STOCK MARKET NEWS: Strong jobs report, Biden blocks rail strike, choppy trading session

The November jobs report came in stronger-than-expected, Biden signs rail strike blocking bill, SpaceX approved to deploy 7,500 satellites. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

President Joe Biden says a bill averting a nationwide rail strike helps the nation avoid an economic catastrophe during a bill signing ceremony at the White House.

“It was the right thing to do at the moment,” Biden said to keep supply chains working through the holidays.

He added the fight over paid sick leave is not over. “I’m going to continue that fight until we succeed,” Biden said.

The president touted his economic achievements, including creating 10.2 million jobs since taking office and unemployment at a 50-year low.

Rail workers will get a 24% wage increase over the next five years.

The U.S. Senate voted 80 to 15 on Thursday to impose a tentative contract deal reached in September on a dozen unions representing 115,000 workers, who could have gone on strike on Dec. 9. But the Senate failed to approve a measure that would have provided paid sick days to railroad workers.

Eight of 12 unions had ratified the deal. But some labor leaders have criticized Biden, a self-described friend of labor, for asking Congress to impose a contract that workers in four unions have rejected over its lack of paid sick leave.

Reuters contributed to this report.

The U.S. Federal Communications Commission (FCC) said on Thursday it approved SpaceX's bid to deploy up to 7,500 satellites, but put on hold some other decisions.

SpaceX's Starlink, a fast-growing network of more than 3,500 satellites in low-Earth orbit, has tens of thousands of users in the United States so far, with consumers paying at least $599 for a user terminal and $110 a month for service. The FCC in 2018 approved SpaceX plans to deploy up to 4,425 first-generation satellites.

SpaceX has sought approval to operate a network of 29,988 satellites, to be known as its “second-generation” or Gen2 Starlink constellation to beam internet to areas with little or no internet access.

A record 2% of U.S. homes for sale were delisted each week on average during the 12 weeks ending Nov. 20, compared with 1.6% one year earlier.

This is according to a Redfin analysis of MLS data across 43 of the 50 most populous U.S. metropolitan areas—those with sufficient data.

Sellers are taking their homes off the market because they’re often receiving no offers for the price they want to sell for, and sometimes, no offers at all. That’s due to a sharp drop in homebuyer demand driven by rising mortgage rates and persistently high home prices. While mortgage rates have dipped slightly since mid-November, the monthly mortgage payment on the median-asking-price home is still 40% higher than it was one year ago.

The European Union on Friday agreed on a $60 per barrel price cap on Russian seaborne crude oil, after holdout Poland gave its support, paving the way for formal approval over the weekend.

The price cap, an idea of the Group of Seven (G7) nations, aims to reduce Russia's income from selling oil, while preventing a spike in global oil prices after an EU embargo on Russian crude takes effect on Dec. 5.

European Commission President Ursula von der Leyen said the price cap would significantly reduce Russia's revenues."It will help us stabilize global energy prices, benefiting emerging economies around the world," von der Leyen said on Twitter, adding that the cap would be "adjustable over time" to react to market developments.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| MNTS | $1.10 | -0.02 | -1.79 |

Momentus is higher in extended trading. The commercial space company announced the resignation of chief financial officer Jikun Kim, effective Jan. 6, 2023.

Kim joined Momentus in September 2020 as Chief Financial Officer. In this role, he led the Company’s accounting and financial planning and analysis group. He oversaw the Company’s Special Purpose Acquisition Company transaction that closed in August 2021 and the process of listing Momentus on the NASDAQ exchange.

The company will announce a successor at a later date.

FTX Japan plans to resume withdrawals in the ordinary course on this basis.

“This week we were able to confirm with the law firm representing the FTX group in the Chapter 11 bankruptcy proceedings that Japanese customer cash and crypto currency should not be part of FTX Japan’s estate given how these assets are held and property interests under Japanese law,” the firm said.

FTX Japan has put together a plan to re-enable withdrawals:

“Development work for this plan has already started and our engineering teams are working to allow FTX Japan users to withdraw their funds. As part of the plan, we are incorporating controls, security audit, reconciliations, and reviews to put in place a robust and secure process,” the firm said.

Galaxy Digital Holdings Ltd will buy crypto lender Celsius Network LLC-owned digital asset custody platform GK8, the crypto financial services company said on Friday.

The purchase followed a sale process executed in connection with Celsius' Chapter 11 bankruptcy and is subject to court approvals and other closing conditions, the company said.

New Jersey-based Celsius filed for bankruptcy in July, citing extreme market conditions and listed a $1.19 billion deficit on its balance sheet.

The deal will add nearly 40 people, including cryptographers and blockchain engineers, as well as an office in Tel Aviv, Galaxy said.

