Stock Market News: Nasdaq’s best January in 22 years, PayPal layoffs, Exxon-White House spat

Investors digest a slew of earnings from major bellwethers including McDonald’s, Exxon Mobil and GM as well as the Case-Shiller home price index which slowed for the seventh straight month. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| WD | $95.38 | 3.62 | 3.95 |

Western Digital Corp. (WDC) on Tuesday reported a loss of $446 million in its fiscal second quarter.

The San Jose, California-based company said it had a loss of $1.40 per share. Losses, adjusted for pretax expenses and stock option expense, were 42 cents per share.

The results missed Wall Street expectations. The average estimate of five analysts surveyed by Zacks Investment Research was for a loss of 8 cents per share.

The maker of hard drives for businesses and personal computers posted revenue of $3.11 billion in the period, which beat Street forecasts. Four analysts surveyed by Zacks expected $3.01 billion.

For the current quarter ending in March, Western Digital expects its results to range from a loss of $1.70 per share to a loss of $1.40 per share. Analysts surveyed by Zacks had forecast adjusted earnings per share of $2.

The company said it expects revenue in the range of $2.6 billion to $2.8 billion for the fiscal third quarter. Analysts surveyed by Zacks had expected revenue of $4.76 billion.

Payment app PayPal became the latest tech company to announce job cuts which continue to climb.

U.S. stocks wrapped the month of January on a high note with gains for all three of the major averages of 1%+ on Tuesday.

For the month, the Nasdaq Composite jumped 10%, the S&P 500 over 6% and the Dow Jones Industrial Average 3%. In commodities, oil fell 1.7% to $78.87 per barrel.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GM | $39.02 | 2.73 | 7.52 |

