Vanguard 401(k): Best Funds for Your Retirement Plan

Image source: Getty Images.

One of the most admirable qualities of Vanguard is that it doesn't have a profit motive. The company is owned by investors who own its funds, resulting in a lineup of investor-friendly funds with microscopic expense ratios. Thus, investors who can invest in its funds in a retirement account have a big leg up on others who are stuck with higher-fee funds.

The three funds below are some of the best retirement funds for investors who are lucky enough to have Vanguard funds in their 401(k) plans.

|

Mutual Fund |

Ticker |

Expense Ratio |

|---|---|---|

|

Vanguard Total Stock Market |

VTSMX |

0.16% |

|

Vanguard FTSE All-World ex-U.S. |

VFWIX |

0.26% |

|

Vanguard Emerging Markets Stock Index |

VEIEX |

0.33% |

Data source: Vanguard.

The fund for U.S. stocks

Vanguard's Total Stock Market Index Fund is an excellent pick for retirement accounts because it is broadly diversified and inexpensive to hold. The Total Stock Market fund held more than 3,600 U.S.-listed stocks at the time of writing, investing in everything from companies worth as little as $10 million to giant household names like Apple, which has a stock market value in excess of $560 billion.

The underlying index for the fund attempts to invest in 99.5% of American stocks by market cap, excluding only the smallest 0.5% of stocks that may be too illiquid or too small for the fund to hold. Excluding the very smallest of U.S.-listed stocks protects the fund from investing in stocks that are so small that Vanguard's index fund would drive the majority of daily buying or selling.

Holdings are weighted by market cap. Thus, larger companies make up a bigger percentage of the fund's assets.

|

Stock |

Percentage of Assets |

|---|---|

|

Apple |

2.37% |

|

Microsoft |

1.85% |

|

ExxonMobil |

1.61% |

|

Johnson & Johnson |

1.51% |

|

Amazon.com |

1.33% |

|

Total Top 5 |

8.67% |

Data source: Vanguard.

A fund for developed foreign markets

A frequent concern of financial planners is that their clients have a "home country bias" in their portfolios, investing too heavily in domestic stocks while investing too little in foreign stocks. The Vanguard FTSE All-World ex-U.S. index fund currently holds 2,550 stocks that are listed outside the United States, making it an excellent fund for beefing up your foreign stock ownership.

Going global has its advantages. Not all corporate behemoths are primarily listed on U.S. exchanges. Note that the five largest companies in this fund are recognizable to most American investors.

|

Stock |

Percentage of Assets |

|---|---|

|

Nestle SA |

1.39% |

|

Novartis AG |

1.10% |

|

Roche Holding |

1.02% |

|

Toyota Motor |

0.88% |

|

HSBC Holdings |

0.73% |

|

Total Top 5 |

5.12% |

Data source: Vanguard.

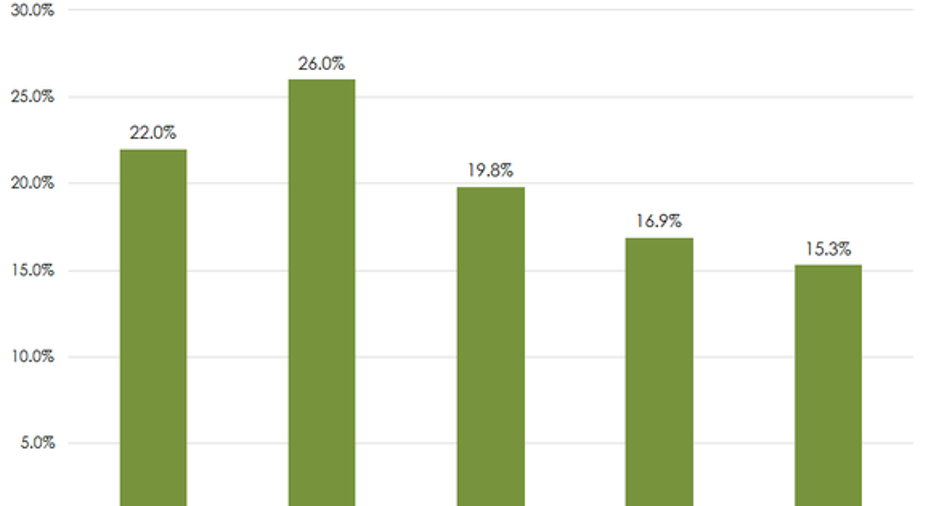

The fund is most heavily invested in developed markets around the world. Japan, the United Kingdom, and France represent its three largest geographic exposures, making up 17.7%, 13.8%, and 6.4% of fund assets, respectively. Emerging markets comprised just 19% of fund assets combined, meaning that you'll likely want to add an emerging markets fund to your portfolio to get more exposure to up-and-coming global economies.

A fund for emerging markets

The Vanguard Emerging Markets Stock Index Fund seeks to invest in small to large companies that are listed in emerging markets around the world. The fund currently holds nearly 4,100 stocks, with China, Taiwan, and India making up its three largest country exposures at 27.5%, 15.4%, and 12.2% of assets, respectively.

By far the riskiest of the three funds discussed here, this fund has a heavy bias toward Asian stocks, specifically Chinese companies. It also has the heaviest weighting in small-cap companies, which are simply less stable than their large-cap counterparts. Nearly half (approximately 48%) of fund assets were invested in companies with market values smaller than $8 billion at the time of writing.

Vanguard's index funds really shine against higher-cost competitors in emerging market funds. The Wall Street Journal recently reported that the average actively managed emerging markets fund had an expense ratio of 1.54% of assets, nearly 4.7 times more than Vanguard's emerging market index fund. The average emerging market index fund charged 0.56%, still 70% more than Vanguard's most expensive share class, which carries annual expenses equal to 0.33% of assets. Vanguard is a leader in driving down fund fees across the industry.

Expenses matter

Investors who buy the three funds above will have a diversified portfolio of thousands of stocks that include household name conglomerates in the largest developed economies to the smallest stocks in emerging markets around the world.

Investors should tread carefully, even with Vanguard's funds. Its funds come in many different forms from the highest-fee Investor Shares share classes to the lowest-cost Admiral, Institutional, and Institutional Plus share classes. The difference can be substantial -- the Investor Shares class of Vanguard's emerging markets fund carry an expense ratio of 0.33% of assets while its Institutional Plus share class carries an annual expense ratio of just 0.10%. (The first table in this article refers to the highest-cost Investor Shares funds.)

Some retirement plans complicate choices by offering multiple share classes of the same funds. When in doubt, pick the lowest-cost share class available, as it will always outperform higher-cost share classes due to the difference in fees.

The $15,834 Social Security bonus most retirees completely overlook If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known Social Security secrets could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $15,834 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after.Simply click here to discover how to learn more about these strategies.

Jordan Wathen has no position in any stocks mentioned. The Motley Fool owns shares of and recommends Amazon.com, Apple, and Johnson and Johnson. The Motley Fool owns shares of ExxonMobil and Microsoft and has the following options: long January 2018 $90 calls on Apple and short January 2018 $95 calls on Apple. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.