STOCK MARKET NEWS: Inflation remains hot, 10-year Treasury hits 4%, Delta leads earnings

Stocks finish higher even as inflation remains elevated with the Dow posting its largest one day percentage gain since November 9, 2020. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

The consumer price index, a measure of prices at the main street level, remains near a 40-year high.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ODC | $22.87 | -0.33 | -1.42 |

Oil-Dri is higher in extended trading. The maker of products for soil in the agriculture, horticulture and sports sectors said fiscal fourth quarter net sales rose 19% to $93.2 million.

Net income jumped to $5.2 million, or 77 cents per share, for the three months ended July 31 compared to $603k, or 8 cents, in the prior year period.

“I am more pleased with the margin and profit improvement experienced during the fourth quarter,” said CEO Daniel Jaffee. “While both are still not back to historic norms, we made considerable progress by the end of the year. We are cautiously optimistic that this momentum will carry over into fiscal year 2023.”

U.S. stocks roared back from losses to close 2%+ higher across the board as investors shrugged off an 8.2% jump in September consumer prices. Bond yields soared with the 10-year Treasury grazing 4% before pulling back to 3.952%. In commodities, oil rose 2% to $89.11 per barrel.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| HMC | $22.32 | 0.56 | 2.57 |

| SONY | $65.43 | 2.26 | 3.58 |

Honda and Sony have announced an order schedule for their new electric vehicle with delivery on track for early 2026.

The new vehicle is expected to sell for a premium with enough features that it would function almost like a rolling smartphone, company officials said.

Sony Honda Mobility has a total of 10 billion yen ($68.23 million) in available capital to invest.

A New Jersey real estate development firm and four executives are facing charges of running a $600 million Ponzi-like fraud.

The Securities and Exchange Commission charged National Realty Investment Advisors (NRIA) and four former executives with violating the antifraud provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934.

The four executives, Rey Grabato II, of Hoboken, N.J., Daniel Coley O’Brien, of Southampton, N.Y., Thomas Nicholas Salzano, of Secaucus, N.J., and Arthur Scutaro, of Bloomfield, N.J. solicited investors in a nationwide campaign promising returns of up to 20 percent.

In reality, they used the money they raised to pay distributions to other investors, to fund an executive’s family’s personal and luxury purchases, and to pay reputation management firms to thwart investors’ due diligence of the executives.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| NFLX | $227.44 | 6.57 | 2.97 |

Netflix will charge $6.99 per month for its ad-supported streaming service. Basic with ads launches on November.

The service will stream at a resolution of up to 720p, or standard high-definition (HD). Content will include four to five minutes of ads per hour. At launch, ads will be 15 or 30 seconds in length, which will play before and during shows and films.

Not all movies and TV shows will be available due to licensing deals. You won't be able to download titles. Starting in November, signing up will be easy — visit Netflix.com, and register with your email, date of birth, and gender to get started.

Netflix ad-free basic plan costs $9.99 per month with 480p resolution. The standard plan goes for $15.59 with 1080p streaming. The premium service is priced at $19.99 for 4K+HDR resolution.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DAL | $30.67 | 1.46 | 5.00 |

Delta Air Lines is rising on a fourth quarter earning outlook . The world's largest airline by revenue said it expects revenue growth of 5%-9% in the December quarter compared to the same period in 2019.

Fourth quarter earnings per share is estimated at $1.00-$1.25.

Delta on Thursday reported third-quarter earnings of $695 million.

On a per-share basis, the Atlanta-based air carrier said it had net income of $1.08. Earnings, adjusted for one-time gains and costs, came to $1.51 per share.

The results missed Wall Street expectations. The average estimate of 12 analysts surveyed by Zacks Investment Research was for earnings of $1.56 per share.

The airline posted revenue of $13.98 billion in the period, which also did not meet Street forecasts. Ten analysts surveyed by Zacks expected $14.16 billion.

For the current quarter ending in December, Delta expects its per-share earnings to range from $1 to $1.25.

The Associated Press contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ACI | $27.49 | 1.82 | 7.09 |

| KR | $46.01 | -0.03 | -0.07 |

U.S. grocery giant Kroger Co is in talks to merge with smaller rival Albertsons Companies Inc, Bloomberg News reported on Thursday, citing people familiar with the matter.

A deal could be reached as soon as this week, the report said, adding that no final decision has been taken and talks could still be delayed or falter.

Both companies did not immediately respond to Reuters' requests for comment on the news.

In what could potentially be one of the biggest deal in recent years in the retail space, the merger talks come at time retailers and grocers are grappling with soaring costs and supply chain disruptions.

A potential deal between the two grocers would give the combined company a market valuation of about $47 billion. Shares of Albertsons surged 8% on the news, while Kroger shares were down marginally.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ACCO | $4.59 | -0.43 | -8.57 |

ACCO Brands fell more than 12% before cutting losses. The manufacturer of office products trimmed its full year outlook, the company said in a regulatory filing.