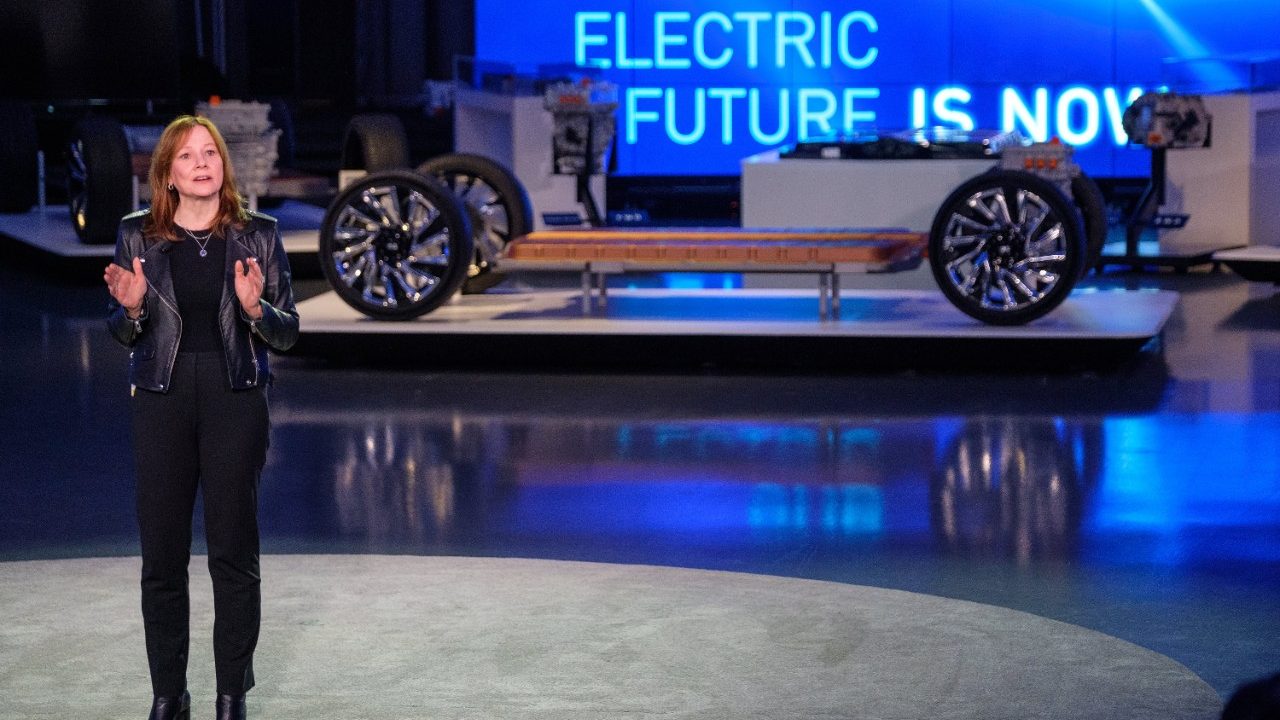

General Motors Chief Executive Mary Barra is betting that moving more slowly than Tesla or Ford to accelerate electric vehicle production for North America will be more profitable in the long run.

Suppliers familiar with GM's production plans through 2025 support the notion the automaker continues to slow-walk electric vehicle investment and output while it continues to bank money from its big combustion-engine pickups and SUVs.

GM plans to build just 170,000 EVs at its plants in the U.S., Canada and Mexico in 2023, and 285,000 in 2024, according to data gathered by AutoForecast Solutions, which expects the automaker's EV production to remain under 500,000 in 2025 - about half of its actual capacity of 1 million.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| LUV | $35.75 | 0.28 | 0.79 |

Winter weather brought ice to a wide swath of the United States on Tuesday, causing the cancellation of more than 1,600 flights nationwide, bringing traffic to a standstill on an interstate through Arkansas and knocking out power to thousands of Texans.

As the ice storm advanced eastward on Tuesday, watches and warnings stretched from the western heel of Texas all the way to West Virginia. Several rounds of mixed precipitation — including freezing rain and sleet — were in store for many areas through Wednesday, meaning some regions could be hit multiple times, the federal Weather Prediction Center warned.

More than 700 flights to or from Dallas-Fort Worth International Airport and more than 250 to or from Dallas Love Field were canceled or delayed Tuesday, according to the tracking service FlightAware.

At Dallas-Fort Worth, a major U.S. airport hub, more than 40% of the flights had been canceled.

Dallas-based Southwest Airlines has canceled more than 500 flights and delayed more than 250 more, FlightAware reported.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BBBY | $2.63 | -0.24 | -8.32 |

Bed Bath & Beyond Inc BBBY.O is preparing to seek bankruptcy protection as soon as this week, and has lined up liquidators to close additional stores unless a last-minute buyer emerges, four people familiar with the matter said on Monday.

Bed Bath & Beyond is negotiating a loan to help it navigate bankruptcy proceedings, with investment firm Sixth Street in talks to provide some funding, two of the people said. The firm loaned Bed Bath & Beyond $375 million last year.

Last week, the retailer said last week it defaulted on a loan, bringing it closer to bankruptcy. Sources have also told Reuters that Bed Bath & Beyond is considering skipping debt payments due on Feb. 1, a typical move that distressed companies take to conserve cash.

The chain has said it is closing 87 Bed Bath & Beyond stores and five buybuy BABY stores, in addition to 150 closures announced last year. It is also shutting its health and beauty discount chain Harmon.

The company reported a loss of about $393 million after sales plunged 33% for the quarter ending Nov. 26.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| NTAP | $65.39 | -0.13 | -0.19 |

| WDAY | $178.01 | 1.53 | 0.87 |

NetApp Inc said on Tuesday it would cut roughly 960 jobs, or about 8% of its global workforce, as the cloud data management firm grapples with tough economic conditions that have crimped customer spending.

The company expects to implement the job cuts largely through the end of fiscal 2023 and incur related charges of about $85 million to $95 million in the third quarter.

