STOCK MARKET NEWS: Fed hikes rates, Musk’s new Twitter changes, Powerball over $1 billion

The Federal Reserve jacked up interest rates, Musk announces new Twitter ‘content moderation council" as the shakeup continues and Powerball tops $1 billion. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

The Federal Reserve, for the fourth straight time, has hiked interest rates.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GSK | $33.88 | 0.42 | 1.26 |

The Food and Drug Administration has accepted a Biologics License Application (BLA) and granted Priority Review for GSK’s respiratory syncytial virus (RSV) older adult vaccine candidate, with a decision expected by early May.

If approved, the shots are expected to generate billions in sales for their makers, given the complex molecular structure of the virus and safety concerns have stymied protracted efforts to develop a vaccine.

The vaccine has the potential to be the first available to help protect adults aged 60 years and older from lower respiratory tract disease caused by respiratory syncytial virus.

Separately, the drugmaker beat third-quarter earnings forecasts on Wednesday and raised its 2022 estimate for the second time in four months, continuing its strong start as a standalone prescription medicine business since spinning off its consumer health unit.

GSK reported a third-quarter adjusted profit of 46.9 pence per share on sales of about 7.83 billion pounds, topping analysts' forecasts for 40.1 pence and 7.32 billion pounds.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ETSY | $87.54 | -3.89 | -4.25 |

Etsy Inc. on Wednesday reported a third-quarter loss of $963.1 million, after reporting a profit in the same period a year earlier.

On a per-share basis, the Brooklyn, New York-based company said it had a loss of $7.62. Earnings, adjusted for asset impairment costs, were 58 cents per share.

The results topped Wall Street expectations. The average estimate of eight analysts surveyed by Zacks Investment Research was for earnings of 37 cents per share.

The online crafts marketplace posted revenue of $594.5 million in the period, also topping Street forecasts. Nine analysts surveyed by Zacks expected $560.2 million.

For the current quarter ending in December, Etsy said it expects revenue in the range of $700 million to $780 million.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| QCOM | $112.50 | -4.83 | -4.12 |

Chipmaker Qualcomm Inc forecast that revenue would come in $2 billion less than Wall Street analysts estimated for the current quarter due to a sharp drop in smartphone sales, and its shares sank 7% in after-hours trading.

Qualcomm also said profits would be less than expected.

Qualcomm expects a low double-digit percentage decline in handset volumes this year, compared with its prior forecast of a mid-single-digit percentage drop.

Revenue from Qualcomm's handsets business, which makes up more than half of total sales, rose 40% in the fourth quarter, while revenue from chips that enable WiFi and Bluetooth connections fell 20%.

The company forecast current-quarter revenue in the range of $9.2 billion and $10 billion, compared with analysts' estimates of $12.02 billion, according to Refinitiv data.

It expects adjusted earnings per share to be between $2.25 and $2.45, compared with analysts' expectations of $3.42.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| MGM | $35.11 | -0.83 | -2.31 |

MGM Resorts International (MGM) on Wednesday reported a third-quarter loss of $576.8 million, after reporting a profit in the same period a year earlier.

On a per-share basis, the Las Vegas-based company said it had a loss of $1.45. Losses, adjusted for non-recurring costs, were $1.39 per share.The results did not meet Wall Street expectations. The average estimate of six analysts surveyed by Zacks Investment Research was for earnings of 22 cents per share.

The casino and resort operator posted revenue of $3.42 billion in the period, beating Street forecasts. Five analysts surveyed by Zacks expected $3.26 billion.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ROKU | $56.05 | -0.74 | -1.30 |

Shares of Roku Inc fell more than 20% in extended trading on Wednesday after the streaming platform said it expects fourth-quarter revenue to be lower than last year.

The company expects total revenue to be about $800 million in the fourth quarter, down from $865.33 million an year earlier.

The forecast mirror warnings signals on ad spending from Snap Inc as companies cut their advertising budgets to rein in costs."As we enter the holiday season, we expect the macro environment to further pressure consumer discretionary spend and degrade advertising budgets, especially in the TV scatter market," the company said.

The company, which reported a 12% rise in quarterly revenue, said the advertising spend continues to grow slowly due to current weakness in the overall TV ad market.

