What If There Was No IRS?

“The third agency of government I would – I would do away with [is] Education, Commerce and, let’s see. I can’t. The third one, I can’t. Sorry. Oops.”

I bet Texas Governor Rick Perry would give anything to forget that embarrassing memory malfunction during last year’s Republican primary debate. For the record, the agency he couldn’t remember was, um, give me a second. Well, now this is embarrassing. Wait, I got it, Energy.

What’s funny is that Perry was actually talking about his flat tax plan and somehow got sidetracked. In any case, he was definitely onto something.

I’d bet serious money that everybody reading this would love to do away with the dreaded IRS. It’s so simple, really. Just implement a flat tax system, do away with the whole 70,000-page tax code and, voila, no more IRS. Life is good.

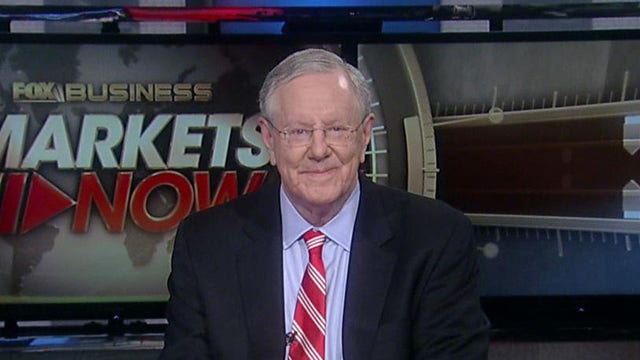

Russia’s had great success with its 13% flat tax rate. Tax revenues are up and so is the economy. And Perry is far from alone in proposing a flat tax in America. Steve Forbes, Jerry Brown (that’s right, a Democrat), and Mr. Flat Tax himself, the late great Jack Kemp, all advocated for a flat tax system.

Now that the IRS has been caught more or less red-handed targeting Tea Party members and other conservative opponents of President Obama prior to the 2012 presidential election, I can’t think of a better time to do away with the one government agency that’s so hopelessly broken every American knows it can’t be fixed.

Don’t even get me started on the agency’s new charter to manage the implementation and enforcement of ObamaCare. The federal government having access to our medical data is scary enough; the idea that the IRS is in charge of that is downright terrifying.

Now, I’ve advocated for a flat tax system ever since I got to know Kemp back in the 90s. He wasn’t much of a politician but let me tell you, he was a tireless advocate for small business America. And what’s good for small business America is good for all Americans. Here are some of the benefits from a flat tax system and IRS overhaul.

Everybody will pay income tax. Today, nearly half of Americans pay no income tax. That means they have no skin in the game. Under a flat tax, if you make very little you pay very little; if you make a lot you pay a lot. The concept that those who make more should pay a higher tax rate is fatally flawed. It actually penalizes people for being successful.

It will simplify everyone’s life. No more 70,000-page tax code. No more Alternative Minimum Tax (AMT) or any other idiotic schemes, for that matter. No more tax year-end mad scramble. No more having to keep all sorts of crazy records. Simple.

There’s bipartisan support. While it’s true that flat tax supporters have mostly been Republicans, during the 2012 election campaign, everyone, even President Obama if I’m not mistaken, said they thought the tax code needed to be overhauled. This is something we can all get behind, for once.

We’d all save money on day one. Whether you’re an individual, a small business, or a big corporation, whatever you spend to do your taxes, you’ll save it right off the bat. I just have a three-person company and it costs thousands to do our taxes every year. Reclaiming that would go straight to the bottom line.

No more corporate loopholes, and less lobbying. Corporations lobby Washington to impact three things: regulations, laws, and tax rules. A flat tax with no deductions will eliminate the latter.

It will cut up to $12 billion a year off the federal budget. In all seriousness, I don’t think we can or need to actually unravel the entire agency, but if we go the flat tax route, we should be able to cut at least $8 or 9 billion out of the federal budget.

It will increase our tax revenues. If you buy into the Laffer Curve as so many economists do, then you believe there’s an optimum tax rate for maximizing tax income. That’s what happened in Russia and, if we do it right, it will happen here. It will also help us balance the budget and reduce our ballooning debt. It’s all good.

It will boost our sluggish economy. This is the argument for doing it now. We need it now to boost our sluggish economy but we’ll need it going forward to improve our competitiveness in global markets. And favorable corporate tax rates will incentivize companies to repatriate capital.

We’d all sleep better at night. The only people that won’t sleep better at night are the IRS employees and independent tax accountants that will be affected. Indeed, they will have to be retrained and redeployed but that should only be temporary. With all that extra money floating around, we’ll need even more bean counters than ever.

Look, this is a simple equation: If we implement a flat tax system and get rid of most of the IRS we bring in more tax revenue, boost the economy, reduce the federal deficit and debt, and benefit every individual and business, big and small. That’s all there is to it.