U.S. companies have been downsizing and slashing costs to better cope with the global economic downturn after global central banks unleashed rapid interest rate hikes to tackle inflation.

"Companies are facing an increasingly challenging macroeconomic environment, which is driving more conservatism in IT spending. We are not immune to these challenges," NetApp Chief Executive George Kurian said in a letter to employees.

The company had about 12,000 employees as of April 29, 2022.

Earlier in the day, software maker Workday Inc also announced plans to cut 3% of its more than 15,000 staff.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GM | $39.09 | 2.81 | 7.73 |

| LAC | $25.01 | 3.02 | 13.73 |

General Motors Co will invest $650 million in Lithium Americas Corp and help it develop Nevada's Thacker Pass lithium mining project, which holds enough of the battery metal to build 1 million electric vehicles annually.

The deal, announced Tuesday, is the latest by an automaker to lock up supply of the key metal amid the rush to go green and gives Lithium Americas a major partner as it tries to develop North America's largest lithium mine, which is mired in a long-running court case.

Lithium Americas aims to extract lithium at Thacker Pass from a large clay deposit, something that has never been done before at commercial scale. The investment marks the second in as many years by the auto giant into novel lithium process. GM signed a supply deal in 2021 with Controlled Thermal Resources Ltd, which is trying to filter lithium from geothermal brines in California.

GM would supplant China's Ganfeng Lithium to become Lithium Americas' largest shareholder. GM has also agreed to buy all the lithium from Thacker Pass when it opens in 2026 - roughly 40,000 tonnes per year.

Under the agreement, GM will buy $650 million of shares in Lithium Americas in two equal parts, with the first tranche coming only if Lithium Americas prevails in an ongoing court case. A U.S. judge earlier this month said she would rule "in the next couple of months" in the case, which centers on whether former U.S. President Donald Trump erred when he approved the mine just before leaving office in 2021.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| PHM | $56.62 | 4.63 | 8.91 |

U.S. homebuilder PulteGroup Inc on Tuesday beat Wall Street estimates for quarterly profit on the back of higher house prices in a tightening market.

Higher prices have helped U.S. homebuilders offset the impact from rising prices of commodities, labor shortages and ongoing supply chain disruptions over the past year.

Pulte's sales rose nearly 19% to $5.17 billion for its fourth quarter ended December 31, 2022.

The homebuilder's quarterly net income rose to $882 million, or $3.85 per share from $663 million, or $2.61 per share, a year earlier.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SPOT | $112.74 | 12.74 | 12.74 |

Spotify Technology SA told investors Tuesday it would tighten spending and work to become efficient after a year of investments in technology and content.

Spotify invested heavily in building up its podcast and audiobooks business in 2022, with operating expenses growing at twice the speed of its revenue. That set the stage for Spotify to lay off 600 employees this month and trim other costs.

The number of monthly active users rose to 489 million in the fourth quarter, beating Spotify's guidance and analysts' forecasts of 477.9 million, helped by marketing campaigns and growth in India and Indonesia.

Premium subscribers, who account for most of the company's revenue, increased 14% to 205 million, topping estimates of 202.3 million, according to IBES data from Refinitiv.

Apart from the forecast of half a billion users, Spotify also expects premium subscribers to reach 207 million in the current quarter and revenue of 3.1 billion euros ($3.35 billion). Analysts were expecting 202 million subscribers and revenue of 3.05 billion euros.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ATCX | $12.04 | 6.57 | 120.11 |

Atlas Technical Consultants Inc said on Tuesday the infrastructure and environmental solutions provider will be acquired by private investment firm GI Partners in an all-cash deal valued at nearly $1.05 billion, including debt.

Shareholders of Atlas are set to receive $12.25 per share in cash, which is more than double the stock's last closing price on Monday.

Atlas will become a private company after the deal, which is expected to close in the second quarter, according to a statement.

Austin, Texas-based Atlas joins a clutch of companies increasingly flocking to private equity firms as a bearish outlook in the high-growth tech sector and turbulent markets have dragged valuations and soured sentiment in public equity markets.