Founded by Michael Novogratz, the company offers a suite of financial services including trading, asset management and investment banking among others to the crypto-focused companies.

Reuters had reported in August that San Francisco-based blockchain payments company Ripple Labs Inc was interested in potentially purchasing assets of bankrupt crypto lender Celsius Network, according to a company spokesperson.

Crypto markets were shaken by the collapse of the popular terraUSD and luna tokens in May, followed by the implosion of crypto exchange FTX last month.

Oil futures were mixed on Friday ahead of a meeting of the Organization of the Petroleum Exporting Countries and its allies (OPEC+) on Sunday and an EU ban on Russian crude on Monday.

Brent crude futures were up 37 cents, or 0.4%, at $87.25 per barrel by 1441 GMT. U.S. West Texas Intermediate (WTI) crude futures rose 55 cents, or 0.7%, to $81.77 per barrel.

Both contracts dipped in an out of negative territory, but, but were on track for their first weekly gains, the biggest in two months at around 4% and 7% respectively, after three consecutive weeks of drops.

European Union governments tentatively agreed on a $60 a barrel price cap on Russian seaborne oil with an adjustment mechanism to keep the cap at 5% below the market price, according to diplomats and a document seen by Reuters.

The cap, which was designed to limit revenues to Russia while not resulting in an oil price spike, still needs formal approval before the bloc's sanctions on Russian crude kick in on Dec. 5.Russian Urals crude traded at around $70 a barrel on Thursday afternoon.

Russian oil output could fall by 500,000 to 1 million barrels per day (bpd) early in 2023 due to the EU ban on seaborne imports from Monday, two sources at major Russian producers said.

OPEC+ is widely expected to stick to its latest target of reducing oil production by 2 million barrels per day (bpd) when it meets on Sunday, but some analysts believe that crude prices could fall if the group does not make further cuts.

Twitter Inc on Friday suspended the account of the artist formerly known as Kanye West again, just two months since being reinstated, after Elon Musk said the rapper violated the platform's rules prohibiting incitement to violence.

The billionaire owner of Twitter, who calls himself a free speech absolutist, had welcomed the return of the rapper, now known as Ye, to the platform in October."I tried my best. Despite that, he again violated our rule against incitement to violence. Account will be suspended," Musk tweeted in reply to a Twitter user who said "Elon Fix Kanye Please."

Ye, who had more than 30 million followers on Twitter before his suspension, did not respond to requests for comment.

Ye's account showed a notice that it was suspended, after one of his posts had earlier appeared to show a swastika symbol inside a Star of David.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CBRL | $100.09 | -13.47 | -11.86 |

Cracker Barrel Old Country Store Inc. (CBRL) on Friday reported fiscal first-quarter net income of $17.1 million.

On a per-share basis, the Lebanon, Tennessee-based company said it had profit of 77 cents. Earnings, adjusted for non-recurring costs, came to 99 cents per share.

On a per-share basis, the Lebanon, Tennessee-based company said it had profit of 77 cents. Earnings, adjusted for non-recurring costs, came to 99 cents per share.

The results fell short of Wall Street expectations. The average estimate of four analysts surveyed by Zacks Investment Research was for earnings of $1.27 per share.

The restaurant operator posted revenue of $839.5 million in the period, surpassing Street forecasts. Three analysts surveyed by Zacks expected $837.8 million.Cracker Barrel shares have declined 12% since the beginning of the year.

Conspiracy theorist Alex Jones filed for bankruptcy on Friday, less than two months after a jury ordered him and the parent company of his Infowars website to pay nearly $1 billion for spreading lies about the 2012 Sandy Hook mass shooting.

Jones filed for Chapter 11 protection from creditors with the U.S. bankruptcy court in Houston, a court filing showed.

The filing said Jones has between $1 million and $10 million of assets and between $1 billion and $10 billion of liabilities. The extent of Jones' personal wealth is unclear.

A lawyer for Jones did not immediately return a request for comment.

Jones claimed for years that the 2012 killing of 20 students and six staff members at Sandy Hook Elementary School in Newtown, Connecticut, was staged with actors as part of a government plot to seize Americans’ guns. He has since acknowledged the shooting occurred.

In October, a Connecticut jury ordered Jones and Free Speech Systems, the parent company of Infowars, to pay nearly $1 billion in damages to numerous families of victims of the Sandy Hook shooting.

The trial was marked by weeks of anguished testimony from the families, who recounted how Jones’s lies about Sandy Hook compounded their grief.

Free Speech Systems filed for bankruptcy in July.

