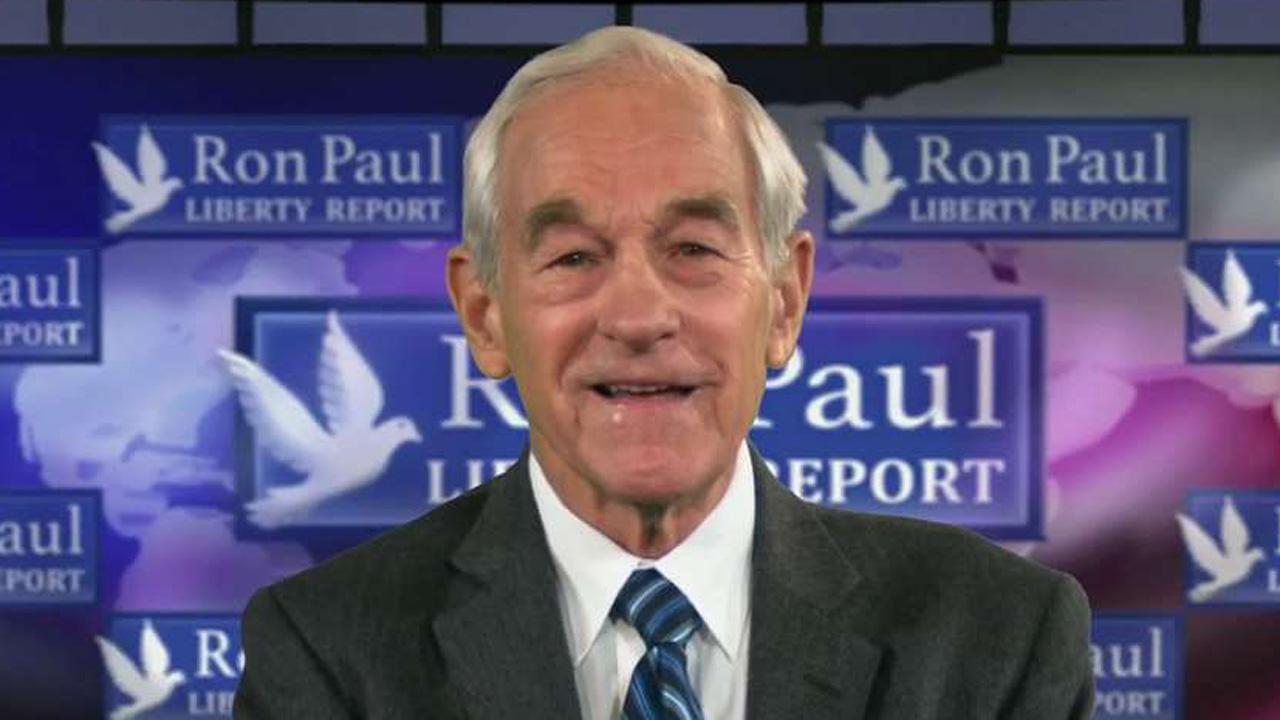

Ron Paul: Raising Rates Now Would Cause Markets to Crash

Former Congressman Ron Paul (R-TX) agreed with Republican presidential nominee Donald Trump’s criticism of the Federal Reserve becoming too political under Fed Chair Janet Yellen.

“I think she is like every other Federal Reserve chairman that’s what they’ve been doing all the way back since Nixon. They have this concrete evidence of him and Johnson. They always manipulate the Fed and the Fed always capitulates to the presidency in power,” Paul said during an interview with FOX Business Network’s Varney & Co.

Last week, Yellen denied the Fed’s role as a political institution in its decision to keep interest rates unchanged.

“I can say, emphatically, that partisan politics plays no role in our decisions about the appropriate stance of monetary policy,” she said during a press conference after the Fed’s policy meeting.

Trump accused the Fed of creating “a big, fat, ugly bubble” and keeping interest rates low to keep the economy going while President Obama remains in office.

“When they raise interest rates, you’re going to see some very bad things happen, because they’re not doing their job,” Mr. Trump said during the first presidential debate.

Paul said Trump is being cautious when suggesting to not raise interest rates in order to maintain the current economic policy.

“There’s a bubble out there and I agree with that. But he [Trump] was more or less making the case for don’t raise interest rates, if you do, you are going to cause a horrendous crash,” Paul told host Stuart Varney.

According to Paul, there’s a limit to how much an economy can be mismanaged by manipulating interest rates and monetizing debt. He went on to say the Fed bubble was created a decade ago and it’s become difficult to correct.

“We’ve been doing this for a long long time, but we are finally ending the conclusion of all this,” Paul said.