STOCK MARKET NEWS: Bed Bath & Beyond latest, JPMorgan CEO Jamie Dimon on economy, Powell speech

JPMorgan CEO Jamie Dimon talks about health of the economy, stocks, oil slip and Bed Bath & Beyond announces more store closings. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

The tech-heavy Nasdaq Composite led the market’s broad gains as investors did some bargain hunting in a choppy session which saw all the main S&P sectors rise excluding consumer staples.

In commodities, oil rose marginally to $75.12 per barrel.

A longtime executive for Donald Trump is expected to be sent to New York's Rikers Island jail after being sentenced on Tuesday to five months behind bars for helping engineer a 15-year tax fraud scheme at the former president's real estate company.

Allen Weisselberg, the Trump Organization's former chief financial officer, pleaded guilty in August, admitting that from 2005 to 2017 he and other executives received bonuses and perks that saved the company and themselves money.

The sentence was imposed by Justice Juan Merchan in a New York state court in Manhattan.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BBBY | $1.89 | 0.27 | 16.71 |

Bed Bath & Beyond is reportedly laying off workers after posting a $393 million quarterly loss.

The domestic merchandise retailer said it is cutting corporate staff along with employees across its supply chain and stores, CNBC said, citing a memo sent to team members.

Bed Bath & Beyond said it started cost reductions of about $80 million to $100 million across the business, including overhead expenses and headcount.

The New Jersey-based company's quarterly loss for the fiscal third quarter ended Nov. 26 includes an impairment charge of about $100.7 million, signaling that its inventory is not worth the value it originally estimated.

Net sales fell 33% to $1.26 billion in the third quarter as inflation strained consumers' pockets and shoppers focused on products other than home goods, furniture and decor — merchandise that is core to Bed Bath & Beyond's inventory mix — for their early holiday and Black Friday purchases.

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| VORB | $1.54 | -0.39 | -20.21 |

Britain's attempt to become the first European nation to launch satellites into space ended in bitter disappointment early on Tuesday when Virgin Orbit said its rocket had suffered an anomaly that prevented it from reaching orbit.

The "horizontal launch" mission had left from the coastal town of Newquay in southwest England, with Virgin's LauncherOne rocket carried under the wing of a modified Boeing 747 called "Cosmic Girl", and later released over the Atlantic Ocean.

The failure deals a further blow to European space ambitions after an Italian-built Vega-C rocket mission failed after lift-off from French Guiana in late December.

The rockets have since been grounded.

“This is a major set-back for Virgin Orbit and for Cornwall’s ambitions as a new launchpad for space ventures, but the problems may not be unsurmountable,” said Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown.

“Shares have fallen by more than 23% in pre-market trading reflecting investors’ deep disappointment. The cash burn rate for the company has been huge, and the prospects for revenue have been significantly set back. While space may have been heralded as the new investment frontier, the ventures clearly come with a huge amount of risk,” Streeter added.

Reuters contributed to this report.

The Federal Reserve's independence from political influence is central to its ability to battle inflation, but requires it stay out of issues like climate change that are beyond its congressionally established mandate, Fed Chair Jerome Powell said on Tuesday.

"Restoring price stability when inflation is high can require measures that are not popular in the short term as we raise interest rates to slow the economy. The absence of direct political control over our decisions allows us to take these necessary measures without considering short-term political factors," Powell said in remarks to a forum on central bank independence sponsored by the Swedish central bank.

But "we should 'stick to our knitting' and not wander off to pursue perceived social benefits that are not tightly linked to our statutory goals and authorities," Powell said. "Taking on new goals, however worthy, without a clear statutory mandate would undermine the case for our independence."

Though Powell said the Fed's regulatory powers give it a "narrow" role to ensure financial institutions "appropriately manage" the risks they face from climate change, "we are not, and will not be, a 'climate policymaker.'"

"Without explicit congressional legislation, it would be inappropriate for us to use our monetary policy or supervisory tools to promote a greener economy or to achieve other climate-based goals," he said. "Decisions about policies to directly address climate change should be made by the elected branches of government and thus reflect the public's will as expressed through elections," he told the forum in Stockholm.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| MSFT | $229.35 | 2.23 | 0.98 |

Microsoft Corp is in talks to invest $10 billion in ChatGPT-owner OpenAI as part of funding that will value the firm at $29 billion, Semafor reported Monday, citing people familiar with the matter.

