Why Netflix Won't Be Part of Apple's New TV App

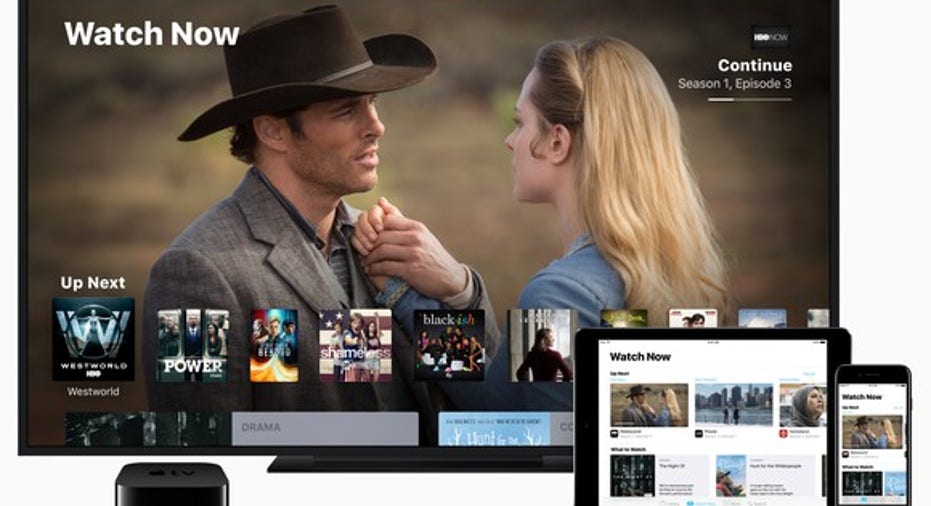

Image source: Apple.

The new TV app from Apple (NASDAQ: AAPL) is a great content aggregator. It collects all of the various video content consumers have access to through iTunes downloads, stand-alone streaming services, and on-demand streaming services that use pay-TV credentials. But there are a couple of major omissions: Netflix (NASDAQ: NFLX) and Amazon.com (NASDAQ: AMZN).

Those omissions have led many people to criticize the app, since at least 50 million Americans watch some of their television through Netflix or Amazon Prime Instant Video. That severely limits Apple's new app in its ability to find and recommend the best content for each user. What's more, it's unlikely Netflix will ever sign on.

Netflix gets a lot of value out of controlling its user experience

The big issue with Apple's TV app, from Netflix's standpoint, is that it cedes control of the user experience to Apple. That could be good for stand-alone networks and online pay-TV streaming portals, which generally have poor user interfaces and low adoption. But for Netflix, which has a quality user interface and strong adoption, it's unnecessary and even detrimental to its business.

Most egregiously, Apple would take over the content recommendation from Netflix, something Netflix relies on to improve watch time and churn. Earlier this year, Netflix published a paper claiming its recommendation engine saves the company $1 billion per year. "When produced and used correctly," the authors say, "recommendations lead to meaningful increases in overall engagement with the product (e.g., streaming hours) and lower subscription cancellations rates."

Additionally, the TV app removes a lot of branding from the user interface. That could have a negative impact on churn for a service like Netflix or Amazon Prime Instant Video. If it's more unclear where this content is coming from, it's harder for users to justify $10 a month for one of those services.

Overall, it's more likely services with a strong brand and user interface such as Netflix or Amazon will see a negative impact from Apple's TV app than the potential positives.

Netflix wants its data all to itself

On top of the potential detriments to Netflix's user experience, Netflix's participation in the TV app would open up a lot of its data to Apple. Netflix is historically very private about its viewer data, as is Amazon. It won't even share its data with the people responsible for creating its original content.

Netflix's viewer data is one of its biggest competitive advantages. It lets it spend its content budget effectively and efficiently. It's also one of the reasons its original series have managed to become so popular.

With Apple's increasing interest in producing original video content -- starting with Apple Music exclusives -- Netflix's viewer data would be immensely valuable. On the flip side, for Netflix to let its data fall into the hands of Apple could give rise to another big competitor.

Even if the adoption rate of Apple's TV app remains relatively low, Netflix's participation would probably generate a significant increase in adoption. As a result, evaluating the impact of Netflix's inclusion is difficult. Management is best off staying on the sidelines and focusing on drawing consumers to its app. Giving up control of both its user experience and data is too risky, given the huge benefits each provide Netflix.

10 stocks we like better than Netflix When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now and Netflix wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of November 7, 2016

Adam Levy owns shares of Amazon.com and Apple. The Motley Fool owns shares of and recommends Amazon.com, Apple, and Netflix. The Motley Fool has the following options: long January 2018 $90 calls on Apple and short January 2018 $95 calls on Apple. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.