Fiat Currency: What It Is and Why It's Better Than a Gold Standard

The gold standard-vs.-fiat currency debate will be waged for years to come.

"In God we trust. All others pay cash."

The most important thing about money is this: People need to be able to count on its value, and that value needs to be stable over time. For that reason, many countries have, over the past century, shifted to a fiat currency.

But what exactly is fiat currency, and what makes it the best alternative? Let's take a closer look.

Underpinning the value of moneyFiat currency is legal tender whose value is backed by the government that issued it. The U.S. dollar is fiat money, as are the euro and many other major world currencies.

This approach differs from money whose value is underpinned by some physical good such as gold or silver, called commodity money. The United States, for example, used a gold standard for most of the late 19th and early 20th century. A person could exchange U.S. currency -- as well as many public and even some private debts --for goldas late as the 1930s.

A fiat currency's value is underpinned by the strength of the government that issues it, not its worth in gold or silver.

Why a fiat currency is better economic policyHere's a look at U.S. inflation since the beginning of the 20th century:

US Inflation Rate data by YCharts

The most important aspect of a currency is the relative stability of its value. And while there are certainly more aspects to inflation than just the currency standard, it's a major factor in monetary policy and a government's ability to control the money supply.

The U.S. dollar -- as well as many public and private debts -- could be converted into gold until the mid-1930s, and the U.S. dollar was tied to the value of gold until the early 1970s, when President Nixon completely severed the relationship between the U.S. dollar and gold. With the exception of the late 1970s' and early 1980s' oil crisis and recession, inflation has become much less volatile, and deflation hasn't been an issue.

A key reason is U.S. monetary policy. Since the Federal Reserve has more flexibility to control supply and demand of currency, it is more able to limit the impact of major economic shocks, such as the financial crisis of 2008-2009. Many economists acknowledge that the government's ability to control the supply of currency played a major role in keeping the crisis -- easily the worst in 80 years -- from causing even greater harm to the American and global economy.

What gold advocates ignoreThose who advocate for a gold or similar standard often use the argument that fiat currencies aren't really "worth" anything, since there isn't anything tangible that underpins its value. That's really not a very accurate description of a fiat currency, versus a gold standard. Simply put, the value ofanycurrency, whether a commodity or a fiat currency, is only relative to what peoplethinkit's worth.

And gold hasn't exactly been stable or reliable in recent years:

Gold Price in US Dollars data by YCharts

What does that chart tell us? In times of uncertainty, people hoard gold. You can see it in the early '80s' oil crisis and recession and the recent financial crisis, when gold prices soared, only to fall sharply once the overall economic environment improved.

This situation is largely what led Franklin D. Roosevelt to sever the convertibility of U.S. currency and debt into gold during the Great Depression. Under the gold standard (especially when currency could be converted to gold), hoarding gold had a direct impact on monetary flow, hurting commerce and exacerbating recessions. By severing the link between gold reserves and currency, the Federal Reserve is better able to combat major economic shocks to the economy.

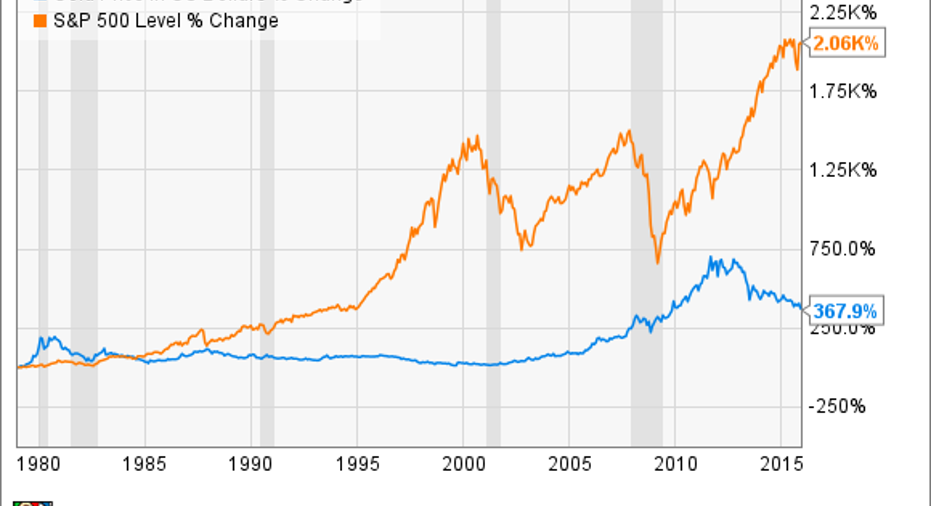

Think gold is a great investment? Historically, it really hasn't been:

Gold Price in US Dollars data by YCharts

The U.S. stock market has been a far superior long-term investment since Nixon severed the relationship between gold and the dollar in the 1970s. And since September 2012, gold has fallen by 40%, while theS&P 500has seen total returns of more than 50%.

Stability is keyIt's fair to argue that the Federal Reserve's efforts to limit the impact of economic crisis could have unforeseen long-term effects, based on the additional money that has been put in circulation, versus a gold or silver standard that limits how much money circulates. The problem gets back to times of major economic crisis: When governments need tools to stop or reduce the harm, a commodity standard has historically had the opposite effect as people hoard it.

By severing the tie between a commodity that people tend to hoard in times of crisis and the value and supply of money, a fiat currency is a better alternative, but only so long as those pulling the levers of monetary supply keep the balance between supply and demand stable.

Here's the bottom line: Currency is a tool of trade. People tend to hoard gold and silver when things are uncertain, and that's harmful when it limits currency flows on a large scale. Removing the relationship between a currency and commodity doesn't create "worthless money." It simply keeps panic from causing greater economic harm in times of crisis when people hoard the underpinning of a commodity currency and stop the wheels of commerce.

That may not make fiat currency better, but it certainly makes it "less bad."

The article Fiat Currency: What It Is and Why It's Better Than a Gold Standard originally appeared on Fool.com.

Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright 1995 - 2015 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.