Dow 17K: A Story of Recovery, Perseverance

Wall Street has emerged from the worst financial crisis since the Great Depression deeply and irreversibly changed. But one certainty has proven itself once again: Patience and courage are critical virtues for investors on Main Street.

A perfect storm of financial and economic turmoil brought the seemingly impenetrable financial system to the very brink of collapse in two painful years starting in 2007. Financial historians are still piecing together the puzzle, but a big bust in the real estate market is cited as the impetus for the financial hurricane.

A Financial System at the Brink of Collapse

A mixture of poor underwriting, excessive risk-taking, lackluster regulations, shaky balance sheets and insufficient corporate governance meant the entire credit market took a massive blow that sent asset prices across the board plummeting, sometimes with a frightening velocity. In March 2008, the U.S. government hastily arranged a deal in which JPMorgan Chase (NYSE:JPM) bought Bear Stearns -- then one of the Street’s biggest mortgage originators and a storied investment bank -- for the fire-sale price of about $2.4 billion.

By early fall, the situation was grave. The U.S. government placed mortgage behemoths Fannie Mae and Freddie Mac under conservatorship on Sept. 7. A mere eight days later, Bank of America (NYSE:BAC) controversially scooped up hemorrhaging Merrill Lynch for $50 billion -- representing a heavy discount to where the Wall Street icon traded the previous year.

Worst of all, Lehman Brothers, the once powerful bond shop, filed for bankruptcy that same fall day after numerous rivals and finally the government snubbed cries begging for a rescue package. Just a day later, the Federal Reserve was forced to craft an $85 billion rescue package to save insurance giant American International Group (NYSE:AIG).

At the same time, the Reserve Primary Money Fund infamously “broke the buck,” meaning investors who stashed assets in the money-market fund, an investment that’s perceived to be almost as safe as cash, suddenly saw their funds shrink to less than a dollar on every dollar invested.

“There were headlines every hour on the hour,” recalled Bob Doll, who was then Chief Investment Officer of Global Equities at BlackRock, the world’s biggest money manager with trillions of dollars in client assets under management. “The financial system as we know it almost fell apart.”

In the frenetic weeks that followed, the situation only deteriorated. Goldman Sachs (NYSE:GS) and Morgan Stanley (NYSE:MS) converted into bank holding companies to make it easier for the Fed to provide them with more liquidity. The Federal Deposit Insurance Corporation helped devise buyout deals to keep Washington Mutual and Wachovia, the nation’s biggest thrifts, from collapsing. The Treasury Department, FDIC and Fed stepped in to give Citigroup (NYSE:C) a rescue package.

Eventually, a great many banks would tap the Treasury Department’s Troubled Asset Relief Program for $245 billion in emergency capital. Treasury used the same program to prop up General Motors (NYSE:GM) and Chrysler -- two of the Big Three U.S. automakers -- as part of an $82 billion investment of the auto industry.

In December 2008, the Fed sliced short-term rates to a range of 0% to 0.25% -- a historic and dramatic move aimed at salvaging the financial system.

Main Street Investors Pummeled by Wall Street’s Woes

The intense turbulence in the financial markets, of course, ricocheted straight to Main Street USA.

“I think retail clients … may not have understood everything that was going on, but sensed there was a real crisis. Some of that sense was brought home to them when money market funds broke the buck,” recalled David Joy, chief market strategist at Ameriprise Financial (NYSE:AMP), which sports $783 billion in assets under management and administration.

It wouldn’t take more than a glance at the Wall Street Journal to realize there was intense trouble. The Dow Jones Industrial Average -- perhaps the most famous market barometer -- hit a closing high of 14164.53 in October 2007. By the end of 2008, the blue-chip average had nose-dived 5388.14 points to 8776.39. The broader economy also skidded into a deep recession, with gross domestic product shrinking at an annual rate of 8.3% in the fourth quarter.

And the bleeding didn’t stop there.

“People were deer in the headlights. Some were concerned, some were scared, some, because they’re trained, asked ‘is this an opportunity,’” Doll, now chief equity strategist at Nuveen Asset Management, said of clients’ varied sentiment at the time.

Investors, large and small, were shedding stocks at an incredible clip, with many preferring the safety of cash or Treasury bonds. In fact, between January 2008 and March 2009, investors yanked a whopping $161.9 billion from equity mutual funds, according to data from the Investment Company Institute.