The owner of brand names including Five Star, Mead and Swingline sees full year net sales of $1.940 to $1.980 billion, down from $2.015-$2.055 billion. Adjusted earnings per share is now forecast at $1.05 to $1.10, down from $1.39 to $1.44.

“Current market capitalization has triggered a review of our goodwill valuation and we expect to take a yet to be finalized non-cash goodwill impairment charge in the third quarter,” said Boris Elisman, chair and CEO. “We have taken immediate actions to protect profitability and free cash flow by curtailing hiring, reducing inventory, and limiting discretionary spending and capital expenditures.”

ACCO holds a third quarter conference call on November 8.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BLK | $540.00 | 8.90 | 1.68 |

BlackRock Inc. on Thursday reported third-quarter earnings of $1.41 billion.

On a per-share basis, the New York-based company said it had profit of $9.25. Earnings, adjusted for amortization costs and non-recurring costs, came to $9.55 per share.

The results exceeded Wall Street expectations. The average estimate of six analysts surveyed by Zacks Investment Research was for earnings of $7.70 per share.

The investment firm posted revenue of $4.31 billion in the period, falling short of Street forecasts. Four analysts surveyed by Zacks expected $4.36 billion.

BlackRock shares have dropped 42% since the beginning of the year, while the S&P’s 500 index has decreased 25%. The stock has fallen 36% in the last 12 months.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| WBA | $33.04 | 1.10 | 3.45 |

Walgreens Boots Alliance topped earnings forecasts in the final quarter of fiscal 2022, and the drugstore chain’s early look at 2023 also fell mostly above expectations.

A drop in COVID-19 vaccinations and a big charge tied to the company’s United Kingdom stores weighed on results, but shares edged up Thursday after Walgreens detailed its performance.

Overall, the company booked a $415 million loss in the quarter that ended Aug. 31, as sales slid 5% to $32.45 billion. Earnings adjusted for one-time items totaled 80 cents per share.

Analysts expect, on average, earnings of 77 cents per share on $32.1 billion in revenue in Walgreens’ fiscal fourth quarter, according to FactSet.

The company faced a tough comparison with last year’s quarter, when its stores saw a surge in sales of vaccines and other products tied to the pandemic, Edward Jones analyst John Boylan said in a research note.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DPZ | $328.69 | 26.93 | 8.92 |

Domino's Pizza sees lower costs than previously estimated. The world's largest pizza chain updated its full year guidance on Thursday. Capital expenditures are now forecast at $100 million, down from $120 million previously estimated.

General and administrative expenses are seen at $415-$420 million, down from $420-$428 million

Domino's on Thursday reported third-quarter profit of $100.5 million.

On a per-share basis, the Ann Arbor, Michigan-based company said it had net income of $2.79.The results did not meet Wall Street expectations. The average estimate of 11 analysts surveyed by Zacks Investment Research was for earnings of $2.95 per share.

The pizza chain posted revenue of $1.07 billion in the period, which matched Street forecasts.

U.S. same store sales increased 2.0% and international same store sales (excluding foreign currency impact) declined 1.8% during the third quarter of 2022.

The Associated Press contributed to this report.

Mortgage rates are climbing again, according to mortgage securitizer Freddie Mac.

The average 30-year fixed rate mortgage rose to 6.92% from 6.66%. A year ago at this time, the 30-year averaged 3.05%.

The 15-year rate averaged 6.09%, up from last week when it averaged 5.90%. A year ago at this time, the 15-year FRM averaged 2.30%.

“Rates resumed their record-setting climb this week, with the 30-year fixed-rate mortgage reaching its highest level since April of 2002,” said Sam Khater, Freddie Mac’s Chief Economist. “We continue to see a tale of two economies in the data: strong job and wage growth are keeping consumers’ balance sheets positive, while lingering inflation, recession fears and housing affordability are driving housing demand down precipitously."

U.S. stocks slumped following the 8.2% jump in consumer prices for September. The reading, hotter than expected, signals inflation is not coming down despite the Federal Reserve’s aggressive path of interest rate hikes. In commodities, oil fell to the $86 per barrel level.

America's retirees are in-line for a hefty cost of living bump next year but inflation may eat into that windfall.

U.S. stocks reversed gains after the September consumer price index came in hotter than expected, rising 8,2%, as Americans continue to be punished with higher prices for everyday items.

The yield on the 10-year Treasury grazed 4%.

U.S. equity futures were trading higher ahead of the most anticipated economic report of the week.

The major futures indexes suggest a gain of 0.5% when the opening bell rings on Wall Street.

Oil prices gained after easing in the previous session on concerns about weakening demand outlook.

