The Worst Hedge Funds of 2015

Hedge funds are supposed to be the smartest investors in the world, right? They're paid millions, if not billions, to find and invest in the deals that no one else sees. The only problem is that even these elites of the investing world don't always get it right.

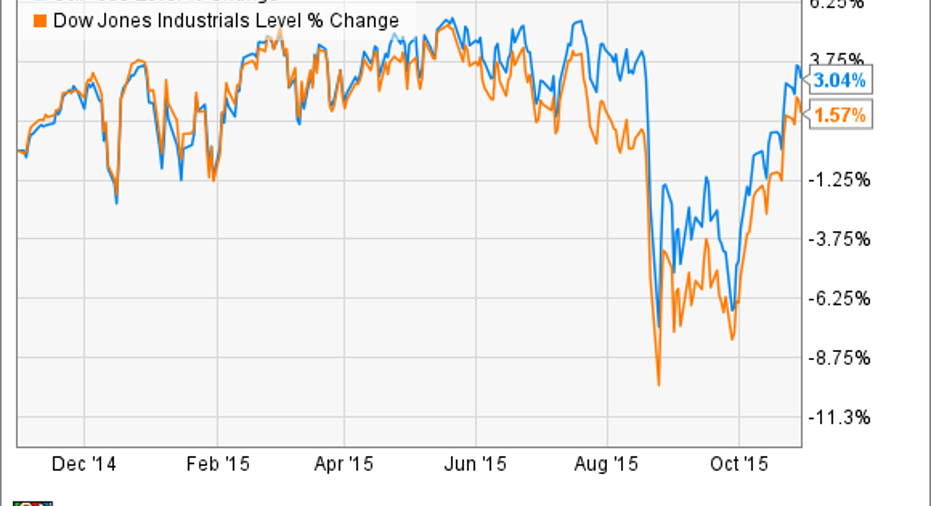

Tough year for hedgiesFor the 12 months ending in October, which is the most recent data available as of this writing, hedge-fund strategies are up just 3.09% across the board compared to 3.04% for the S&P 500. For the investors widely considered the smartest on Wall Street, simply matching the S&P is an underwhelming result.

Hedge funds focusing on North America have a net return of even less, 2.73%, but they aren't the worst of all. That honor goes to the funds specializing in the emerging markets, which have posted a negative 0.3% return over this same period.

Hedge fund performance has gotten worse as the year has gone on, tracing the tough summer that was seen more generally across all equity markets.

Every month from June to July of this year, the hedge-fund industry reported negative monthly returns, the longest streak since the June to November months of 2008. With that tough environment as context, a few big-name hedge funds have performed much worse than their average competitors. Here are three worth noting.

1. Greenlight Capital Offshore, David Einhorn Famed hedge-fund manager and frequent headline-grabber David Einhorn's Greenlight Capital has had a tough 2015. This is especially true for the Greenlight Capital Offshore fund, which was down 16.29% as of Oct. 31.

The bad news may be getting worse for Einhorn, with the recent announcement that Keurig Green Mountain Coffee Roasters is to be sold to a group of private investors. The fund held a short position in Keurig at an average cost of $102. Before the announced takeover, that bet was nearly 50% in the black for Einhorn and Greenlight.

However, with the acquisition priced at a 78% premium to the stock's price, the deal all but wiped out what was Einhorn's third-best investment of 2015. We'll have to wait until the fund's next regulatory filing, or until he makes public comment on the news to find out if the fund lucked into selling the position before the news broke, but early indications are that what was a home run may now just be a base hit.

2. Fortress Investment Group, Macro Fund, Mike Novogratz Perhaps the most disappointing hedge fund of 2015, Fortress Investment Group's Macro Fund, found itself down 17.5% through September, at which time the fund closed its doors and returned money to investors.

The decision to close the fund came after a 5% decline in September. The company then announced that fund manager Mike Novogratz would be stepping down and cashing out his equity in the publicly traded management company for more than $250 million.

Novogratz said, "I do not believe the current environment is conducive to achieving our best results." In this case, investors lost nearly 18% on their cash, while he walks away with a quarter of a billion dollars. It's debatable which "best results" he's referring to -- his own or his investors.

3. Pershing Square Capital, Bill Ackman Bill Ackman's Pershing Square Capital was down 20% through November 17, putting it at or near the bottom of hedge-fund performance, no matter how you define it. This compares to a 37% gain in 2014.

A number of big bets have turned sour for Ackman and company, including Valeant Pharmaceuticals , which is down 35% year to date. Ackman has publicly defended the company, but even his efforts haven't overcome the ongoing scandal related to alleged accounting improprieties and abusive practices.

Likewise, Ackman's continuing $1 billion short of supplement company Herbalife has also been a particularly bad investment this year. Pershing alleges that Herbalife is a pyramid scheme, and should be shut down as an illegal business. Thus far, regulators and the market have disagreed: Herbalife is up 47% year to date, and is up 65% since Ackman first announced his short on December 20, 2012.

2015: A dose of hedge-fund reality for investors Investing in hedge funds is out of reach for most retail investors. We just don't have the fat checkbooks to even get our foot in the door. But with returns like these, and sky-high fee structures, that reality may just be a blessing in disguise.

The article The Worst Hedge Funds of 2015 originally appeared on Fool.com.

Jay Jenkins has no position in any stocks mentioned. The Motley Fool owns shares of and recommends Valeant Pharmaceuticals. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright 1995 - 2015 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.