In September, Billtrust owner BTRS Holdings Inc said it will be acquired by EQT Private Equity in an all-cash transaction, valuing its equity at nearly $1.7 billion.

U.S. single-family home price growth cooled further in November, surveys showed on Tuesday, which together with declining mortgage rates could help to slow the housing market's slide deeper into recession.

The S&P CoreLogic Case Shiller national home price index, covering all nine U.S. census divisions, increased 9.2% year-on-year in November, pulling back from October's increase of 10.7%.

A surge in remote work during the COVID-19 pandemic led to a housing market boom, driving prices to record highs.

The Federal Reserve's fastest interest rate-hiking cycle since the 1980s has driven housing into recession.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| MCD | $266.11 | -4.78 | -1.76 |

McDonald's Corp on Tuesday beat Wall Street estimates for quarterly profit on higher menu prices, even as it warned short-term inflationary pressures would persist in 2023.

Investors are watching bellwethers like McDonald's for any sign consumers are cutting spending to help determine whether the Federal Reserve's monetary tightening will help cool the U.S. economy without causing a recession.

The Big Mac maker also expects its accelerated plan to build more new restaurants will boost business, contributing nearly 1.5% to its 2023 systemwide sales growth in constant currencies.

Like other fast-food chains, Chicago-based McDonald's raised prices of its burgers and fries last year to keep up with surging commodity and labor costs and it forecast margin growth this year.

Chief Executive officer Chris Kempczinski told investors those short-term inflationary pressures will persist in 2023.

Even so, traffic rose 5% for full-year 2022, McDonald's disclosed on Tuesday, as its meals remained less expensive than many competitors, drawing low-income consumers.

The dollar gave up gains made earlier on Tuesday after data showed U.S. labor costs increased less than expected in the fourth quarter, and before the Federal Reserve is expected to hike rates by 25 basis points on Wednesday.

The Employment Cost Index, the broadest measure of labor costs, rose 1.0% last quarter after increasing 1.2% in the July-September period, the Labor Department said on Tuesday.

Still, it is not seen as likely to sway the U.S. central bank from hiking rates further.

Fed funds futures traders are pricing for the Fed’s benchmark rate to peak at 4.93% in June, up from 4.33% now.

But investors are also bearish on the U.S. economy and see the Fed as having to cut rates back to 4.48% by December. This is despite Fed officials stressing they will need to keep rates in restrictive territory for a period of time in order to bring down inflation.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| UPS | $182.91 | 5.94 | 3.36 |

United Parcel Service Inc on Tuesday beat expectations for quarterly adjusted profit, as it prioritized lucrative shipments and kept a tight lid on costs as global recession threatens and inflation deflates e-commerce demand.

UPS also raised its quarterly dividend by 6.6% and announced a new $5 billion share repurchase plan.

Executives at the Atlanta-based company said they are paring costs to match a decelerating transportation market that has translated into softer demand for UPS air shipments and home deliveries, while also investing in future growth.

UPS Chief Executive Officer Carol Tomé described the outlook for economic growth in 2023 as "cloudy."

UPS Chief Financial Officer Brian Newman elaborated on the economic risks, citing decades-high inflation, rising interest rates, recession risks, war in Eastern Europe and COVID-related disruptions in China.

UPS forecast 2023 revenue between $97.0 billion and $99.4 billion, below analysts' average target of $99.98 billion, according to Refinitiv data.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TSLA | $168.07 | 1.41 | 0.84 |

Tesla Inc disclosed on Tuesday it had received requests from the U.S. Justice Department for documents related to its Full Self-Driving and Autopilot driver-assistance systems as regulatory scrutiny intensifies.

Reuters reported in October Tesla is under criminal investigation over claims that the company's electric vehicles could drive themselves.

