LendingClub slashing headcount by 225

The layoffs come amid efforts by the company to cut costs

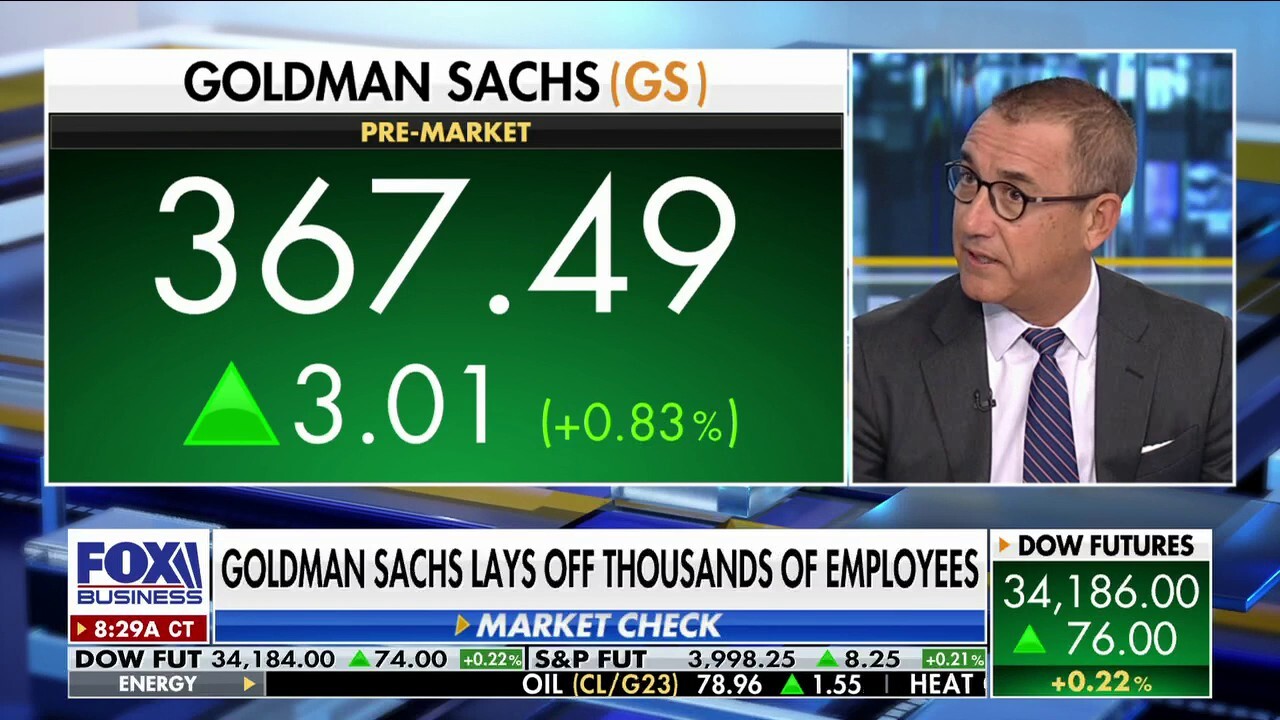

Goldman Sachs' Joe Duran addresses layoffs affecting 3,200 employees

Goldman Sachs head of personal finance management Joe Duran provides his 2023 market outlook and discusses the firm's 'tough decision' to cut 3,200 jobs on 'Varney & Co.

LendingClub Corporation is slashing its headcount by 14%, the financial services firm announced Thursday.

That will equate to 225 workers losing their jobs in the cuts, LendingClub said in a press release. The company’s workforce was over 1,300 at the end of 2021, according to its most recent annual report filed in February.

SALESFORCE TO LAY OFF 10% OF WORKFORCE TO CUT COSTS AMID ECONOMIC DOWNTURN

The layoffs, LendingClub projected, will bring about $25-30 million in annualized run-rate savings during the year.

Hundreds of media industry staffers were laid off this week during a brutal period that saw Warner Bros. Discovery, Gannett and others slash headcount as economic uncertainty plagues news organizations. (Getty)

LendingClub anticipates a roughly $5.7 million charge in connection to trimming its headcount. Much of that cost was "expensed in the fourth quarter of 2022," the three-month period for which LendingClub plans to report its results later this month, according to the company’s press release.

Resumes should have clear sections, be arranged in reverse-chronological order and have easy-to-follow bullet points. (iStock / iStock)

CEO Scott Sanborn said the "very difficult decision to reorganize and reduce" its workforce was a measure to "enable us to more closely align our expense structure to loan volume and revenue, while ensuring effective execution against our strategic priorities and long-term vision."

THE DEBATE SWIRLING INSIDE HR DEPARTMENTS: HOW TO LAY OFF WORKERS

In the same release it announced the layoffs, LendingClub offered preliminary fourth-quarter results, including expectations of a $260-263 million range for revenue and a $21-24 million range for net income. The company also originated $2.5 billion worth of loans, it said.

Those estimates included the effects of the layoff-related costs plus an acquisition, according to the release.

LAYOFFS ARE ON THE RISE, BUT NEARLY 50% OF WORKERS ARE STILL LOOKING TO QUIT IN 2023

With its cost-cutting reorganization plan, the company aims to "align its operations to reduced marketplace revenue following the Federal Reserve’s historic pace of interest rate hikes," LendingClub said.

The Federal Reserve increased rates multiple times in 2022, including four back-to-back 75-basis-point hikes and, most recently, a 50-basis-point lift. In the minutes of the Fed’s December meeting, policymakers indicated they project rates could go up to 5.1% in 2023, as previously reported by FOX Business.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| LC | LENDINGCLUB CORP. | 16.95 | +1.26 | +8.06% |

LendingClub generated $304.9 million in third-quarter revenues, up from the $246.2 million it reported in the same period the prior year. Its net income widened from $27.2 million to $43.2 million.

After hours on Thursday, the company’s stock was up about 5%.