Average US credit score hits all time high. See how your state compares

Washington, D.C., and Arizona saw the highest spike, with the average score growing by 10 points

The average FICO Score in the U.S. climbed 1%, or 7 points, reaching a record of 710 in 2020 despite the coronavirus-fueled economic downturn, according to Experian.

The increase in 2020 is "unusually high" compared to the average growth seen over the past decade, according to the credit reporting company. Although the average FICO Score grew by 21 points over the past decade, one-third of that growth occurred in 2020 alone, according to Experian data.

CLICK HERE TO READ MORE ON FOX BUSINESS

Experts say that this growth is likely a result of "changes in credit utilization, credit card debt and delinquency rates – all of which have seen improvement since the onset of the pandemic."

In 2020, nearly 70% of Americans had a credit score of at least 670, which is an improvement of three percentage points compared to 2019.

Washington, D.C., however, saw the highest spike with the average score growing by 10 points, according to the data.

AVERAGE FICO CREDIT SCORES HIT RECORD HIGHS — 5 THINGS YOU SHOULD DO

Likewise, the average score grew by 10 points in Arizona. Following closely behind was Delaware, North Carolina and Idaho, where the average score grew by nine points.

Comparatively, North Dakota consumers saw the smallest increase, with the average score growing just three points. South Dakota, Hawaii, Nebraska and Vermont also recorded the lowest FICO Score growth, according to the data.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

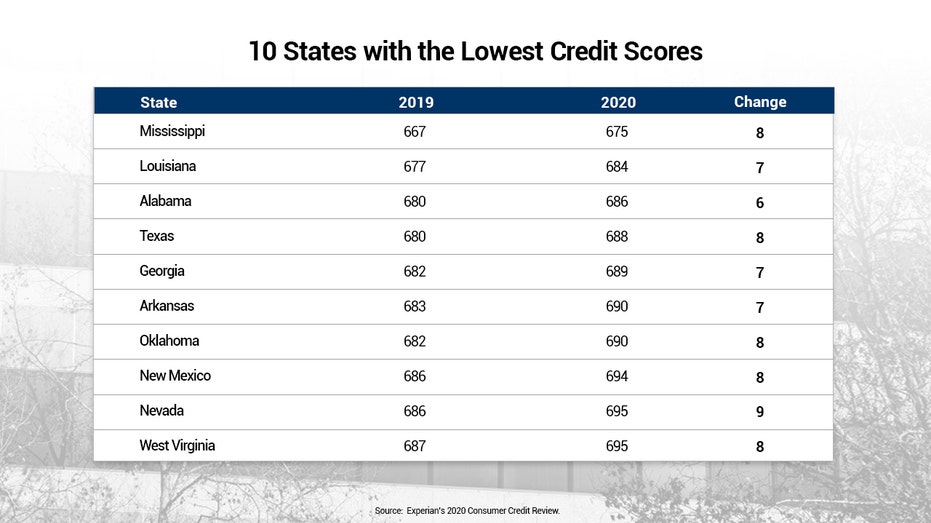

The data revealed that states that had lower average scores in 2019 saw larger increases in 2020 compared to states where consumers already had higher average scores.

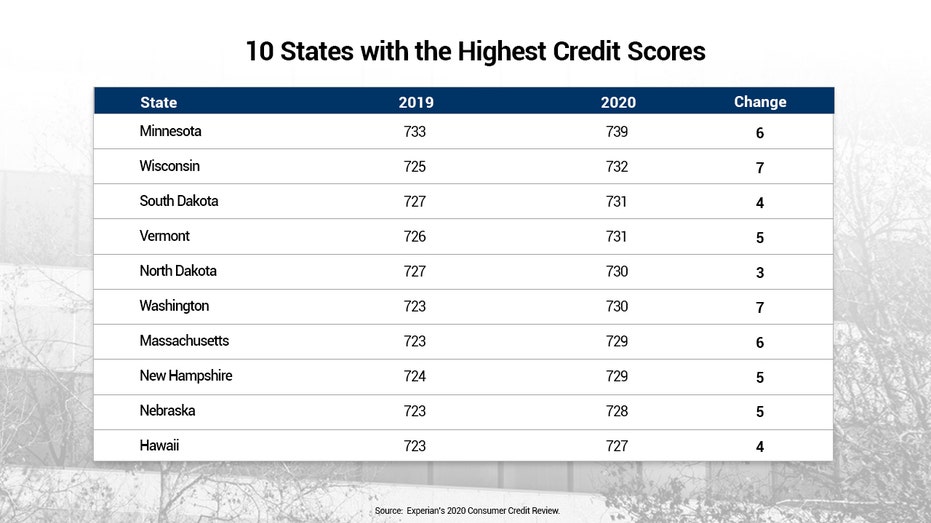

Below are the 10 states that had the highest credit scores and 10 with the lowest credit scores in 2020.

FOX Business

FOX Business