New FTX boss condemns Bankman-Fried for 'complete failure of corporate controls'

FTX CEO says crypto exchange suffered 'complete failure of corporate controls'

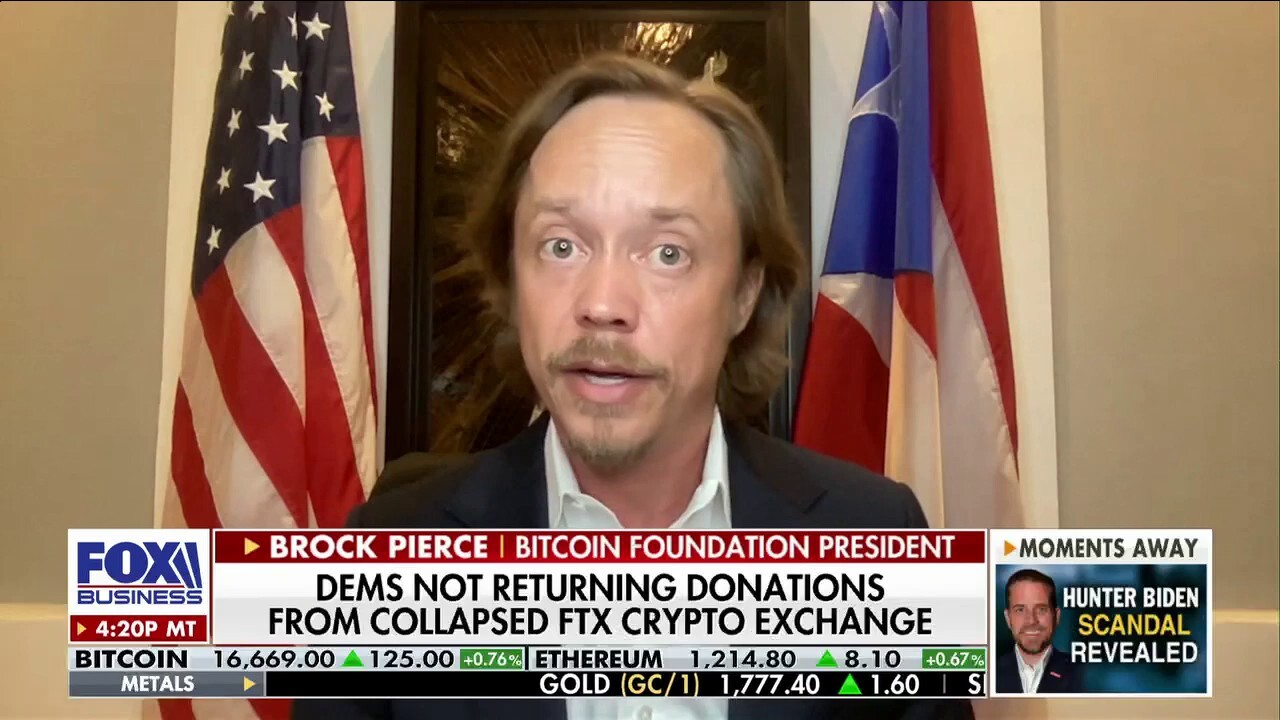

Bitcoin Foundation president: FTX was clearly 'cozy' with government

Wisconsin Rep. Bryan Steil and Bitcoin Foundation president Brock Pierce break down FTX founder Sam Bankman-Fried's donations to the Democratic Party on 'The Evening Edit.'

The new CEO of collapsed crypto exchange FTX on Thursday issued a scathing rebuke of his predecessor, Sam Bankman-Fried, accusing the former boss of allowing "a complete failure of corporate controls."

John Ray III was appointed chief executive of FTX last week shortly before the company filed for Chapter 11 bankruptcy and Bankman-Fried resigned. The attorney — who previously oversaw the $23 billion bankruptcy of energy firm Enron — is now tasked with investigating the rapid and stunning downfall of FTX.

"Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here," Ray said in a filing with the U.S. Bankruptcy Court for the District of Delaware. "From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented."

INSIDE THE COLLAPSE OF CRYPTO EXCHANGE FTX: EVERYTHING YOU NEED TO KNOW

Sam Bankman-Fried, founder and CEO of FTX Cryptocurrency Derivatives Exchange, speaks during the Institute of International Finance annual membership meeting in Washington, D.C., on Oct. 13, 2022. (Ting Shen/Bloomberg via Getty Images / Getty Images)

In the filing, Ray said that he did "not have confidence" in the accuracy of FTX's balance sheets and its affiliated trading firm, Alamedia Research. The companies, he wrote, were "unaudited and produced while the Debtors [FTX] were controlled by Mr. Bankman-Fried."

A "substantial portion" of assets held by FTX may be "missing or stolen," Ray said in the filing.

The newly appointed exec also noted that many of the companies in the FTX Group did not have appropriate corporate governance, nor did they hold board meetings. On top of that, he suggested that employees used corporate funds to pay for homes and other items.

WHO’S REALLY TO BLAME FOR FTX CRYPTO COLLAPSE?

"In the Bahamas, I understand that corporate funds of the FTX Group were used to purchase homes and other personal items for employees and advisors. I understand that there does not appear to be documentation for certain of these transactions as loans, and that certain real estate was recorded in the personal name of these employees and advisors on the records of the Bahamas," he said.

FTX, once the world's third-largest exchange with a valuation near $32 billion, sent shockwaves through the crypto world on Friday when it announced that it was filing for bankruptcy, along with Alameda Research and other affiliated companies. Days earlier, industry rival Binance backed out of a deal to buy its troubled competitor after taking a look at the books and learning that FTX had "mishandled customer funds."

Bankman-Fried, the firm's founder and CEO, announced his resignation when the bankruptcy papers were filed in Delaware on Friday.

FTX was once the world's third-largest exchange with a valuation near $32 billion. (OLIVIER DOULIERY/AFP via Getty Images / Getty Images)

Both the company and Bankman-Fried are under investigation in the U.S. and other countries for possible securities violations amid allegations that FTX used $10 billion of customer funds to prop up Alameda Research, its affiliated trading firm.

The sudden collapse, which threatened to upend futures markets, has been likened the crypto industry's "Lehman Brothers" moment — a reference to the 2008 collapse of the global financial services firm that helped to spark the global financial meltdown.

It has raised major concerns about an industry that has remained largely unregulated.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Panels in both the Senate and the House are planning to hold hearings on FTX's collapse next month. The House Financial Services and Senate Banking committees plan December hearings that will examine the sudden demise of FTX under the leadership of Bankman-Fried, a Democratic mega-donor.