U.S. West Texas Intermediate crude futures traded around $87.00 a barrel.

Brent crude futures traded around $93.00 a barrel.

Both OPEC and the U.S. Energy Department have cut their demand outlooks.

The Bureau of Labor Statistics is expected to say the consumer price index rose 0.2% month-over-month in September, slightly above August’s 0.1% pop.

On a year-over-year basis watch for prices climb 8.1% in September, easing back from August’s hotter-than-expected reading of 8.3% thanks to moderating energy costs.

The Labor Department will release the number of new claims for unemployment benefits last week, likely to show that the labor market remains tight. Expectations are for 225,000, up slightly from a higher-than-expected 219,000 the prior week.

The Nikkei 225 in Tokyo sank 0.6%, Hong Kong's Hang Seng tumbled 1.8% and China's Shanghai Composite Index lost 0.3%.

Wall Street's benchmark S&P 500 ended lower Wednesday after inflation in producer prices edged down but still was near a multi-decade high.

The S&P 500 gave up 0.3% to 3,577.03 on Wednesday for its sixth daily decline.

The Dow Jones Industrial Average slipped 0.1% to 29,210.85. The Nasdaq composite lost 0.1% to 10,417.10. Both are on pace for a weekly loss.

A high-stakes inflation report due Thursday is expected to show the fight to rein in soaring consumer prices has a long way to go.

The Labor Department is releasing the highly anticipated consumer price index (CPI) report on Thursday morning, providing a fresh look at how hot inflation ran in September.

Economists expect the gauge, which measures a basket of goods, including gasoline, health care, groceries and rent, to show that prices rose 0.2% in September from the previous month — up from the 0.1% reading in August. On an annual basis, inflation is projected to have climbed by 8.1%.

Taiwan Semiconductor Manufacturing's quarterly profit surged 80% on strong sales of its chips used in data centers and electric cars.

However, the company cut its annual investment budget by at least 10% and struck a more cautious tone on upcoming demand.

TSMC's advanced chips for high-end customers such as Apple and Qualcomm had shielded it from the downturn flagged by chipmakers including AMD and Micron Technology.

TSMC said Thursday there are challenges from rising inflationary costs next year and cut its capital expenditure for 2022 to around $36 billion.

Toshiba Corp shares jumped on Thursday following a report that a domestic-led consortium is looking to buy the Japanese conglomerate for $19.1 billion.

A group of firms led by Japan Industrial Partners, a domestic private equity firm, had made the bid, according to the Kyodo news agency.

The bid comes to a 26% premium from Wednesday's closing price.

Shares of Toshiba jumped 7.5% putting them on track for their biggest one-day gain in more than a year.

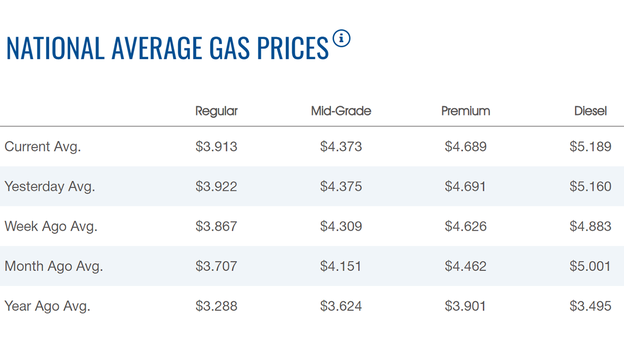

The average price of a gallon of gasoline slipped for the second straight day after a recent run of increases.

The price on Thursday was $3.913, according to AAA.

Wednesday's price was $3.922. A week ago, gasoline was at $3.867.

Gas hit a high of $5.016 on June 14.

Diesel's price gained to $5.189 per gallon.

Oil prices gained Thursday morning after easing in the previous session on concerns about weakening demand outlook.

U.S. West Texas Intermediate crude futures traded around $87.00 a barrel.

Brent crude futures traded around $92.00 a barrel.Both OPEC and the U.S. Energy Department have cut their demand outlooks.

OPEC on Wednesday cut its outlook for demand growth this year by between 460,000 bpd and 2.64 million bpd, citing the resurgence of China's COVID-19 containment measures and high inflation.

The U.S. Energy Department lowered its expectations for both production and demand in the United States and globally. It now sees just a 0.9% increase in U.S. consumption in 2023, down from a previous forecast for a rise of 1.7%.

Bitcoin was trading around $19,000, after snapping a two-day losing streak.

For the week, Bitcoin has lost 5%. For the month, the cryptocurrency was off more than 1%.

Bitcoin has lost more than 58% year-to-date.

Ethereum was trading around $1,200, after losing more than 4% in the past week.

Dogecoin was trading at 5 cents after losing more than 7% in the past week.

Live Coverage begins here