The news underscores rising interest in the artificial intelligence company, whose chatbot has dazzled amateurs and industry experts with its ability to spit out haikus, debug code and answer questions while imitating human speech.

The funding could also include other venture firms and documents sent to prospective investors outlining its terms indicated a targeted close by the end of 2022, according to the report.

Microsoft declined to comment, while OpenAI did not immediately respond to Reuters requests for comment.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CVAC | $11.98 | 1.62 | 15.64 |

| GSK | $34.74 | 0.21 | 0.62 |

Germany's CureVac AG said on Friday its second-generation COVID-19 vaccine produced virus-neutralizing antibodies against the BA.1 subvariant of Omicron, based on preliminary data from an early-stage trial.

CureVac is developing the vaccine with Britain's GSK and the companies are looking to catch-up to similar vaccine development by rivals.

The company said the vaccine was shown to be generally well tolerated in the trial. Younger adults showed the presence of neutralizing antibodies beginning at the lowest tested dose, data showed.

CureVac gave up on its first-generation vaccine candidate, CVnCoV, in 2021 after poor data.

The company also said its flu vaccine, which also uses mRNA technology, successfully boosted antibody levels against flu and was well-tolerated in an early-stage study.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| OSH | $29.15 | 6.58 | 29.15 |

| CVS | $90.99 | -0.50 | -0.55 |

CVS Health Corp is exploring an acquisition of primary care center operator Oak Street Health Inc, Bloomberg News reported on Monday citing people familiar with the matter.

No final decision has been made and discussions could fall through, the report added.

CVS declined to comment while Oak Street did not immediately respond to a Reuters request.

Oak Street Health runs primary care centers across United States for recipients of Medicare, the U.S. government insurance program for Americans aged 65 and older, and has private equity firms such as General Atlantic and Newlight Partners among its shareholders.

Drugstore chain owner CVS has been expanding its products beyond managing health and pharmacy benefits with acquisitions in recent years, including its $8 billion buyout of home healthcare service company Signify Health last year.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| COIN | $39.26 | 0.99 | 2.59 |

Coinbase Global Inc said on Tuesday it will reduce its workforce by about 20%, or 950 employees, as part of a restructuring plan, in a third round of layoffs for the cryptocurrency exchange since last year.

The company said it expects to incur about $149 million to $163 million in restructuring expenses. Its shares reversed course to fall 2.7% premarket after rising more than 5% on the layoffs announcement earlier.

Coinbase said it had no additional comment on the plan.

Coinbase in November cut more than 60 jobs in its recruiting and institutional onboarding teams, after slashing 1,100 jobs, or 18% of its workforce, in June.

Shares in the company lost roughly 86% of their value last year, in line with the downturn in the fortunes of the sector.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ACI | $21.15 | 0.23 | 1.11 |

Albertsons topped Wall Street revenue and profit estimates.

The supermarket chain that plans to merge with Kroger said third quarter net sales grew 8.5% to $18.15 billion, driven by a 7.9% increase in identical sales and higher fuel sales, with retail price inflation as the primary driver of the identical sales increase.

The estimate was $17.64 billion.

Net income for the 12 weeks ended Dec. 3, was $375.5 million, down from $424.5 million.

The company reported profits of 87 cents per share. Profits of 67 cents per share were anticipated by the sixteen analysts providing estimates for the quarter.

The company's brands include Albertsons, Safeway, Vons, Jewel-Osco, Shaw's, Acme and Tom Thumb.

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| PFE | $48.20 | -0.19 | -0.39 |

Pfizer Inc is not in talks with Chinese authorities to license a generic version of its COVID-19 treatment Paxlovid for use there, but is in discussions about a price for the branded product, Chief Executive Albert Bourla said on Monday.

Reuters reported on Friday that China was in talks with Pfizer to secure a license that will allow domestic drugmakers to manufacture and distribute a generic version of the U.S. firm's COVID-19 antiviral drug Paxlovid in China.