Separately, the California-based firm also announced that its chief financial officer, Steve Louden, will leave the company sometime in 2023.

U.S. stocks sank in a volatile session after Federal Reserve Chairman Jerome Powell signaled rate hikes will continue after policymakers raised interest rates by an expected 75 basis points, the fourth consecutive such hike. The yield on the 10-year Treasury rose to 4.059%. In commodities, oil gained 1.8% to $90 per barrel.

Fed Chair Jerome Powell still believes there’s a path to a soft landing but said it’s more difficult now than before.

“I would say the path has narrowed over the course of the past year,” Powell said during a press conference following the two-day meeting of the central bank’s rate setting committee. “The inflation picture has become more challenging.”

Powell noted goods inflation has not come down as much as expected given that supply chain issues have largely been untangled, while inflation in the services sector is beginning to rise.

The producer price index increased 8.5% on an annual basis in September.

Energy services rose 19.8% on an unadjusted basis in September, while services excluding energy grew 6.7%. Medical care services rose 6.5%.

“No one knows whether there will be a recession or not and how large it will be,” Powell said.

The chair added that job losses from a soft landing may be less than expected because job openings are so strong.

The Fed raised interest rates Wednesday by an expected 75 basis points, saying “inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures."

The increase brings the target range for the federal funds rate to 3.75-4%.

The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time,” the bank’s rate setting Federal Open Market Committee said in a statement.

U.S. stocks popped higher following the Federal Reserve's 75 basis point rate hike. The Dow Jones Industrial Average paced the gains as Boeing, Verizon and Dow Chemical topped the leader board.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BA | $151.25 | 7.87 | 5.49 |

| VZ | $38.20 | 0.83 | 2.22 |

| DOW | $48.03 | 1.10 | 2.34 |

Stocks bounced around as investors digest the latest rate hike and Federal Reserve Chairman Jerome Powell's warning that pausing rate hikes would be "premature"...

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CHGG | $26.21 | 5.10 | 24.17 |

Chegg rose as much as 32% Wednesday. The education technology company agreed to enhance security and reported earnings that topped Wall Street forecasts.

Chegg agreed to bolster its data protections as part of a consent agreement reached with the U.S. Federal Trade Commission (FTC), which had criticized company security practices, saying they exposed the personal data of millions of users.

The agency alleged that Chegg failed to act after suffering four security breaches since 2017, exposing sensitive information like dates of birth, family heritage and passwords.

The company on Tuesday reported third-quarter profit of $251.6 million. On a per-share basis, the Santa Clara, California-based company said it had net income of $1.23. Earnings, adjusted for one-time gains and costs, were 21 cents per share. The results beat Wall Street expectations. The average estimate of eight analysts surveyed by Zacks Investment Research was for earnings of 14 cents per share.

The provider of online textbook rental services posted revenue of $164.7 million in the period, which also topped Street forecasts. Nine analysts surveyed by Zacks expected $158.2 million.The Associated Press and Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SABR | $5.39 | -0.56 | -9.33 |

Sabre is trading lower Wednesday. The provider of technology services to the travel industry missed Wall Street revenue estimates and lowered its 2022 outlook.

Third quarter revenue rose 50% to $663.39 million from a year ago; analysts expected $689.51 million.

The operating loss for the three months ended September 30 was $56.5 million compared to an operating loss of $156.7 million.

The adjusted loss was 25 cents per share. The mean expectation of five analysts for the quarter was for a loss of 25 cents per share.

Sabre adjusted down its 2022 outlook. The company expects to finish the year with booking at 55% of 2019 levels, compared to prior guidance of 60%.

Adjusted EBITDA is expected to be $90 million versus the prior outlook of $100 million.

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ROK | $243.63 | -12.02 | -4.70 |

Rockwell Automation is trading lower Wednesday. The industrial equipment and software maker issued 2023 guidance that was lower than its 2022 results.

The company sees 2023 full year sales growth of 9.5% compared to 2022 actual growth of 10.9%.

Organic sales are expected to rise 11% compared to 11.3% in 2022.

2022 fourth quarter results did top Wall Street estimates.

Rockwell Automation reported fiscal fourth-quarter earnings of $338.9 million.