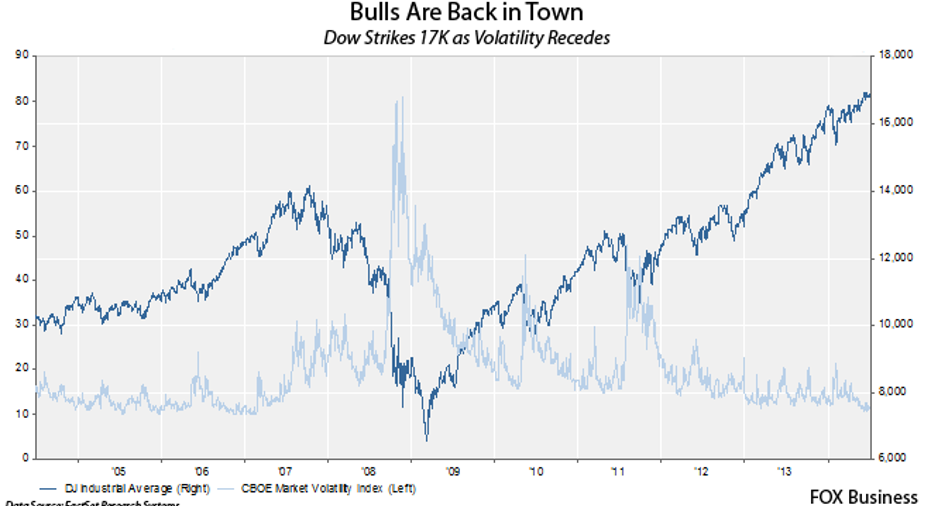

On March 9, 2009, the Dow careened to its bear-market low of 6547.05, representing a crash of 7617.48 points, or 53.8%, from its 2007 highs. Fear was running high, with the CBOE’s VIX, a measure of implied volatility, trading at 49.68 (still an improvement from the record closing high of 80.86 notched in November 2008).

Naturally, skittish clients asked Doll a whole range of questions: “Are we going to have a depression? Is the system going to make it? Are the markets going to make it?”

They were right to be nervous.

A portfolio made up of 10 shares of the popular SPDR S&P 500 exchange-traded fund (TICKER:SPY) -- an investment vehicle that provides exposure to a broad swath of large-capitalization U.S. stocks -- would have been worth $1,564.80 at the Oct. 9, 2007 bull-market high. The value of that same group of holdings plummeted $883.70, or 56.5%, to $681.10 by the time Wall Street bottomed to its bear-market low on March 9, 2009.

The advice Doll and Joy -- two asset-management veterans -- gave to clients at the time was fairly similar: Hang in there, because light always eventually makes its way through even the thickest clouds.

“The first thing we tried to do was make sure our clients had access to liquidity, and hold their hands to figure out what was going on and find out if the policy response was appropriate and likely to succeed and (encourage them) not to make emotional decisions,” Joy recalled, noting Ameriprise even tapped its own capital reserves to provide clients liquidity when money-market funds ran into trouble.

“We generally had faith the financial system would stabilize.”

Echoing that sentiment, Doll said “the advice (at the time) was the central government has lots of firepower” that can be used to support the economy.

Indeed, under the leadership of Ben Bernanke, the Fed launched a series of unprecedented moves aimed at pulling the world’s biggest economy out of what many economists say could have been an even deeper recession or even a depression. In addition to ultra-low short-term rates, the Fed unleashed several rounds on bond purchases to put pressure on longer-term rates and support the housing market, and utilized other unorthodox tools to buttress ailing banks. Other government agencies, notably Treasury and the FDIC, also played important roles.

A New Wall Street Emerges

Fast-forward five years since Wall Street hit rock bottom and the world is a different, although certainly still perilous, place. Employment, as measured by the Labor Department, finally returned to pre-crisis levels in May, while the jobless rate hit its lowest level since September 2008 in June. Auto-industry sales are running at the highest rate since 2006. The U.S. economy, despite a tough first quarter, is expected to grow at an annual pace of at least 3% this year. And the VIX is at its lowest level since 2007.

As the economy improves, and the financial system heals, the Fed is slowly beginning its exit from the massive easing program. Indeed, economists are even beginning to question whether the central bank will begin hiking rates sooner than expected, given the better-than-expected jobs gains of late.

Perhaps most impressive of all, the Dow on Thursday rallied to the 17000 level for the first time ever. That represents a once unfathomable 10452.95-point, or 159.7%, surge from bear-market lows. It also signifies a solid 2835.47-point, or 20%, advance from the 2007 bull-market highs.

That portfolio made up of ten shares of the SPDR S&P 500 ETF is now worth $1,978.50, as the S&P 500 rallies to new record highs. That represents a whopping $1,297.40, or 191%, advance from the bear-market lows. More importantly, though, given even the best stock pickers historically aren’t great at calling market bottoms, the portfolio is up $413.70, or 26.4%, from the bear-market highs reached in 2007.

The moral if the story is even when the going gets tough -- really tough -- it’s often better to hang in there … even if it means some temporary losses on paper.