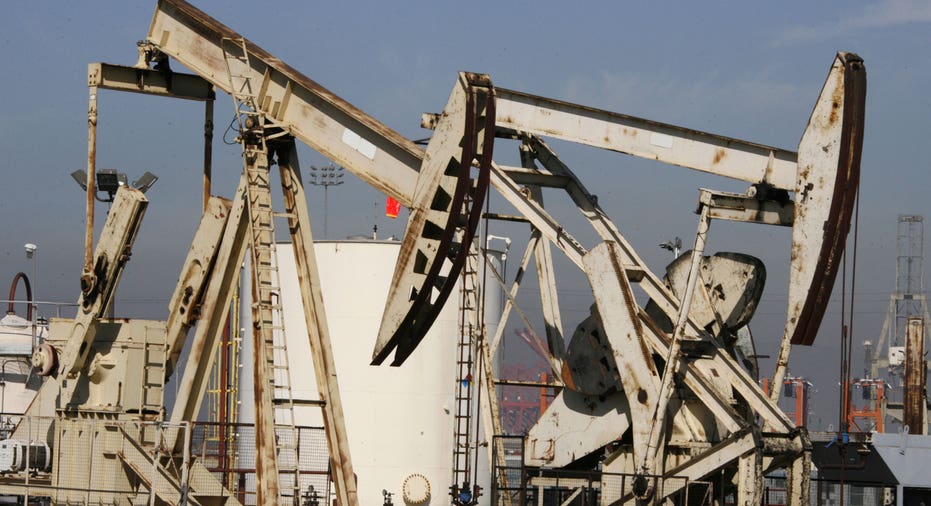

Oil prices drop 3 percent on rising global supplies

Oil prices settled nearly 3 percent lower on Friday as rising U.S. production as OPEC exports hit a 2017 high cast doubt over efforts by producers to curb global oversupply.

Brent crude

U.S. West Texas Intermediate (WTI) crude futures

Both benchmarks posted a sixth weekly decline in the past seven weeks with WTI down 3.9 percent on the week and Brent off 2.5 percent.

"The stream of relentless supply continues," said Matt Smith, director of commodity research at Clipperdata.

He said OPEC exports were 2 million barrels per day (bpd)higher in June than in 2016, despite of an extension of a 1.8 million bpd production cut deal led by the Organization of the Petroleum Exporting Countries.

"We've seen exports last month from OPEC much stronger than they were in April and May, seemingly indifferent to the OPEC production cut deal," Smith said.

Reuters oil data showed OPEC production is now at the highest level this year.

Russia, which is cooperating with OPEC in a deal to stem production, said it was ready to consider revising parameters of the deal if needed.

A group of oil-producing countries monitoring the deal will meet on July 24 in Russia, when they could recommend adjusting the pact.

Meanwhile, U.S. producers seemed undeterred by lower prices with drillers adding seven oil rigs this week, according to energy services company Baker Hughes, bringing the total rig count up to 763, the most since April 2015. [RIG/U]

On Thursday, U.S. government data showed that U.S. oil production

"It takes somewhat lower prices to slow down U.S. production," said Rob Haworth, senior investment strategist at U.S. Bank Wealth Management.

Amidst rising U.S. production, the market largely ignored a 6.3 million-barrel slump in U.S. crude inventories

U.S. bank Morgan Stanley said it expected WTI prices to remain below $50 until mid-2018, adding that "if output cuts from the OPEC are not enough, U.S. shale production will need to slow down for a chance of a balanced market in 2018."

Money managers raised their net long U.S. crude futures and options positions in the week to July 3, the U.S. Commodity Futures Trading Commission (CFTC) said. The increase came after hedge funds and other money managers cut U.S. crude net longs to a nine-month low in the previous week.

(Additional reporting by Karolin Schaps in London, Henning Gloystein in Singapore and Aaron Sheldrick in Tokyo; Editing by Chris Reese and Marguerita Choy)