ObamaCare’s Second Week: A Tale of Two Exchanges

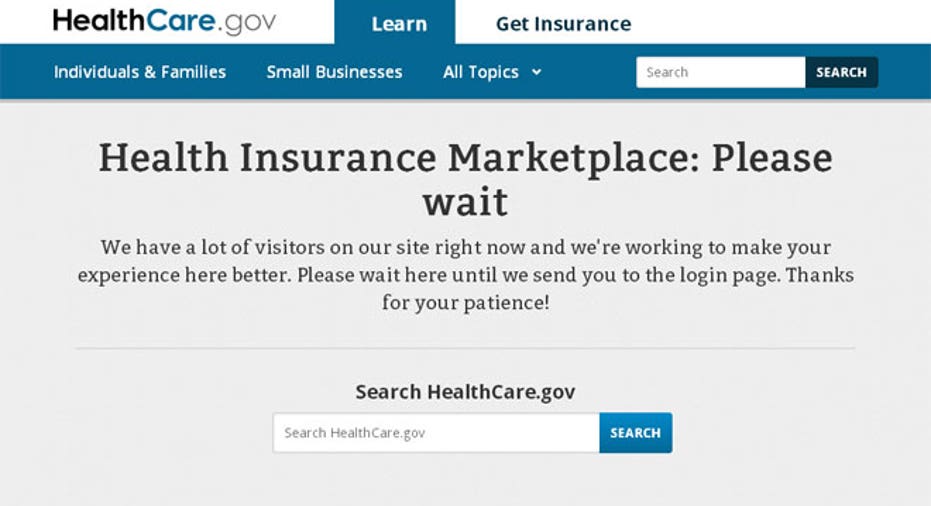

As the Affordable Care Act’s second week of open enrollment season comes to a close, glitches and error messages continue to plague the sign-up website.

The White House says Healthcare.gov’s frequent problems are due to overwhelming interest, yet the administration has not offered hard numbers on how many Americans have signed up for coverage.

Experts say it’s still too early to make an overall evaluation of the health-care law since the exchanges are still in their infancy, but the American would likely give the marketplaces’ launch low marks. The Associated Press-GfK released a poll this week showing only 7% of Americans say the rollout has gone well. The same percentage report that someone in their home has tried to sign up for insurance through either a state or federally-run exchange, and three-quarter of those who tried to sign up experienced issues.

The open enrollment period runs through March 31, 2014, and all individuals in the U.S. must obtain coverage by that date to avoid the individual mandate penalty for not being insured of $95 per person, per year. This number ticks up to 2.5% of annual income per individual by 2016.

The AP reported this week, citing an anonymous source within the administration, that individuals may need to obtain coverage by Feb. 14, 2014, six weeks before open enrollment ends, in order to be deemed covered. The White House declined to directly comment on that point when asked about the deadline by FOXBusiness.com.

Exchange Performance

Exchange grades vary depending on whether the marketplace is state or federallyrun according to Paul Howard, senior fellow and director of the Manhattan Institute’s Center for Medial Progress. Thirty-six states have exchanges that are being federally-operated, with the states running the rest.

“It’s a tale of two exchanges,” Howard says. “The states have cleaned up their glitches and they are running well with a grade of about a ‘B.’ But the federal exchanges will be at a ‘C-‘or ‘D’ until they clean up their act.”

Robert Zirkelbach, spokesman for America’s Health Insurance Planes (AHIP), says the organization is seeing enrollments from both state and federal exchanges, and that the systems appear to be improving every day.

AHIP’s members make up more than 90% of the insurance carriers in the country, the company claims, so Zirkelbach’s evidence is solely anecdotal. “We are starting to see some progress. But we don’t even have data. It does sound like the systems are working better.”

Howard says state exchanges in particular that let consumers shop and compare pricing, like Kentucky’s exchange, had higher enrollment numbers.

“This is probably the right approach,” he says. “People should be able to window shop. I’d expect glitches for at least the next week or so.”

Enrollment Numbers

The Department of Health and Human Services maintains there is a high interest among Americans regarding these exchanges, which is why many had issues signing up for coverage. The department has divulged 8.6 million people visited the Healthcare.gov in its first 72 hours, but declined to say how many people were able to enroll in a plan.

Because there are no hard numbers, Howard says he feels it’s an ‘incomplete’ grade for enrollment this week.

In certain states like California, for example, enrollment started to pick up. Covered California, the state’s exchange, reported this week it had enrolled more than 16,000 households in the first five days of open enrollment.

AHIP is not focusing on enrollment numbers right now, says Zirkelbach, but rather the end date of Jan. 1, 2014, when insurance actually kicks in for policy holders.

“Our health plans across the country are focused on doing what they can to help people understand their choices and get enrolled in coverage,” he says.

Aside from inquiries regarding exchanges, AHIP’s insurers said they have been getting a ton of incoming calls about plans independent of these exchanges, so enrollment overall is of interest to the general public, he says.