Alcoa Starts Earnings Season With Red Ink, Slight Beat

Kicking second-quarter earnings season off on a slightly positive note, Alcoa (NYSE:AA) reported a deeper quarterly loss but an adjusted profit beat on Monday as the aluminum maker continues to grapple with slumping prices.

While the Pittsburgh-based company has the honors of being the first member of the Dow Industrials to report quarterly results, it is no longer looked at as a key bellwether due to its heavy reliance on tepid aluminum prices.

Still, its shares rallied about 2% on the heels of the stronger-than-expected quarterly numbers.

Alcoa said it lost $119 million, or 11 cents a share, last quarter, compared with a net loss of $2 million, or zero cents a share, a year earlier.

Excluding one-time items, the company said it earned 7 cents a share, exceeding forecasts from analysts by a penny.

Hurt by an 8% quarter-over-quarter decline in aluminum prices, revenue dipped 1.9% to $5.85 billion, slightly beating consensus calls for $5.82 billion.

“Our businesses showed remarkable operating performance in the quarter with solid free cash flow," CEO Klaus Kleinfeld said in a statement. “We reached another milestone with record profitability in our downstream business while acting decisively to defy the headwinds of falling metal prices in our upstream businesses.”

The net loss included $42 million in charges tied to the closure of facilities as well as $62 million tied to settlement negotiations over allegations of racketeering.

Alcoa’s stock retreated last week to its lowest level since April 2009 after J.P. Morgan Chase (NYSE:JPM) downgraded the company to “neutral” from “overweight” and slashed its price target by 25% to $9.

J.P. Morgan cited the “persistently weak aluminum price environment,” which recently led the investment bank to trim its 2013 price forecast to 89 cents a pound from 94 cents and downgrade its 2014 target to 93 cents from $1.06.

Despite concerns about the health of China and other emerging economies, Alcoa on Monday reaffirmed its call for 7% global aluminum demand growth in 2013 and “essentially balanced” aluminum markets. The company sees aerospace demand jumping 9% to 10%, commercial transportation demand of 3% to 8% and automotive growth of 1% to 4%.

Alcoa also detailed its efforts to save cash by scaling back on production. The company said it achieved $539 million in productivity savings across all business segments during the first half of 2013, reaching more than half of its $750 million annual target.

Alcoa, which suffered an embarrassing downgrade of its credit rating cut to junk in May, said its debt-to-capital ratio dipped to 34.5% in the second quarter, down from 34.7% in the first quarter and 36.1% a year earlier. The company’s debt dropped by $566 million quarter-over-quarter.

Meanwhile, Alcoa also disclosed proposing a cash settlement of $103 million to the Department of Justice to put to rest an investigation into racketeering and fraud charges filed by Aluminum Bahrain, or Alba. The company said it has recorded a charge of $103 million.

Alcoa said settlement talks are ongoing and there is the potential of an additional charge of up to approximately $200 million to settle the matter.

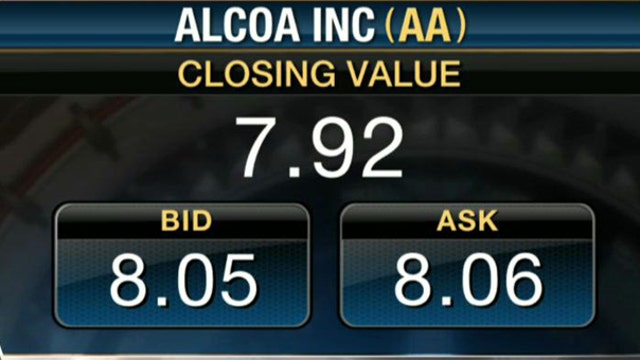

Shares of Alcoa traded up 1.77% to $8.06 in after-hours action on Monday after rallying 1.41% to $7.92 during regular trading. While the Dow is up 16% on the year, Alcoa has lost about 9% of its value.

Following Alcoa’s kickoff, earnings season will pick up later this week with quarterly reports on tap from Yum Brands (NYSE:YUM), Wells Fargo (NYSE:WFC) and J.P. Morgan Chase (NYSE:JPM).