Tesla, Apple stock splits pave way for more gains

The biggest brands have seen shares rally 33% in the 12 months following a split

Stock splits at Apple and electric-car maker Tesla may spur further gains for both companies by making their shares more affordable -- temporarily at least -- to small investors.

Stock in the iPhone-maker co-founded by Steve Jobs fell to $124.81 following its 4-for-1 split while Tesla’s stock dropped to $442.68 after a 5-for-1 split. Apple shares had previously risen 70% this year while Tesla's jumped 435%.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AAPL | APPLE INC. | 278.12 | +2.21 | +0.80% |

| TSLA | TESLA INC. | 411.11 | +13.90 | +3.50% |

“It makes absolutely no economic sense that a split should cause a stock to rally, but it almost always does,” Matt Maley, Boston-based chief market strategist at Miller Tabak & Co., told FOX Business. “The general feeling is smaller investors can buy the stock.”

While a stock split doesn’t make a company any “cheaper” overall, since its market capitalization remains the same, it does give retail investors who couldn’t afford shares at previous levels a chance to buy at lower prices.

The discounts don't last long, though: History shows that big-name brands typically see their share price rally soon after a split.

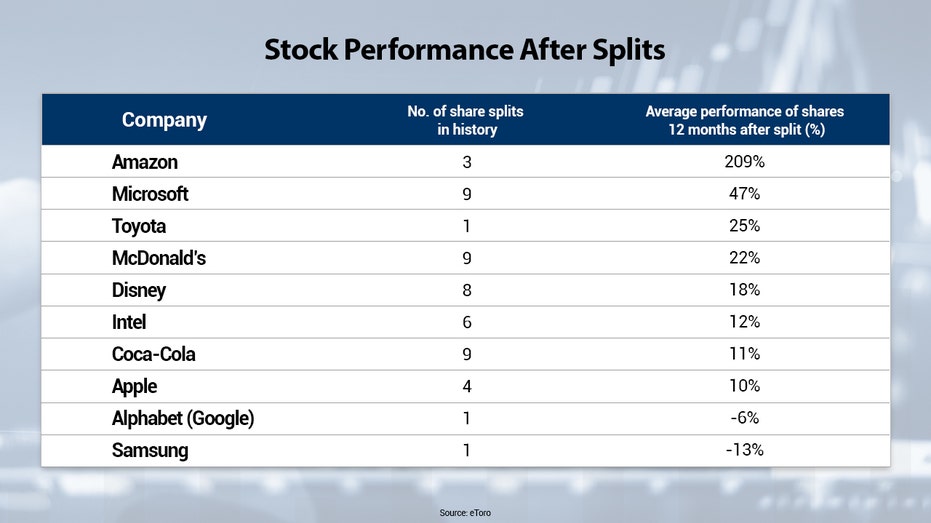

The 10 biggest global brands that have carried out a stock split over the past 60 years have seen their share price rise by an average of 33% over the next 12 months, according to data from London-based social trading and multi-asset brokerage company eToro.

While this is the first split in Tesla’s 10-year history as a publicly-traded company, Apple shares have split four times before, gaining an average of 10%, according to eToro data.

The Cupertino, California-based firm's shares saw a 58% boost in the 12 months following a February 2005 split but fell 61% in the wake of a June 2000 split, which occurred just before the dot-com bubble burst.

Although many investors welcome the opportunity to be able to get into Apple and Tesla shares at a cheaper price, not everyone is on board.

There are a number of reasons a split could give investors "some heartburn," according to Scott Hendrix, co-founder of Austin, Tx.-based wealth manager Current Investments.

He says the lower share prices will result in more volatility, a dilution of earnings per share and make it harder for investors to track their basis, or cost of investment.

Stock split or not, mega-cap tech stocks look like they are going higher, according to Wedbush Securities analyst Dan Ives.

CLICK HERE TO READ MORE ON FOX BUSINESS

"Tech stocks are at all-time highs and the strong are getting stronger,” Ives told FOX Business, adding that behemoths such as Facebook, Apple, Amazon, Google and Netflix may rally as much as 25% over the next six to nine months.