Referring to that report, Bourla, speaking at J.P. Morgan's healthcare conference in San Francisco, said "We are not in discussions. We have an agreement already for local manufacturing of Paxlovid in China. So we have a local partner that will make Paxlovid for us, and then we will sell it to the Chinese market.

"Pfizer has a licensing agreement with the U.N-backed Medicines Patent Pool (MPP) that allows 35 drugmakers around the world to make cheap versions of Paxlovid and supply the treatment in 95 poorer countries.

That license does not allow them to sell generic Paxlovid in China, where infections have surged since December, prompting a severe shortage of flu and COVID drugs.

BlackRock's Rick Reider, who manages $2.3 trillion in assets, has a warning for investors who are betting on when the Federal Reserve will slow their pace of rate hikes.

Leading banker Jamie Dimon is more optimistic on the economy than he was just a few months ago.

Modena CEO Stephane Bancel gave a fresh forecast on the coronavirus and what's ahead for the biotech giant.

Bed Bath & Beyond, teetering on a possible bankruptcy filing, is taking steps to avoid the worse case scenario.

U.S. stock futures are lower on Tuesday as investors await remarks from Federal Reserve Chairman Jerome Powell.

Dow Jones Industrial Average futures are down 147 points, or 0.44%, while S&P 500 and Nasdaq futures are down 0.45% and 0.61%, respectively.

At 9 a.m. ET, Powell is expected to participate in a panel discussion about central bank independence hosted by Sweden's central bank, Sveriges Riksbank.

In commodities, oil prices were slightly higher. West Texas Intermediate Crude futures are up 0.29% while Brent crude futures are up 0.23%.

Cryptocurrency prices were higher early Tuesday.

At approximately 4:45 a.m. ET, Bitcoin was trading at nearly $17,251 (+0.38%), or higher by $65.

For the week, Bitcoin was trading higher by nearly 3%. For the month, the cryptocurrency was higher by more than 0.25%.

Ethereum was trading at approximately $1,329.9 (+0.70%), or higher by about $9.2.

For the week, Ethereum was trading higher by 8.65%. For the month, it was trading higher by approximately 4.62%.

Dogecoin was trading at $0.076675 (+01.46%), or higher by approximately $0.001107.

For the week, Dogecoin was higher by almost 6%. For the month, the crypto was lower by nearly 22%.

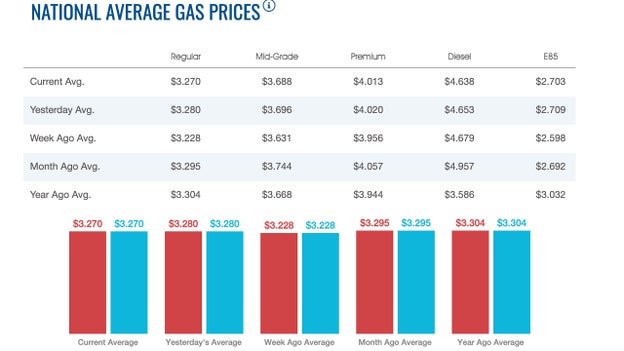

The nationwide price for a gallon of gasoline slipped a full penny on Tuesday to $3.27. On Monday, a gallon of gasoline nationwide cost $3.28. On Sunday, that same gallon of gasoline was $3.281, according to AAA.

A year ago, the price for a gallon of regular gasoline was $3.304. One week ago, a gallon of gasoline cost $3.228. A month ago, that same gallon of gasoline cost $3.295.

Gas hit an all-time high of $5.016 on June 14.

Diesel remained below $5.00 per gallon on Tuesday, falling to $4.638. On Monday the price stood at $4.653. On Sunday, a gallon of diesel cost $4.663, but that is still a far cry from the $3.583 of a year ago.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $33,517.65 | -,112.96 | -0.34 |

| SP500 | $3,892.09 | -2.99 | -0.08 |

| I:COMP | $10,635.65 | 66.36 | 0.63 |

U.S. stock futures moved lower Tuesday morning after the Nasdaq posted a second day of gains, aided by Tesla and other tech shares.

Traders worry repeated rate hikes by the Fed and other central banks to cool inflation that is at multi-decade highs might tip the world into recession. They hope Thursday's report on U.S. consumer prices will show inflation moderating, reducing the need to slow economic activity further.

