Stocks rebound, Spirit-JetBlue latest, Musk threatens Twitter: LIVE UPDATES

FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

U.S. stocks notched modest gains across the board as consumer discretionary and material companies led the advance while healthcare and energy pulled back. Twitter shares fell over 1% but off the worst levels of the session after Elon Musk threatened to dump the deal. In commodities, oil closed fractionally lower at $118.50.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $32,915.78 | +16.08 | +0.05% |

| SP500 | $4,121.43 | +12.89 | +0.31% |

| I:COMP | $12,061.37 | +48.64 | +0.40% |

| AMZN | $124.79 | +2.44 | +1.99% |

| TWTR | $39.55 | -0.58 | -1.46% |

The Dow Jones Industrial Average rose over 16 points or 0.05%, while the S&P 500 and Nasdaq Composite rose 0.3% and 0.4%, respectively.

BMO Capital Markets chief investment strategy Brian Belski provides insight on investing in the stock market on 'Making Money.'

Twitter shares sank after Elon Musk, in an SEC Filing, is questioning whether the company's metrics on spam accounts is accurate as a result he is reserving his right to exit the deal.

U.S. stocks kicked off the week higher helped by a rebound in large-cap tech with Amazon shares trading post its 20-for-1 stock split. Elsewhere, Twitter shares fell after Elon Musk fired a warning to the company. In commodities, oil topped $118 while gas prices hit a new record of $4.86 a gallon.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TWTR | $40.16 | +0.25 | +0.63% |

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SAVE | $20.74 | -0.37 | -1.75% |

| JBLU | $10.47 | -0.06 | -0.57% |

| ULCC | $9.81 | -0.43 | -4.20% |

JetBlue makes the latest move, upping the ante for Spirit against Frontier.

"Superior, all-cash premium: JetBlue’s proposal offers Spirit stockholders aggregate consideration of $31.50 per share in cash, comprised of $30 per share in cash at the closing of the transaction and the prepayment of $1.50 per share of the reverse break-up fee" the airline disclosed on Monday.

Amazon will begin trading at a lower price following its 20-to-1 stock split.

Cryptocurrency was trading higher early Monday morning as Bitcoin, Ethereum and Dogecoin were all moving higher heading into the workweek.

Bitcoin was trading at nearly $31,315 (+4.59%), up nearly $1,385 overnight. For the week, Bitcoin was higher by nearly 1.74% and for June, the top cryptocurrency was trading down slightly more than 18%.

Ethereum was also higher early Monday, trading at nearly $1,900 (+5%), up approximately $91 overnight. For the week, it was trading down 0.27% and for the month, Ethereum traded down nearly 34.3%.

Dogecoin was trading at $0.0836 (+2.95%), up approximately $0.0023. For the week, however, it was down nearly 1.7% and for the month, it was down about 36.65%.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $32,899.70 | -348.58 | -1.05% |

| SP500 | $4,108.54 | -68.28 | -1.63% |

| I:COMP | $12,012.73 | -304.16 | -2.47% |

U.S. stocks were higher Monday after the benchmark S&P 500 index lost 1.6% on Friday amid concern about higher interest rates along with a possible economic downturn and job losses.

On Wall Street, the S&P 500 declined to 4,108.54 for its eighth weekly loss in the past nine weeks. The Dow Jones Industrial Average fell 1% to 32,899.70. The Nasdaq fell 2.5% to 12,012.73.

Government data showed U.S. employers added 390,000 jobs in May, beating expectations of 322,500. Investors are uneasy about the possibility Federal Reserve interest rates aimed at cooling inflation that is running at a four-decade high might tip the U.S. economy into a recession.

The same government report showed wages were slightly lower than forecast in May, which might reduce future pressure for prices to rise. That would reduce pressure on the Fed for more rate hikes.

More than four out of five stocks in the S&P 500 fell. The biggest declines were in tech stocks.Tesla tumbled 9.2% after U.S. safety regulators said more than 750 owners have complained about cars suddenly stopping on roadways for no apparent reason while operating on their partially automated driving systems.

