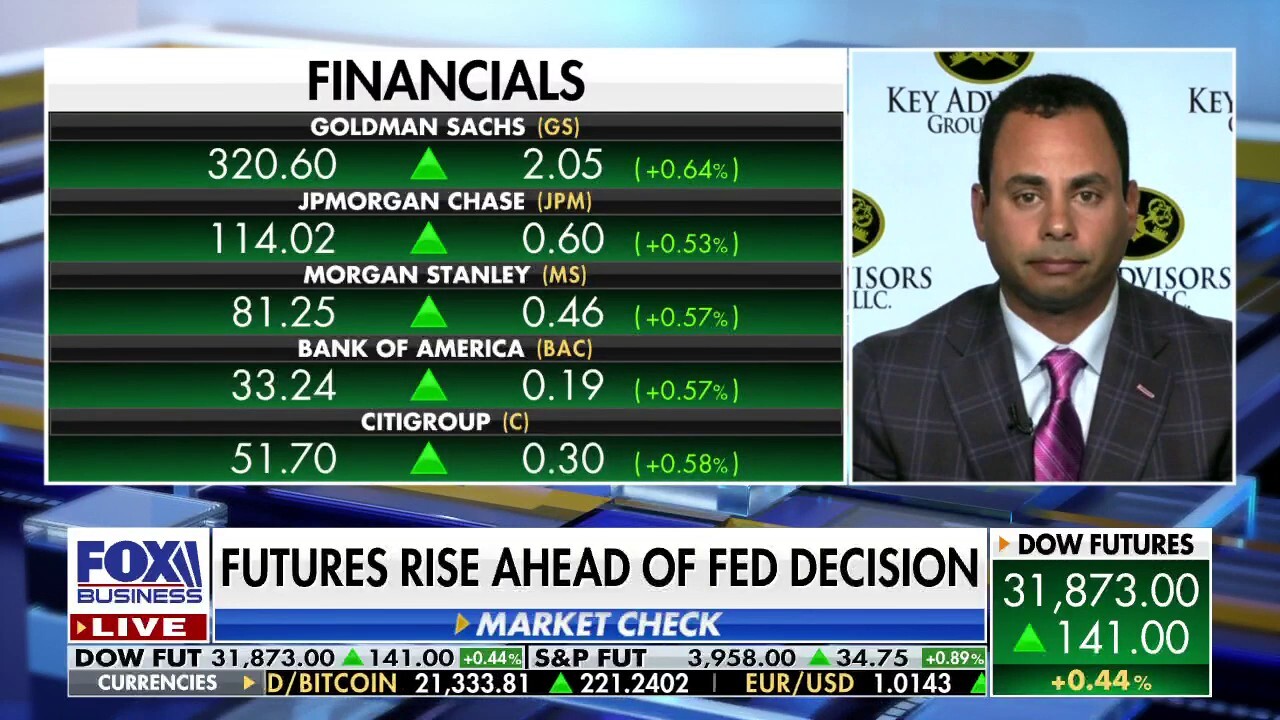

Inflation has 'finally come to a head with the consumer': Eddie Ghabour

The Key Advisors Group owner argues US is headed towards 'mild recession'

Inflation has 'finally come to a head with the consumer': Investment expert

Key Advisors Group LLC co-owner Eddie Ghabour argues the U.S. is heading into a 'mild recession' in the coming months unless the Federal Reserve 'pivots.'

Key Advisors Group LLC co-owner Eddie Ghabour argued on Wednesday that, based on recent data, inflation has "finally come to a head with the consumer."

Speaking on "Varney & Co." Wednesday, Ghabour pointed to second-quarter earnings reports, including from AT&T.

He noted that the telecommunications company said that "consumers are having a hard time paying their cell phone bills" and that the same trend is happening with auto loans and credit cards.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| T | AT&T INC. | 27.13 | -0.18 | -0.66% |

| WMT | WALMART INC. | 131.18 | +4.24 | +3.34% |

Last week, AT&T said customers have been paying their bills about two days later than they did the same time last year, which affected about $1 billion in quarterly cash flow.

WHY IS INFLATION STILL SO HIGH, AND WHEN WILL IT START TO COOL?

"Walmart comes out and again talks about the consumer is now just buying staples and their apparel continues to show higher inventory," Ghabour said, pointing to another example of inflation’s impact on customers and businesses.

On Monday, Walmart cut its profit expectations as the company noted that inflation forced shoppers to spend more on essentials like food and less on discretionary items.

A recent survey revealed that an increasing percentage of American households are having difficulty paying their bills as inflation continues to wreak havoc on budgets across the country.

The U.S. Census Bureau survey, conducted between June 29 and July 11, found that over 48 million American households had a "somewhat difficult" time meeting their household expenses and over 43 million had a "very difficult" time. Another 58 million households were having a "little difficult" time meeting expenses.

Key Advisors Group LLC co-owner Eddie Ghabour weighs in on markets and the economy as inflation sits at new 40-year highs. (iStock / iStock)

The Labor Department revealed earlier this month that inflation accelerated more than expected to a new four-decade high in June as the price of everyday necessities remains painfully high, exacerbating a financial strain for millions of Americans.

The department said the consumer price index, a broad measure of the price for everyday goods, including gasoline, groceries and rents, rose 9.1% in June from a year ago. Prices jumped 1.3% in the one-month period from May. Those figures were both far higher than the 8.8% headline figure and 1% monthly gain forecast by Refinitiv economists.

The data marked the fastest pace of inflation since December 1981.

WANT TO CURB INFLATION? STOP GOVERNMENT SPENDING

Price increases extended across the board: Energy prices rose 7.5% in June from the previous month, and are up 41.6% from last year. Gasoline, on average, costs 59.9% more than it did one year ago and 11.2% more than it did in May. The food index, meanwhile, climbed 1% in June, as consumers paid more for items like cereal, chicken, milk and fresh vegetables.

Changing inflation starts with putting a 'stake in the heart of the American consumer': Business adviser

Gerald Storch, former Toys 'R' Us CEO and current Storch Advisors CEO responds to news that consumers are shifting to less expensive items amid inflationary pressures.

Ghabour argued that because signs have emerged recently indicating that inflation has "finally come to a head with the consumer," he believes the United States is headed towards a "mild recession."

"I believe we’re going to take a major leg lower in the coming months unless the Fed pivots because we are heading into a recession, in our opinion," he continued.

POWELL PLEDGES THE FED IS ‘ACUTELY FOCUSED’ ON TACKLING INFLATION

The Federal Reserve on Wednesday raised its benchmark interest rate by 75 basis points for the second straight month as it tries to bring scorching-hot inflation under control, a move that threatens to slow U.S. economic growth and exacerbate financial pressure on Americans.

The widely expected move puts the key benchmark federal funds rate at a range between 2.25% to 2.50%, the highest since the pandemic began two years ago. It marks the fourth consecutive rate increase this year.

CLICK HERE TO READ MORE ON FOX BUSINESS

FOX Business’ Michael Lee and Megan Henney contributed to this report.