Fears About Euro-Zone Holdings Trigger Wild Swings in Jefferies Stock

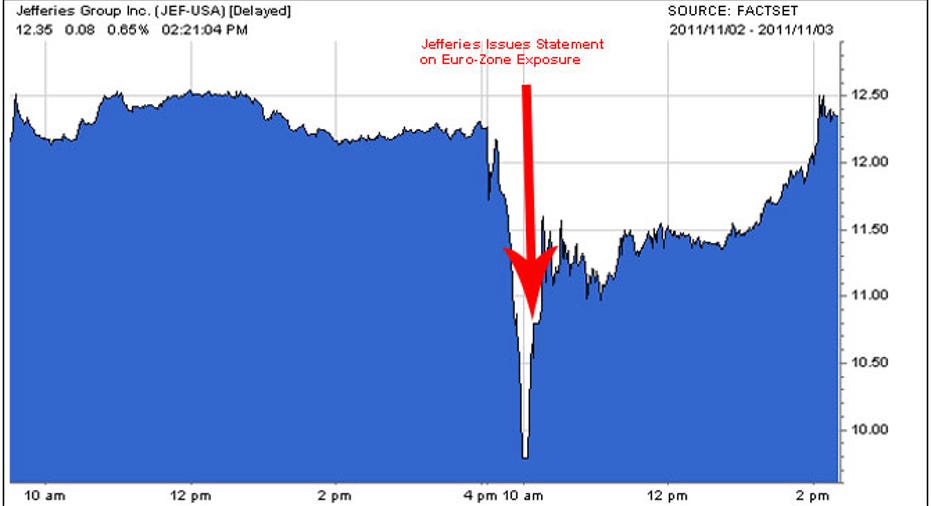

Battling market fears that its exposure to European sovereign debt could place it in a similar boat as now-bankrupt MF Global, shares of investment bank Jefferies (NYSE:JEF) plummeted as much as 20% to two-year lows on Thursday before storming back.

The latest jitters regarding Jefferies appeared to be triggered by a report from Egan-Jones, an independent credit ratings company, that expressed concern about the amount of leverage and sovereign-debt holdings of the New York-based company.

“We are concerned about the values included the $2.7 billion of ‘sovereign debt obligations'...representing 77% of shareholders equity,” Sean Egan, the founding principal at Egan-Jones, wrote in the note. “Although not as highly leveraged as MF Global’s 40:1, we would prefer that [Jefferies] maintain a lower leverage than its 12.9:1.”

Concerns on Wall Street have increased in recent weeks about the amount of exposure U.S. banks have to Europe, which is in the midst of a scary sovereign debt crisis. The markets have expressed fear about the losses company would suffer if the value of bonds of nations like Greece and Italy continue to deteriorate.

Coming just three days after euro-zone debt-laden MF Global filed for the eighth-largest bankruptcy in U.S. history, the Egan-Jones report helped send Jefferies stock plunging as much as 20% to $9.79 -- their lowest level since March 2009. The action in Jefferies stock appeared to drag down the broader markets as well.

However, the stock rallied off its lows after being halted by circuit breakers as the company fought back and another analyst weighed in.

Without specifying the Egan-Jones report, Jefferies said it wanted to clarify its sovereign-debt positions “in response to information published today.”

“To be clear, as of August 31, 2001, Jefferies had no meaningful net exposure to European sovereign debt,” the company said in a statement.

After cutting its losses to just 6% for much of the session, Jefferies received a late-day boost from positive commentary from closely-watched banking analyst Meredith Whitney. In recent action, shares of Jefferies crept into positive territory and were up 0.65% to $12.35.

Jefferies said recent reports and calculations appear to have only been focusing on a long inventory of $2.684 billion, and disregarding short positions of $2.545 billion and offsetting positions in futures instruments. Short positions pay off if the value of those assets decline.

However, Bill Hassiepen, senior analyst at Egan-Jones, told FOXBusiness.com the analysis did consider these short positions. He expressed concern about the quality of these hedges.

“We actually have taken that into account. It’s not clear as to how this is all being managed. Who are the counterparties?” said Hassiepen.

Jefferies spelled out its net exposure (including hedges) to the sovereign debt of troubled euro-zone nations as of Thursday’s opening of business: $104 million to Italy, $28 million to Ireland, $5 million to Portugal, $3 million to Greece and a short position of $178 million to Spain.

Added together, the net short exposure of $38 million equates to just 1% of Jefferies’ shareholders’ equity.

Jefferies also reiterated that while it may take positions in euro-zone debt, they are “short term in nature,” recorded in the trading book of its regulated U.K. broker dealer, marked to market daily and fluctuate depending upon demand and opportunities.

There do appear to be major differences between Jefferies and MF Global, which admitted to having $6.29 billion in net exposure to the sovereign debt of troubled countries like Italy thanks to bullish bets directed by CEO Jon Corzine, the former leader of Goldman Sachs (NYSE:GS).

That revelation caused regulators to demand the company boost its capital levels, credit ratings companies to slash their ratings and MF Global's stock to plunge. Eventually, MF Global suffered a classic run on the bank as customers and counterparties fled.

“They don’t have anywhere near the leverage of MF Global,” said Hassiepen. “Jefferies is a fairly well-run company. I’m hoping they don’t have the full risk profile that an MF Global has. Nothing in their disclosures suggests that.”

Hassiepen also said their hedges appear to be stronger than the ones MF Global claimed to have.

The sudden focus on Jefferies underscores investor skepticism about disclosures from financial-services companies in the wake of the financial crisis.

“The days of Morgan Stanley coming out and saying, ‘This is what we have and take our word for it,’ are over. The market is demanding more and better disclosures,” said Hassiepen.