On a per-share basis, the Milwaukee-based company said it had net income of $2.91. Earnings, adjusted for non-recurring costs, came to $3.04 per share.

The results exceeded Wall Street expectations. The average estimate of eight analysts surveyed by Zacks Investment Research was for earnings of $2.94 per share.

The industrial equipment and software maker posted revenue of $2.13 billion in the period, also exceeding Street forecasts. Seven analysts surveyed by Zacks expected $2.11 billion.The Associated Press contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TUP | $4.53 | -3.20 | -41.40 |

Tupperware Brands fell as much as 45% in Wednesday trading. The direct seller of plastic storage containers and cosmetics warned that it may not be able to maintain financial compliance with its credit agreements due to volatility in its earnings and progressive tightening of the financial covenants.

Tupperware is talking with its lenders but warned: “The company's ability to amend its covenants, obtain a waiver or otherwise refinance its debt, as well as the timing and terms of any such amendment or refinancing, are dependent upon a number of factors, and there can be no assurance that the Company will be successful in such efforts.

The company also missed Wall Street revenue and profit estimates.

Third quarter net sales fell 20% to $302.8 million. Analysts were looking for $316.1 million.

The net loss from continuing operations was $(3.8) million, compared to $60.4 million in the prior year period.

Adjusted earnings came in at 14 cents per share for the quarter ended September 24. The mean expectation of three analysts for the quarter was for earnings of 48 cents per share.

The Federal Reserve is set to escalate its battle against inflation this week with another substantial interest rate hike, risking deeper economic pain for millions of households and businesses nationwide.

And Wall Street is even more laser-focused on what Fed Chairman Jerome Powell could signal in the central bank's inflation fight during his 2:30 p.m. ET press conference Wednesday.

U.S. stocks drifted lower ahead of a likely 75 basis point rate hike due at 2pm ET, followed by Federal Reserve Chairman Powell’s press conference where he is expected to lay the groundwork for future action. In commodities, oil hovered at the $88 per barrel level.

Powerball climbed to its second largest lottery jackpot ever and the drawing is Wednesday evening.

A positive read on the job market bodes well for Friday's monthly employment report, the last before the Midterm elections.

Twitter CEO Elon Musk issued a statement clarifying how the platform will proceed with election integrity and content moderation, including hate and harassment, after the platform took action against several networks that looked to sway or otherwise impact American political discourse ahead of the 2022 midterm elections.

In a series of tweets, Musk said he was looking into reinstating certain accounts on the platform and was establishing a content moderation council.

"Twitter's content moderation council will include representatives with widely divergent views, which will certainly include the civil rights community and groups who face hate-fueled violence," Musk said in a tweet to his 113 million followers.

Musk also said he talked to several civil society leaders, including the Anti-Defamation League's Jonathan Greenblatt, The Asian American Foundation's Norman Chen, the NAACP's Derrick Johnson and more about how Twitter will "continue to combat hate & harassment & enforce its election integrity policies."

Read more on the story by clicking here: Twitter CEO Elon Musk details election integrity, content moderation on platform ahead of 2022 midterms

U.S. equity futures traded higher on Wednesday, the day after stocks declined on concerns the Fed may not slow the pace of interest rate increases.

The major futures indexes suggest a gain of 0.3% when trading begins on Wall Street.

Oil prices rose more than 1% on Wednesday after industry data showed a surprise drop in U.S. crude inventories, suggesting demand is holding up.

U.S. West Texas Intermediate (WTI) crude futures traded around $88.00 a barrel.

Brent crude futures traded at $94.00 a barrel.

The Federal Reserve is widely expected to raise the Federal Funds rate by three-quarters of a percentage point to a range of 3.75%-4%, up from the current range of 3%-3.25%.

It would be the central bank’s fourth consecutive 75-basis point rate hike, following moves in September, July, and June.

Traders will also get the first of this week major labor-related reports.

The payroll processing firm ADP will release its National Employment report for October. Economists anticipate an increase of 195,000 private-sector jobs.

Shares of Match Group were 16% higher in premarket trading after the parent company of dating apps Tinder and Hinge beat estimates for third-quarter revenue as more paying users, undeterred by decades-high inflation, signed up on its dating apps.

