathy Lester says other departments nationwide have reached out about how to start gas gift card exchanges for guns.

Well, if you talk to oil executives, they'll tell you it's because they're very uncertain about the future.

Given all the anti-fossil policies coming out of Team Biden, even if you get a lease someplace, you probably won't get a permit.

The EPA, Energy Department and Interior Department have all radically tightened their environmental tests for oil, gas, refining, LNG, pipelines — everything. Not only have they radically tightened their environmental restrictions; they've also destroyed the permitting reductions for new projects put in place by President Trump a couple of years ago. NEPA rules have been thrown out the window.

One federal decision, the same story. So, it's bad enough that the woke Bidens have relied on nutty ideas like the social cost of carbon, but they've also added states, counties and native tribes into the decision-making process.

By the way, we should probably add trial lawyers as well, because they're going to have a field day. So, basically nothing is going to get done.

That's one big reason the rig count hasn't responded to record-high energy prices. Call it the regulatory tax or the uncertainty tax. Why should they invest in the future when there may not be a fossil fuel future?

YELLEN CALLS ELEVATED INFLATION 'UNACCEPTABLE,' BUT OFFERS FEW SOLUTIONS TO COOL PRICES

Fuel prices at a gas station in New York, U.S., on Tuesday, May 17, 2022. (Photographer: Stephanie Keith/Bloomberg via Getty Images / Getty Images)

Another reason incidentally is all this ESG investing stuff, where fossil companies have had difficulty in securing finance for their projects.

ESG is the holy grail of the entire Biden administration. It's right up there with another falsehood called existential immediate climate risk. This is about left-wing progressive ideology, not facts, but there you have it. It’s the Biden war against fossil fuels.

So, no wonder demand continues to exceed supply and prices continue to go up. Even now, oil production through the end of May is 1.2 million barrels per day, less than the 13.1 million reached pre-pandemic.

So, with all this gnashing of teeth about high inflation and Biden "feeling your pain" of the cost at the pump for ordinary families, and all the excuses, and all the apology tours — we the U.S. are still significantly undersupplied with oil even at this late date. Undersupplied oil means high prices at the pump and everywhere else.

CLICK HERE TO GET THE FOX NEWS APP

Inflation ‘much higher’ than the Fed target: Expert

The Macro Compass founder Alfonso Peccatiello discusses how the Fed is handling inflation and why it’s impacting the stock market.

This is a homegrown problem, self-inflicted. The root cause of this energy problem is not Vladimir Putin, though factually I will concede since February or so Putin's war has contributed, but from day one of the Biden administration, indeed even day one after Biden’s election, energy prices have been rising because of bad, anti-fossil, woke policies and a command-and-control central planning approach to implementing these poor policies.

But you know what? The cavalry is coming.

This article is adapted from Larry Kudlow's opening commentary on the June 7, 2022, edition of "Kudlow."