Time to Pay the Bills. Which Comes First?

Dear Dr. Don,

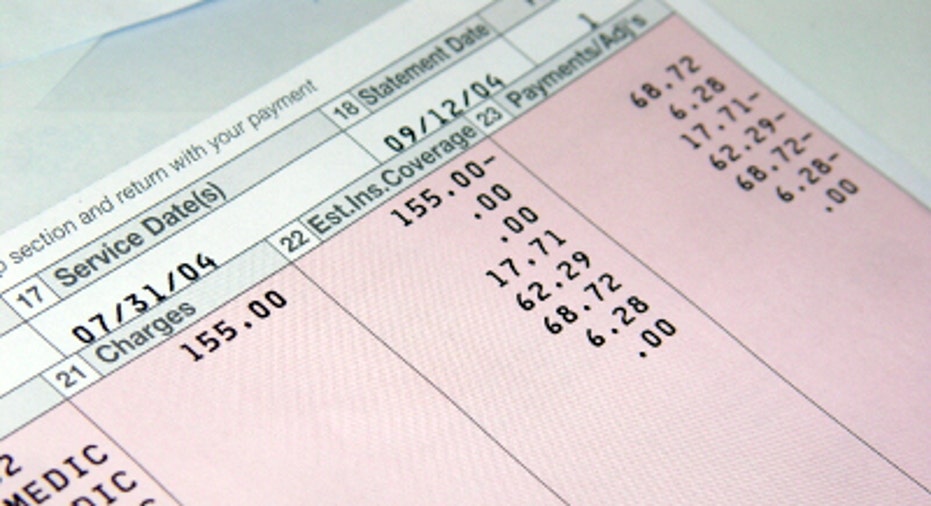

I have about $24,500 in my savings account, and I need help deciding what to do with it. My husband and I owe about $56,000 on our home, and we owe another $49,000 on our vehicles. We also have about $41,000 in credit card debt from the summer, when my husband was laid off. Besides our savings, we have a certificate of deposit valued at $27,930. Given all of that, which debt should I pay first?

Thanks,

-- Lavada Litany

Dear Lavada, I'm going to assume you're paying double-digit interest rates on your credit card debt. If that's the case, I'd argue that you use the $24,500 to pay down your credit cards.

Using the money to pay down the credit card balances should free up funds in your household budget to further reduce these balances. You'll want to get to the point where you're not using current income to pay for past spending.

There are different approaches to reducing these balances. In general, you should pay off the credit cards with the highest interest rates first while making the minimum monthly payments on all your cards. If you have the ability to pay off a card, however, do it. That way, you'll remove the monthly payment from your household expenses, and that will free up more cash to pay down the other cards.

You can hang on to your CD in case of emergencies. It'll charge you an early withdrawal penalty if you need to use it. So you may want to alter this strategy if you know you're going to need an infusion of cash soon.

Get more news, money-saving tips and expert advice by signing up for a free Bankrate newsletter.

Bankrate's content, including the guidance of its advice-and-expert columns and this website, is intended only to assist you with financial decisions. The content is broad in scope and does not consider your personal financial situation. Bankrate recommends that you seek the advice of advisers who are fully aware of your individual circumstances before making any final decisions or implementing any financial strategy. Please remember that your use of this website is governed by Bankrate's Terms of Use.

Copyright 2013, Bankrate Inc.