Faber Says Market Selloff Is 'An Appetizer of Something Larger'

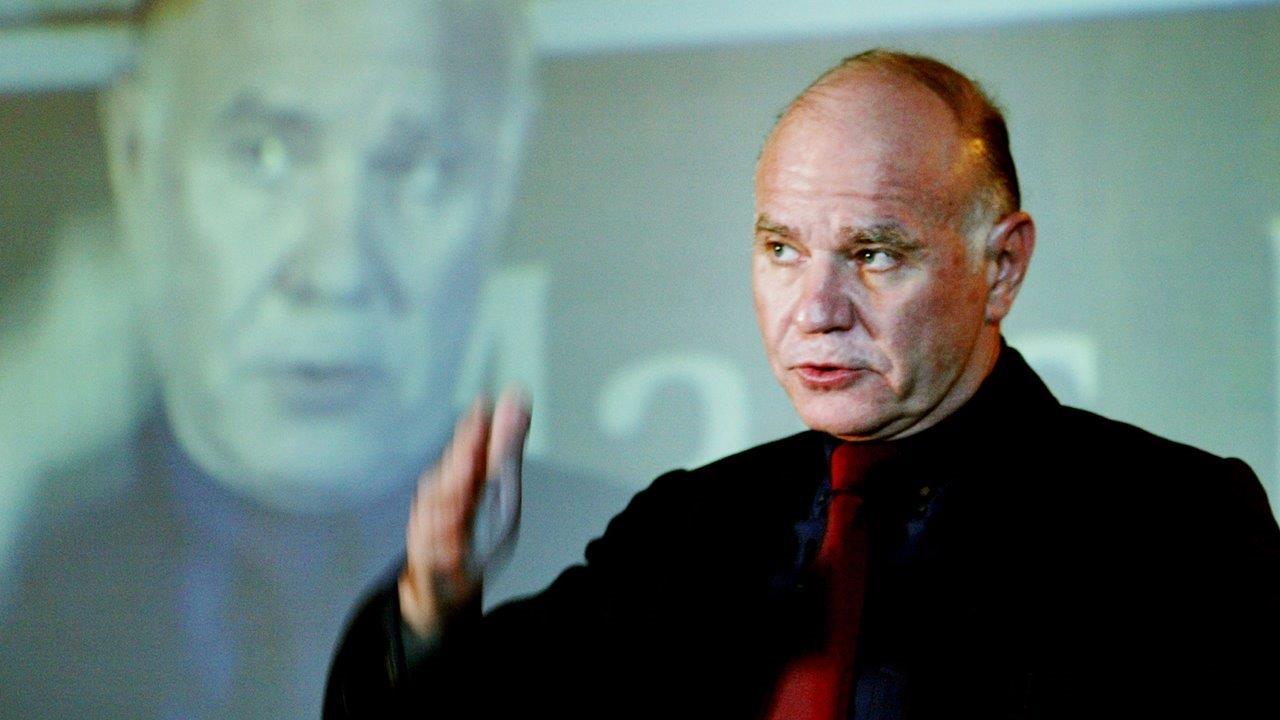

Editor of the Gloom, Boom & Doom Report, Marc Faber, said he believes the current state of the markets could be leading to something bigger.

“It could be worse… what we’re seeing here is just an appetizer of something larger,” he told the FOX Business Network’s Trish Regan.

Faber believes certain plans are at least one of the reasons behind what is happening with the markets.

“My sense is that many policies that were implemented- in particular zero interest rates and more recently negative interest rates- are rather negative for asset markets than positive,” he explained. “They create a lot of uncertainty in investors’ minds and we have statistics on all the countries that have introduced negative interest rates. In all these countries actually the savings rate went up.”

He added: “These policies may be actually counterproductive… they are negative for bank earnings… I’m not blaming only the Fed. I’m blaming the Fed, the Bank of Japan and the ECB under Mr. Draghi. They talk to each other every day, they coordinate monetary policies…”

Faber compared the central banks to the 1975 film ‘One Flew Over the Cuckoo's Nest.’

“The central banks remind me of the movie ‘One Flew Over the Cuckoo's Nest’ where the doctors are the insane, whereas the inmates are actually quite common people with common sense and normal,” he said. “This is exactly what I think is happening today.”

The Gloom, Boom & Doom Report editor explained why he thinks U.S. politics could impact the economy.

“I believe that the global economy is in a recession already. The political background in the U.S. is also going to create a lot of uncertainty. The two leading candidates are outsiders of the political establishment- Bernie Sanders and Donald Trump- and that may create further tensions within the financial service industry.”