OPEC's sneaky oil move may leave energy markets thirsty

OPEC is keeping the spigot closed

OPEC has always been ultra-competitive but the cartel's latest move is downright sneaky and may leave global energy markets thirsty.

While the globe is getting optimistic about a post-COVID-19 economic recovery with vaccine distribution becoming more widespread, the sneaks in the OPEC Plus cartel are using this as a golden opportunity to fleece the global economy while the Biden Administration remained silent.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| USO | UNITED STATES OIL FUND - USD ACC | 76.99 | +0.30 | +0.39% |

US ENERGY INDEPENDENCE IS ON THE WAY OUT

Last week, OPEC and the Russians shocked the market by not raising oil production at a time when oil markets are signaling, they need more supply as prices climb.

BIDEN’S HALT OF NEW OIL AND GAS PERMITS ON FEDERAL LANDS HAS LAWMAKERS DEMANDING ANSWERS

The market structure in oil is in what is known as “contango,” where nearby futures contracts trade at higher prices than crude in the future, suggest that the oil supply is tight and needs more supply. Right now the backwardation discrepancy is so wide it almost like the market is screaming out for help.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BNO | UNITED STATES BRENT OIL FUND - USD ACC | 32.02 | +0.19 | +0.60% |

That is why market watchers were expecting that the OPEC Plus would heed the market's call and raise output and restore as much as 1.5 million barrels of previous cuts to soothe rising oil prices and feed the ravenous oil-hungry global market. They also expected that Saudi Arabia, which just two months ago unilaterally cut production by another 1 million barrels of oil day would start to give that back to the market. Yet it seems that the temptation to squeeze the market line in their pockets is too tempting for OPEC Plus mainly because right now there is no one to stop them.

Instead of raising production the cartel instead left output unchanged with a few modest exceptions. Saudi Arabia extended its 1 million barrel-a-day cut. That caused a major price spike in driving prices to a two-year high as well as a surge in gasoline and diesel prices already compromised by the freak winter storm in Texas which compromised refineries.

TEXAS STORM HANGOVER COULD SPEED PUMP PRICE JUMP

OPEC Plus cried all the way to the bank. These oil ministers are feeling invincible and feel as if they can cut production whenever they want. OPEC Plus Knows that they once again control the global oil market as the Biden administration had backed away from trying to be a leader in oil and gas production. OPEC Plus sensed an opportunity, took advantage and is now the undisputed leader in the global oil markets.

Under President Trump, OPEC Plus was not so bold. He realized that when OPEC cut oil production to just drive-up oil prices that it was a direct hit to the consumers, especially those at the lower end of the wage scale. He realized that when OPEC Plus cut production when the market was signaling that it needed it, that it was just a wealth transfer from oil-consuming nations into their own pockets. Trump called OPEC out on Twitter at least eight times between 2018 and 2019 and OPEC Plus listened to him. They not only reversed one of their production cuts they also canceled plans to cut production in the future. That helped U.S. consumers and American families with their budgets. It allowed them to buy other things for their children instead of feeding that money into the gas tank.

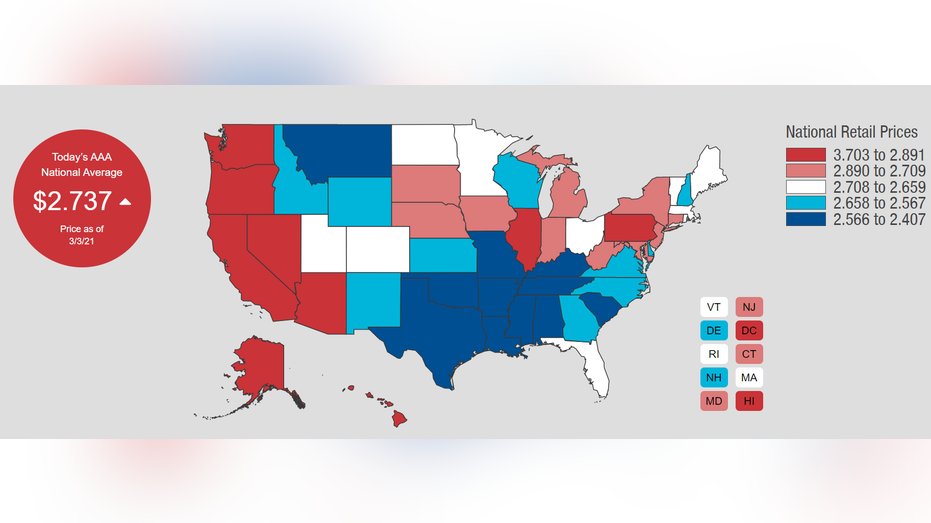

The Biden administration on the other hand seems to endorse OPEC Plus, quietly. Not only did it not call out Saudi Arabia for their unilateral 1 million barrel a day production cut, it has been silent on oil prices even as the cost of oil is 80% higher since Biden was elected four months ago. Some parts of the country are already paying over $3 a gallon for gasoline and shortly the rest of the country will be joining them in that dubious honor.

One might say that the Biden administration is happy about what OPEC Plus did what they did because they need sharply higher prices to achieve their carbon goals. What you are going to experience at the gas pump in the coming weeks is just the start of the Biden Green New Deal.

It means gasoline and all carbon under President Biden's plan must cost more.

How much more?

A report from energy consultant Wood Mackenzie Ltd. says that if you are going to stop global temperatures from rising above 1.5 degrees Celsius from pre-industrial levels, carbon prices must surge to $160 per ton of CO2 by 2030, up from a global average of $22 at the end of last year. That is a 600% increase.

That may give you an indication of the upside on oil and gasoline prices under the Biden administration's plan which will suffer from needlessly higher gasoline and heating bills in the coming weeks and years.

Manufacturers facing higher costs will be forced to restrict hiring or keep wages low because of increased energy costs. That will mean fewer job opportunities. Manufacturers may also go offshore to avoid some Biden policies.

If the price for oil and gas gets too far out of control it could also be a risk to the overall economy. History is clear that most recessions are preceded by an oil price spike caused by things other than supply and demand fundamentals.

READ MORE ON FOX BUSINESS BY CLICKING HERE

With OPEC Plus unchecked and the Biden administration rooting them on, we are going to face some major economic challenges. Yet don’t work about the sneaks in the OPEC Plus cartel, they'll be like kids in a candy store taking as much money from the U.S. economy as they can because no one will stop them.

Phil Flynn is senior energy analyst at The PRICE Futures Group and a Fox Business Network contributor. He is one of the world's leading market analysts, providing individual investors, professional traders, and institutions with up-to-the-minute investment and risk management insight into global petroleum, gasoline, and energy markets. His precise and timely forecasts have come to be in great demand by industry and media worldwide and his impressive career goes back almost three decades, gaining attention with his market calls and energetic personality as writer of The Energy Report. You can contact Phil by phone at (888) 264-5665 or by email at pflynn@pricegroup.com.