Another Bank Bailout on the Way?

Remember the bank bailout?

How could we forget?

No post-economic-debacle program get's under people's skins more than the bank bailout. Through TARP, the federal government loaned financial institutions $700 billion, and $25 billion is never expected to come back. The Federal Reserve floated nearly $3.5 trillion more.

It was, without question, the biggest bank bailout our country has ever seen. And, now it looks like it could happen all over again. Federal Reserve Bank President Thomas Hoenig says things simply haven't changed that much. Bank executives are still, despite new reform laws on the books, two years later, earning salaries and bonuses that look more like the result of boom years than recession.

This stings even more when you contrast their lifestyles with those of most Americans: 15 million unemployed and an economy with near record bankruptcies and foreclosures.

Hoenig writes today the five biggest banks-- after feasting on taxpayer dollars--are 20% bigger than they were before the crisis.

Bigger.

That's right--they never paid the price for the debacle. What's more, they control more than $8.5 trillion in assets or 60$ of the gross domestic product.

This means: no government official in his or her right mind would ever let one of these five banks fail because it would bring the entire economy down with it.

So two years after the biggest financial disaster of our lifetimes we are closer to another financial disaster because nobody really got rid of “too big to fail” they only enshrined it.

Banks need to be smaller, so they can never threaten our economy again.

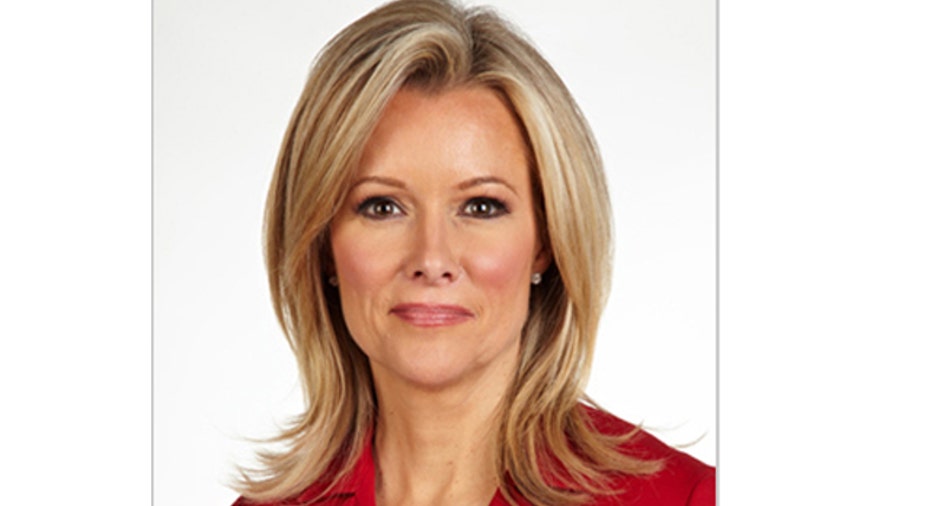

Be sure to catch the Willis Report on the FOX Business Network every weekday from 5-6pm ET.