User's Guide To Education

When everybody agrees on something, it’s usually worth questioning conventional wisdom. And, so it is with the value of a college education. Over the years, parents have been told that a mere college degree will guarantee little Johnny a secure future and even a million-dollar pay premium over high school grads. But these days Johnny is lucky if his sheepskin buys him a job.

All this week we will help you fight back against the high cost of education with our series, User’s Guide to Education. Check this space for updates and log onto Twitter @GerriWillisFBN and Facebook for more information or to voice your concerns and questions.

Turns out, the financial benefits of a college degree are way overstated. The million dollar advantage for students earning undergrad degrees, if it ever existed at all, is largely being discounted today. Some experts say a more accurate value is $300,000 and others say $500,000. Regardless, the numbers are an average and there is no guarantee your child will earn the same. And, it’s cold comfort for parents who watched an enterprising 17-year-old Brit sells his news reading app to Yahoo for $30 million last year. Clearly, you don’t have to have a degree to earn money.

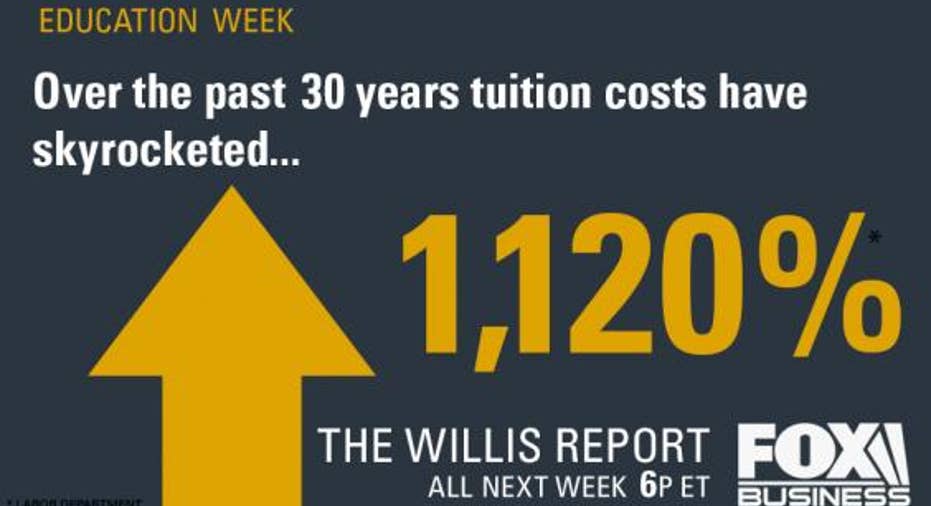

Even so parents and their kids cling to the advantages of the four-year undergrad career despite the fact that prices are only going up. Annual tuition inflation continues to perk along at 3 to 4 percent above the broader economy’s price hikes. CourseSmart estimates that over the past 30 years tuition costs have risen 1,120 percent while healthcare has gone up just 600 percent and housing has risen 375 percent. An education is four times as expensive as it was 30 years ago. Today, a single year at a public institution can run you $22,261 if you count everything from room and board to beer. If you don’t qualify for scholarships, it’s easy for a four-year tab to run into six figures. If gas prices rose this quickly, there’d be a move in Congress to tap the strategic petroleum reserve. Remember when students would take jobs and pay for school as they learned? You can’t do that now.

It’s no surprise then that total student debt tops $1 trillion dollars, and that the average grad enters the workforce (if he’s lucky), with $25,000 in debt. College debt is taking a toll on mom and dad too. People over 60 hold $36 billion in college debt. College debt is dogging generations of Americans, with no end in sight.

And, yet mom and dad – even ones who work in finance – can’t even imagine applying a basic financial test to one of their most expensive purchases – return on investment. And, it’s a good thing nobody seems to be holding college administrators to a higher standard because the results aren’t impressive. Richard Arum is a professor at New York University who wrote the book “Academically Adrift,” which documents the erosion of academic standards and performance. He says today’s fulltime college students on average report spending just 27 hours per week on academic activities – less time than a typical high school students spends at school. Average time studying fell from 25 hours per week in 1961 to 20 hours per week in 1981 and 13 hours per week in 2003. Only one in five fulltime college students report devoting more than 20 hours per week to studying.

And instruction? Forget about it. Despite the wave of federal funding, recent government reports show that the percentage of full-time instructional faculty in degree granting institutions declined from 78 percent in 1970 to 52 percent in 2005. On average, faculty spend just 11 hours per week on advising and teaching college students. Only 40 percent of college students are taught by tenured or tenure-track instructors.

So where are the billions of dollars in rising tuition fees ultimately backed by taxpayer dollars going? Education experts say finer gyms, sushi bars and climbing walls suck up an ever increasing amount of higher ed dollars. Richard Vedder, who directs the Center for College Affordability and Productivity and teaches economics at Ohio University, describes the situation as an “academic arms race” with schools spending more and more on infrastructure to attract more students who much spend more money to afford the nicer digs. Says, Vedder, “Even classroom buildings have to have atriums – if not, it’s downscale. “

Another pricey accoutrement are luxury dorms – suites, private bathrooms or baths for no more than four people.” He describes one Ivy league dorm as having 35-foot ceilings in the dining room with triple-leaded glass windows. The cost of this nirvana? $120 million or $350,000 for each of the 350 beds in the building. “It’s crazy,” says Vedder. There are even schools that do laundry for their students or offer valet service for those who need to get to class ASAP. The Harvard campus that Ryan O’Neal and Ali MacGraw floated through in the movie Love Story couldn’t hold a candle to what’s happening on school campus today. Even the non-Ivies are forced to compete.

And, maybe all of this would be okay if students were learning, Arum, says, though on this most important test our nation’s colleges are struggling. The shocking findings of his investigations are these: A third of students gain no measurable skills during four years of college. None. Instead, students and parents alike see the four-year degree as a credential, a qualification or resume line item that they are willing to pay dearly for in return for career legitimacy. But this emperor has no clothes on and today’s parent’s need to understand the limitations of the college degree. In the coming week, we will help you understand the tricks and tips that will allow you to stretch your education dollars, find the institution that is the best match for your child. Our User’s Guide to Education continues all this week. Check this space and Fox Business Network at 6 pm and 9 pm daily to get our exclusive take on education.