U.S. stocks fell across the board as the yield on the 10-year Treasury spiked above 3.5% following the stronger-than-expected November jobs report which included a hefty jump in wages creating a new wrinkle for the Federal Reserve in their inflation fight. In commodities, oil ticked up to the $81 per barrel level.

The Department of Justice may probe the collapse of crypto trading firm FTX and whether its founder Sam Bankman-Fried and other executives on how the company and its funds were mismanaged, according to Coindesk.

November was a strong month for U.S. job growth and wages saw a big move.

U.S. equity futures were trading lower ahead of the most anticipated economic report of the month. the November jobs report.

The major futures indexes suggest a decline of 0.1% when the opening bell rings for the final time this week.

Oil benchmarks were on track for their first weekly gains after three consecutive weeks of decline.

U.S. West Texas Intermediate crude futures traded around $80.00 per barrel.

Brent crude futures traded around $86.00 per barrel.

This week’s key economic report, November’s employment data out at 0830 ET Friday morning, will give investors further insight into the impact that higher borrowing costs are having on growth.

Economists surveyed by Refinitiv say the U.S. economy likely added 200,000 new nonfarm jobs.

That’s down from a stronger-than-expected tally of 261,000 in October and would mark the weakest job growth since December 2020.

"The outlook has been fading for the job market after the strength seen earlier this year. That’s expected to be reflected in the November employment data," said Bankrate.com senior economic analyst Mark Hamrick. "After matching the pre-pandemic low of 3.5% in July and September, the jobless rate edged up to 3.7% in October. Further increases in the unemployment rate are likely in the unemployment rate in the months ahead, even if unchanged in the forthcoming November snapshot."

The unemployment rate is anticipated to hold steady at 3.7%.

In Asia, Tokyo's Nikkei 225 index lost 1.6%, the Hang Seng in Hong Kong edged down 0.3% and China's Shanghai Composite index gave up 0.3%.

The declines followed a 0.1% retreat in the benchmark S&P 500, which closed at 4,076.57 on Thursday. The Dow Jones Industrial Average fell 0.6% to 34,395.01, while the Nasdaq edged 0.1% higher to 11,482.45.

A growing number of businesses are laying off workers en masse as they brace for a potential recession triggered by high inflation and rising interest rates.

Despite still-solid job growth and record-high wages in many industries, dozens of businesses are battening down the hatches as they warn of an increasingly grim economic outlook.

Amazon, Apple, Meta, Lyft and Twitter are among the companies either implementing hiring freezes or letting workers go as the Federal Reserve moves to raise interest rates at the fastest pace in decades in order to combat inflation.

Economists widely expect the Fed to trigger a recession with higher interest rates, which could force consumers and ultimately businesses to pull back on spending.

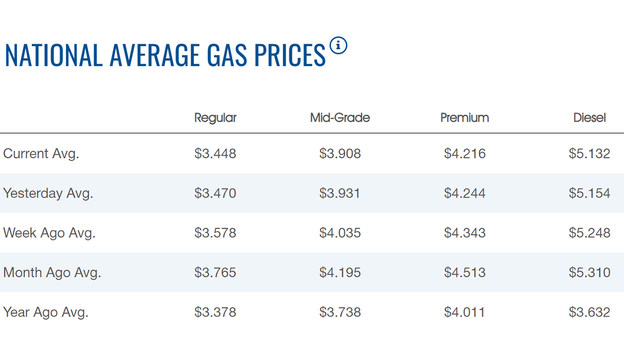

The nationwide price for a gallon of gasoline slipped Friday to $3.448, according to AAA.

The average price of a gallon of gasoline on Thursday was $3.470.

One week ago, a gallon of gasoline cost $3.578. A month ago, that same gallon of gasoline cost $3.765.

Gas hit an all-time high of $5.016 on June 14.

Diesel declined to $5.132.

Oil futures were trimming gains on the day ahead of the release of the monthly jobs report in the U.S. and a weekend meeting of OPEC+.

U.S. West Texas Intermediate crude futures traded around $80.00 per barrel.

Brent crude futures traded around $86.00 per barrel.

Both benchmarks were on track for their first weekly gains after three consecutive weeks of decline.

European Union governments tentatively agreed on a $60 a barrel price cap on Russian seaborne oil with an adjustment mechanism to keep the cap at 5% below the market price, according to diplomats and a document seen by Reuters.

Bitcoin was trading around $16,000, after falling 1% on Thursday, snapping a two-day winning streak.

For the week, Bitcoin was trading 2% higher.

The cryptocurrency has lost more than 63% year-to-date.

Ethereum was trading around $1,200, after gaining 6% in the past week.

Dogecoin was trading at 9 cents, after gaining more than 24% in the past week.

Live Coverage begins here