Shares of Airbnb were 5% lower in premarket trading after the company forecast fourth-quarter revenue below market estimate, saying a strong U.S. dollar had started to pressure its business and that bookings would moderate after a bumper third quarter.

Shares of Cheesecake Factory were lower by 7% in premarket trading after the dining chain missed Wall Street revenue and profit estimates.

In Asia, Japan’s benchmark Nikkei 225 declined 0.1%, Hong Kong's Hang Seng jumped 2.4% and China's Shanghai Composite index added 1.2%.

On Tuesday, the S&P 500 fell 0.4% to 3,856.10 after having been up as much as 1% shortly after trading opened. The Dow Jones Industrial Average fell 0.2% to 32,653.20 and the Nasdaq composite dropped 0.9%, to 10,890.85.

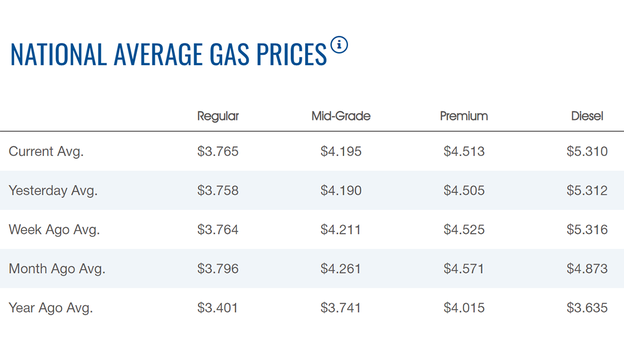

The nationwide price for a gallon of gasoline rose Wednesday to $3.765, according to AAA.

The average price of a gallon of gasoline on Tuesday was $3.758.

One week ago, a gallon of gasoline cost $3.764.

A month ago, that same gallon of gasoline cost $3.796.

Gas hit an all-time high of $5.016 on June 14.

Diesel slipped slightly to $5.310.

Oil prices rose more than 1% on Wednesday after industry data showed a surprise drop in U.S. crude inventories, suggesting demand is holding up.

U.S. West Texas Intermediate (WTI) crude futures traded around $89.00 a barrel.

Brent crude futures traded at $96.00 a barrel.

Both benchmark contracts rose about 2% in the previous session on a weaker U.S. dollar and reports that China's government was going to consider ways to relax COVID rules.

Data from the American Petroleum Institute showed crude oil inventories fell by about 6.5 million barrels for the week ended Oct. 28, according to market sources.

Analysts polled by Reuters had on average expected crude inventories to rise by 400,000 barrels.

Bitcoin was trading around $20,000, after snapping a two-day losing streak.

For the week, Bitcoin has gained nearly 2%.The cryptocurrency is down more than 55% year-to-date.

Ethereum was trading around $1,500, after gaining more than 8% in the past week.

Dogecoin was trading at 13 cents, after gaining more than 126% in the past week, about the same time Elon Musk took control of Twitter.

Three major retailers have tentatively reached an agreement to resolve thousands of state and local government lawsuits involving opioid painkillers.

CVS Health Corp, Walgreens Boots Alliance and Walmart agreed to pay about $13.8 billion to resolve those suits, according to two people familiar with the negotiations.

The proposed settlement breaks down this way: CVS to pay $5 billion over 10 years, Walgreens to pay $5.7 billion over 15 years and Walmart to pay $3.1 billion, mostly up front, the sources say.

CVS, Walmart and Walgreens declined to comment. A spokesperson for the plaintiffs' attorneys in the litigation did not immediately respond to Reuters for comment.

It would be the first nationwide deal with retail pharmacy companies, following nationwide opioid settlements with drugmakers and distributors totaling more than $33 billion.

State and local governments accused drugmakers of downplaying the risks of their opioid pain medicines, and distributors and pharmacies of ignoring red flags that prescriptions were being diverted into illegal trafficking.

More than 3,300 lawsuits have been filed since 2017.

CVS, Walgreens and Walmart are the three largest retail pharmacies in the country by market share.

Click here for more on the story: CVS, Walmart, Walgreens agree to $13.8B opioid settlement: report

Live Coverage begins here