“Traders are bringing back talk of a ‘soft landing,’ which could support risk equities,” said Anderson Alves of ActivTrades in a report. If the data show lower U.S. inflation, “another dovish wave may hit markets,” helped by “easing recession fears.”

Futures for Wall Street's benchmark S&P 500 index and the Dow Jones Industrial Average were off 0.2%. On Monday, the S&P dipped 0.1% and the Dow lost 0.3%. The Nasdaq composite gained 0.6%.

Despite trader optimism, Fed officials say rates will have to stay elevated for an extended period to extinguish upward pressure on prices. The Fed benchmark lending rate stands at a range of 4.25% to 4.50%, up from close to zero a year ago.

On Monday, Fed board members Mary Daly and Rafael Bostic dampened hopes for a rate cut this year. Daly said she expects the benchmark to be raised to over 5%. Bostic said it will be kept there “for a long time.”

Forecasters expect Thursday's report to show inflation slowed to 6.5% in December from November's 7.1%. That is down from June's 9.1% peak but well above the Fed's 2% target. Warnings are also coming for what look to be lackluster corporate profits when reporting season begins Friday as companies contend with higher labor and other costs.

Meanwhile, Asian stocks were mixed and European markets opened lower. London, Frankfurt and Hong Kong fell. Shanghai and Tokyo rose.

The Shanghai Composite Index rose 0.4% to 3,169.50 while the Hang Seng in Hong Kong shed 0.3% to 21,331.46.

The Nikkei 225 in Tokyo gained 0.8% to 26,175.56.

The Kospi in Seoul was up less than 0.1% at 2,351.31 and Sydney's S&P-ASX 200 lost 0.3% to 7,131.00. India's Sensex sank 1% to 60,134.70.

New Zealand gained while Southeast Asian markets retreated.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $65.88 | 1.05 | 1.62 |

| CVM | $2.60 | 0.11 | 4.42 |

| XOM | $108.47 | -2.06 | -1.86 |

Oil edged lower on Tuesday on expectations that further interest rate hikes in the United States, the world's biggest oil user, will slow economic growth and limit fuel demand.

Brent futures for March fell 33 cents to $79.32 a barrel, a 0.4% drop, by 0719 GMT. U.S. West Texas Intermediate crude dipped 29 cents, or 0.4%, to $74.34 per barrel. Both benchmarks climbed 1% on Monday, after China, the world's biggest oil importer and second-largest consumer, opened its borders over the weekend for the first time in three years.

Two United States Federal Reserve officials this week expected the Fed policy rate - now at 4.25% to 4.5% - to need to rise to a 5% to 5.25% range to bring higher inflation rates under control.

"(The expectation) is more hawkish than what markets are pricing at the moment (4.75-5% range)," said Yeap Jun Rong, Market Analyst at IG in a note, adding that the upcoming speech from Fed chair Jerome Powell later on Tuesday could mirror the hawkish tone with some pushback as well.

Fed policymakers said fresh inflation data out later this week will help them decide whether they can slow the pace of interest rate hikes at their upcoming meeting, to just a quarter point increase instead of the larger jumps they used for most of 2022.

China also issued a second batch of 2023 crude import quotas, according to sources and documents reviewed by Reuters on Monday, raising the total for this year by 20% from the same time last year.

But analysts warned that China's demand revival may play limited role to drive up oil prices under the global economic downward pressure.

"The social vitality of major Chinese cities is rapidly recovering, and the restart of China's demand is worth looking forward to. However, considering that the recovery of consumption is still at the expected stage, the oil price will most likely remain low and range-bound," said analysts from Haitong Futures.

Separately, U.S. crude oil stockpiles likely fell 2.4 million barrels, with distillate inventories also seen slightly down, a preliminary Reuters poll showed on Monday.

Industry group American Petroleum Institute is due to release data on U.S. crude inventories at 4:30 p.m. EDT (2030 GMT) on Tuesday.

The Energy Information Administration, the statistical arm of the U.S. Department of Energy, will release its own figures at 10:30 a.m. (1430 GMT) on Wednesday.

Live Coverage begins here