The U.S. Justice Department launched the previously undisclosed probe in 2021 following more than a dozen crashes, some of them fatal, involving Tesla’s driver assistance system Autopilot, the people said.

Chief Executive Officer Elon Musk has championed the systems as innovations that will both improve road safety and position the company as a technology leader.

Regulators are examining if Autopilot's design and claims about its capabilities provide users a false sense of security, leading to complacency behind the wheel with possibly fatal results.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| PFE | $43.36 | -0.19 | -0.44 |

Pfizer Inc on Tuesday forecast a bigger-than-expected drop in sales of its COVID-19 vaccine and treatment in 2023, intensifying investor concerns over demand for the products as governments cut orders and work through inventories.

Chief Executive Albert Bourla said that 2023 should be a "transition year" for Pfizer's COVID products, before potentially returning to growth in 2024.

Pfizer's total annual sales crossed the $100 billion mark for the first time in 2022, driven by the more than $56 billion in sales of the COVID-19 vaccine and Paxlovid antiviral. In 2023, it expects revenue to be $67 billion to $71 billion.

Pfizer has turned to acquisitions such as its $5.4 billion buyout of Global Blood Therapeutics Inc and its $11.6 billion purchase of migraine drugmaker Biohaven to bolster its pipeline of future products. It launched five new products last year and hopes to introduce as many as 14 more over the next year and a half, including a vaccine for respiratory syncytial virus (RSV) as well as an mRNA vaccine for influenza.

Excluding the COVID-19 drugs, Pfizer expects 2023 revenue to grow 7% to 9%.

Pfizer developed its COVID-19 vaccine with German partner BioNTech, and the companies split the profits. The U.S. drugmaker forecast 2023 sales of $13.5 billion from the shot, below Refinitiv estimates of $14.39 billion, and projected $8 billion in sales of Paxlovid, short of analysts' expectation of $10.33 billion.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| XOM | $112.69 | -0.87 | -0.77 |

Exxon Mobil Corp posted a $56 billion profit for 2022, the company said on Tuesday, taking home about $6.3 million per hour last year, and setting not only a company record but a historic high for the Western oil industry.

Oil majors are expected to break their own annual records on high prices and soaring demand, pushing their combined take to near $200 billion. The scale has renewed criticism of the oil industry and sparked calls for more countries to levy windfall profit taxes on the companies.

Exxon's results far exceeded the then-record $45.2 billion net profit it reported in 2008, when oil hit $142 per barrel, 30% above last year's average price. Deep cost cuts during the pandemic helped supercharge last year's earnings.

Excluding charges, profit for the full year was $59.1 billion.

Production was up by about 100,000 barrels of oil and gas per day over a year ago to 3.8 million bpd.

Adjusted per share profit of $3.40 beat consensus of $3.29 per share, according to Refinitiv data.

General Motors pulled in a solid quarter, despite inflation and what may be a deepening recession.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TOL | $58.20 | 1.71 | 3.03 |

| MTG | $13.93 | 0.03 | 0.22 |

| DHI | $95.92 | 1.09 | 1.15 |

| LEN | $101.06 | 1.84 | 1.85 |

Case-Shiller Home Prices slipped 0.8% in November vs. October. Still, prices rose 8.6% annually in November, the lowest since September 2020.

Annually, home prices rose 6.8% down from 8.6% in October as measured by the 20-city index, matching the Refinitiv estimate. That’s down 7 months in a row from a record 21.3% annual gain in April.

,

Advanced Micro Devices will report their fiscal fourth quarter and full year 2022 financial results at 5 p.m. ET.The tech company's earnings report comes ahead of Alphabet, Amazon and Apple reporting on Thursday.The company's third quarter earnings showed 5.6 billion in revenue to notch a 29% increase from the year prior. In 2023, the stock has rallied to recover some of the losses made in 2022, rising approximately 12% after losing roughly 40% the last year. Over the last five days, shares are about 3% beneath the redline.

Live Coverage begins here