Meanwhile, benchmarks in Shanghai, Tokyo and Hong Kong rose. A survey showed activity in Chinese retailing and other service industries shrank in May but at a slower rate than the previous month. The ruling Communist Party is allowing stores, factories and other businesses in Shanghai to reopen after a two-month shutdown to fight virus outbreaks. Restrictions in the capital, Beijing, are easing.

The Shanghai Composite Index rose 1.2% to 3,233.73 after the business news magazine Caixin said its monthly purchasing managers' index for services rose to 41.4 from April's 36.2 on a 100-point scale on which numbers below 50 show activity contracting.

The Hang Seng in Hong Kong gained 1.4% to 21,379.67 and the Nikkei 225 in Tokyo added 0.7% to 27,956.19. Korean markets were closed for a holiday.

Sydney's S&P-ASX 200 shed 0.3% to 7,215.90 while New Zealand markets were closed for a holiday. India's Sensex opened down 0.6% at 55,559.30. Southeast Asian markets declined.

Benchmark U.S. crude rose 70 cents to $119.57 per barrel in electronic trading on the New York Mercantile Exchange. The contract gained $2 on Friday to $118.87. Brent crude, the price basis for international oil trading, advanced 72 to $120.44 per barrel in London. It closed $2.11 higher the previous session at $119.72. The dollar declined to 130.72 yen from Friday's 130.85 yen. The euro edged up to $1.0724 from $1.0720.

Click here for more.

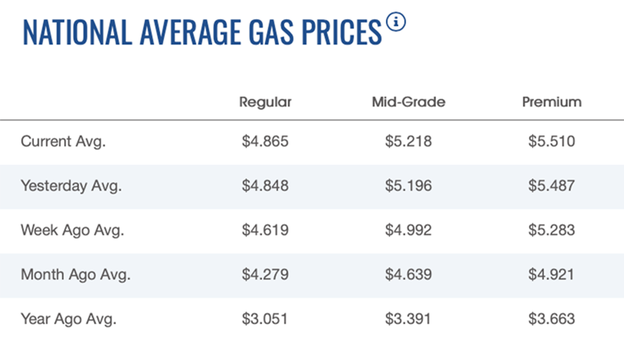

The average price for a gallon of gasoline in the U.S. rose to a record on Monday at $4.865, according to the latest numbers from AAA.

The price on Sunday was $4.848, while the price on Saturday was $4.819. One week ago, the average price for a gallon of gasoline was $4.619, a 20 cent hike.

A month ago, gasoline sold for an average of $4.279, while a year ago, gas could be bought for $3.051 a gallon.

The price of diesel increased Monday to $5.645, rising almost a penny from Sunday. A week ago, a gallon of diesel sold for $5.523. One year ago, a gallon of diesel sold for $3.197.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $89.47 | +2.22 | +2.54% |

| CVX | $177.60 | +1.60 | +0.91% |

| XOM | $99.09 | +1.42 | +1.45% |

Oil futures gained on Monday, with Brent rising above $120 a barrel after Saudi Arabia raised prices for its crude sales in July, signaling tight supply even after OPEC+ producers agreed to accelerate output increases over the next two months.

Brent crude firmed 68 cents, or 0.6%, to $120.40 a barrel at 0640 GMT after touching an intraday high of $121.95, extending a 1.8% gain from Friday.

U.S. West Texas Intermediate (WTI) crude futures were up 61 cents, or 0.5%, at $119.48 a barrel after earlier hitting a three-month high of $120.99. It gained 1.7% on Friday. Saudi Arabia raised the July official selling price (OSP) for its flagship Arab light crude to Asia by $2.10 from June to $6.50 premium versus the average of the Oman and Dubai benchmarks, state oil producer Aramco said on Sunday.

The July OSP is the highest since May, when prices hit all-time highs due to worries of disruption in supplies from Russia because of sanctions over its invasion of Ukraine.

The price increase came despite a decision last week by the Organization of the Petroleum Exporting Countries and allies, together called OPEC+, to increase output in July and August by 648,000 barrels per day, or 50% more than planned. Iraq said on Friday it aimed to raise output to 4.58 million bpd in July.

Click here to read more

Live Coverage begins here